The race to build the next generation of artificial intelligence just gained a major accelerant after IBM and AMD teamed up with San Francisco-based Zyphra, an open-source AI research and product company, to deliver one of the world’s most advanced AI training infrastructures.

According to the company’s press release, the move could have sweeping implications for industries like finance, banking, and digital payments.

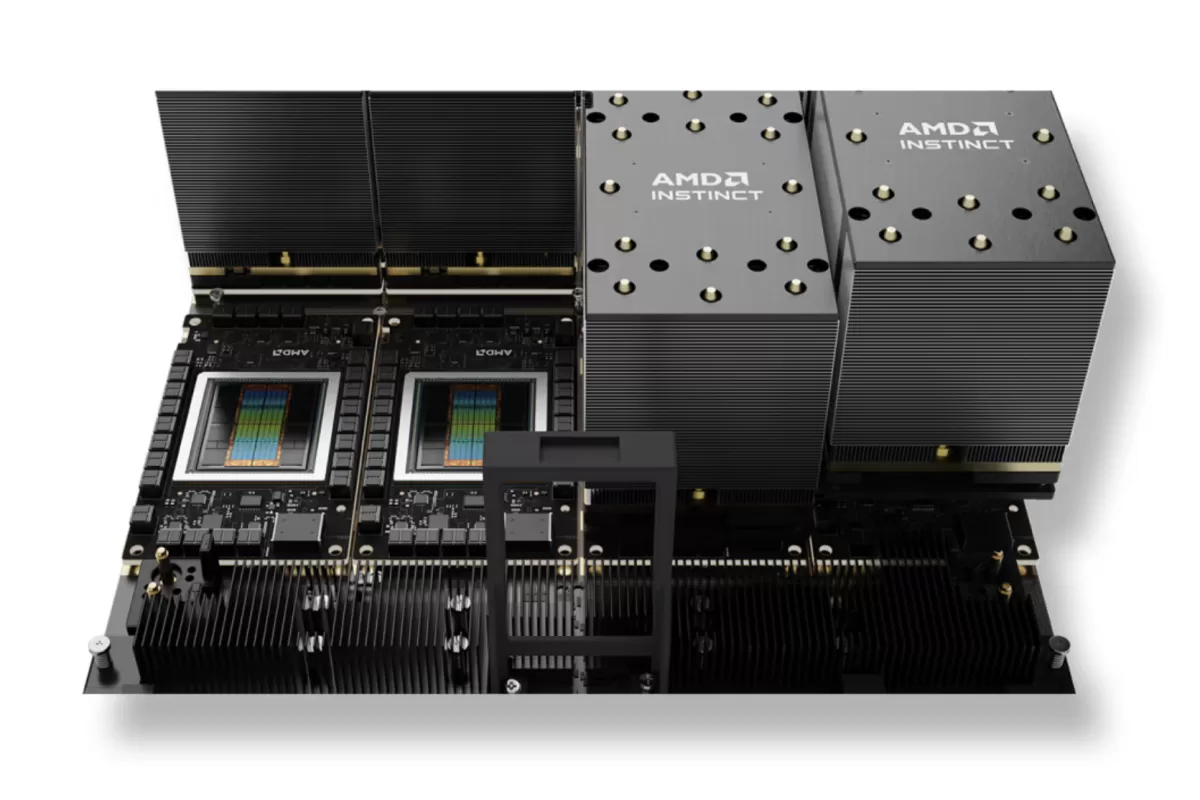

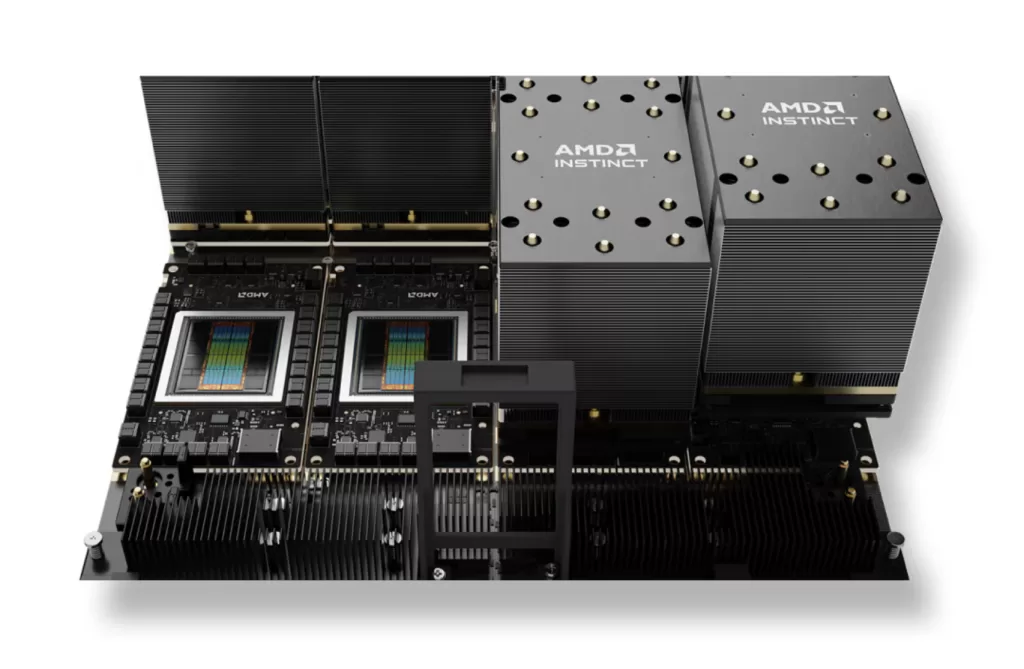

Under a multi-year agreement, IBM will deploy a large-scale cluster of AMD Instinct MI300X GPUs on IBM Cloudto help Zyphra train frontier multimodal foundation models — systems that process language, vision, and audio together.

The collaboration combines IBM’s cloud capabilities with AMD’s silicon expertise and Zyphra’s research focus on open-source “superintelligence” — AI designed to learn, adapt, and reason more like humans.

Building the brains behind the next AI wave

Open-source superintelligence company leverages new integrated capabilities for AMD training clusters on IBM Cloud

Zyphra, which recently secured a Series A funding round at a $1 billion valuation, is developing a new class of AI models that integrate long-term memory and continual learning — traits essential for AI systems that must adapt in real time. Its flagship initiative, Maia, aims to become a general-purpose “superagent” capable of supporting knowledge workers across sectors, including finance and enterprise services.

“This collaboration marks the first time AMD’s full-stack training platform—spanning compute through networking — has been successfully integrated and scaled on IBM Cloud, and Zyphra is honored to lead the way in developing frontier models with AMD silicon on IBM Cloud,” said Krithik Puthalath, CEO and Chairman of Zyphra. “We’re excited to partner with IBM and AMD to power the next era of open-source, enterprise superintelligence.”

The deployment, which began in early September, represents the first large-scale dedicated AI training cluster on IBM Cloud using AMD’s new hardware stack — including AMD Pensando Pollara 400 AI NICs and Ortano DPUs. Expansion is already planned for 2026.

Why fintech firms should pay attention

For fintech companies — from neobanks to digital lenders and payments startups — the implications are profound.

The same high-performance infrastructure that trains multimodal models for research can also power smarter fraud detection, real-time risk analysis, automated financial advice, and hyper-personalized customer experiences.

As Alan Peacock, GM of IBM Cloud, puts it: “Scaling AI workloads faster and more efficiently is a key differentiator in achieving ROI for both established enterprises and emerging companies alike.”

For financial firms wrestling with the compute demands of large-scale generative AI, this kind of infrastructure offers a blueprint: cloud-based AI training that combines power, scalability, and security. With regulators increasingly scrutinizing how AI models make decisions, the ability to build and audit open, explainable systems — as Zyphra advocates — could give fintech innovators a competitive edge.

Redefining the AI stack

AMD’s Philip Guido, EVP and Chief Commercial Officer, said the collaboration represents “a new standard in AI infrastructure,” one that blends IBM’s enterprise cloud expertise with AMD’s leadership in high-performance computing.

The combined platform is not just about raw speed; it’s about energy efficiency and adaptability. As fintech companies look to deploy AI more responsibly — whether in credit scoring, investment algorithms, or compliance monitoring — efficiency translates to lower costs and smaller environmental footprints.

The IBM-AMD partnership is already expanding into quantum-centric supercomputing, an emerging field that merges quantum and classical processing. Such advances could eventually enable quantum-safe encryption and ultra-accurate simulations of financial systems, both potential game-changers for the fintech sector.

A foundation for open, responsible AI

Zyphra’s open-source approach aligns with a broader trend toward transparency and collaboration in AI, which mirrors the open-finance movement reshaping banking. By developing its “superintelligence” framework in the open, Zyphra could democratize access to advanced AI tools — allowing smaller fintech players to compete with deep-pocketed incumbents.

As financial institutions race to adopt generative AI, this collaboration offers a glimpse of what’s next: AI infrastructure built not just for performance, but for openness, explainability, and scale.

In the coming years, the convergence of AI infrastructure, open science, and financial innovation may determine which companies define the next era of digital finance — and which are left struggling to catch up.