Coins.ph is starting the year with record-breaking momentum, posting a 327% surge in spot trading activity based on its most recent available data — signaling a sharp acceleration in the adoption of digital assets across the Philippines.

The local exchange logged a landmark performance in November, generating $500 million (around ₱29.4 billion) in spot trading volume — nearly four times higher than the $117 million recorded in the same month in 2024. The rally extended into early 2026, with Coins.ph reaching an all-time high of $50 million in daily spot trading volume just last week.

Driving much of this growth is the platform’s Spot Trade feature, a professional-grade order-book exchange that allows users to trade directly with one another based on real-time market demand. Unlike standard “Buy/Sell” or “Convert” functions, the feature offers lower fees and greater price control, appealing to both retail traders and institutional users seeking efficiency at scale.

Stablecoins move from speculation to infrastructure

Behind the surge in trading volumes is the expanding role of stablecoins such as USDT and USDC, which are pegged 1:1 to the US dollar.

Once viewed primarily as speculative instruments, stablecoins are increasingly being used as practical tools for payments and settlements — particularly in remittance-heavy markets like the Philippines, where overseas Filipinos sent home $38.3 billion in 2024.

With faster processing and greater transparency than traditional banking rails, stablecoins are now being adopted for corporate payrolls, contractor compensation, and supplier payments, creating a new layer of digital financial infrastructure.

“These spot trading milestones are a testament to the critical role stablecoins are playing in modernizing Philippine finance,” said Wei Zhou, chief executive officer of Coins.ph. “They reflect strong market demand for efficient and regulated digital asset trading, especially for our USDT-PHP and USDC-PHP pairs. We expect this momentum to shape both Coins.ph and the broader digital asset market throughout 2026.”

Liquidity edge and institutional demand

The exchange is also seeing robust activity through its over-the-counter (OTC) Desk, a service built for high-net-worth individuals and institutional clients executing trades worth more than ₱1 million. The OTC Desk allows large transactions to be completed without disrupting market prices, offering deep liquidity and personalized execution support.

A key contributor to this performance is pricing efficiency.

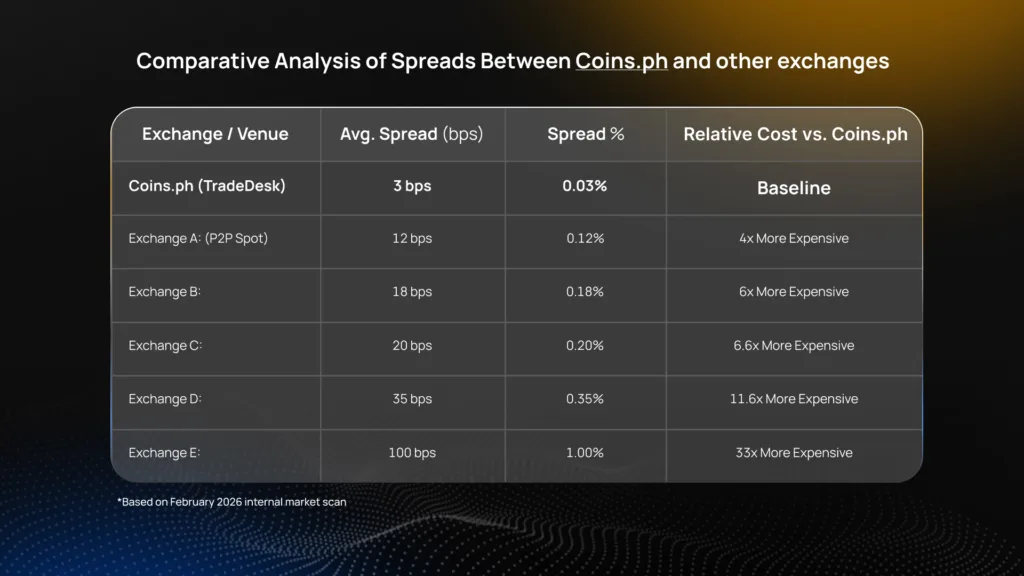

Coins.ph has reduced its trading spread — the gap between buy and sell prices — to as low as 3 basis points, significantly lower than the 12 to 35 basis points commonly seen on competing platforms. This tighter spread allows high-volume traders to retain more value per transaction, strengthening the platform’s appeal among professional market participants.

Scaling stablecoin use cases nationwide

To maintain its growth trajectory, Coins.ph is expanding its stablecoin infrastructure through its integration with the Circle Payments Network, enabling near-instant and compliant peso settlements across more than 120 domestic banks and e-wallets.

The company is also rolling out education campaigns and on-the-ground roadshows in major cities to promote real-world use cases of stablecoins — from low-cost remittances to business disbursements — positioning digital assets as tools for everyday financial activity rather than speculative trading alone.

About Coins.ph

Founded in 2014, Coins.ph is an all-in-one financial app that combines traditional financial services with digital assets. It is licensed by the Bangko Sentral ng Pilipinas as both a virtual asset marketplace and a mobile wallet provider. The platform enables users to trade cryptocurrencies, make payments, and send or receive funds through crypto remittances in a single, secure ecosystem.

With spot trading volumes reaching new highs and stablecoins emerging as a backbone for digital payments, Coins.ph’s latest figures suggest that the Philippines’ crypto economy is moving from early adoption into a more mature phase of financial utility.