The Bangko Sentral ng Pilipinas (BSP) sees inflation remaining manageable over the medium term, even as economic growth momentum softens and external headwinds push the country’s balance of payments (BOP) back into deficit territory.

In its latest assessment, the BSP said December 2025 inflation settled at 1.8 percent, comfortably within its forecast range of 1.2 to 2.0 percent, and below the government’s 3.0 percent ±1 percentage point target band.

For full-year 2025, inflation is projected to average below the lower end of the target range, largely driven by earlier declines in rice prices.

Looking ahead, the central bank expects inflation to normalize, settling within target in 2026 and 2027, with inflation expectations remaining “well anchored.”

Price pressures remain contained

For December, the BSP noted that upside price pressures came from higher food prices amid lingering weather-related supply disruptions and strong holiday demand, as well as increases in LPG and gasoline prices.

These were partly offset by lower electricity rates in Meralco-serviced areas and declining kerosene and diesel prices.

The BSP reiterated that it will continue to closely monitor domestic and global developments, maintaining a data-dependent approach to monetary policy.

Easing cycle near its end

While inflation risks appear contained, the Monetary Board acknowledged that the outlook for domestic economic growth has weakened further. Business sentiment has continued to deteriorate amid governance concerns and heightened uncertainty over global trade policy.

That said, the BSP expects domestic demand to recover gradually as the effects of earlier monetary easing filter through the economy and public spending gains traction.

“On balance, the Monetary Board views the monetary policy easing cycle as nearing its end,” the BSP said, adding that any further rate cuts are likely to be limited and guided by incoming data.

For financial markets and digital finance players, this signals a period of policy stability, with fewer surprises on the rate front but continued sensitivity to growth and external risks.

External headwinds return BOP to deficit

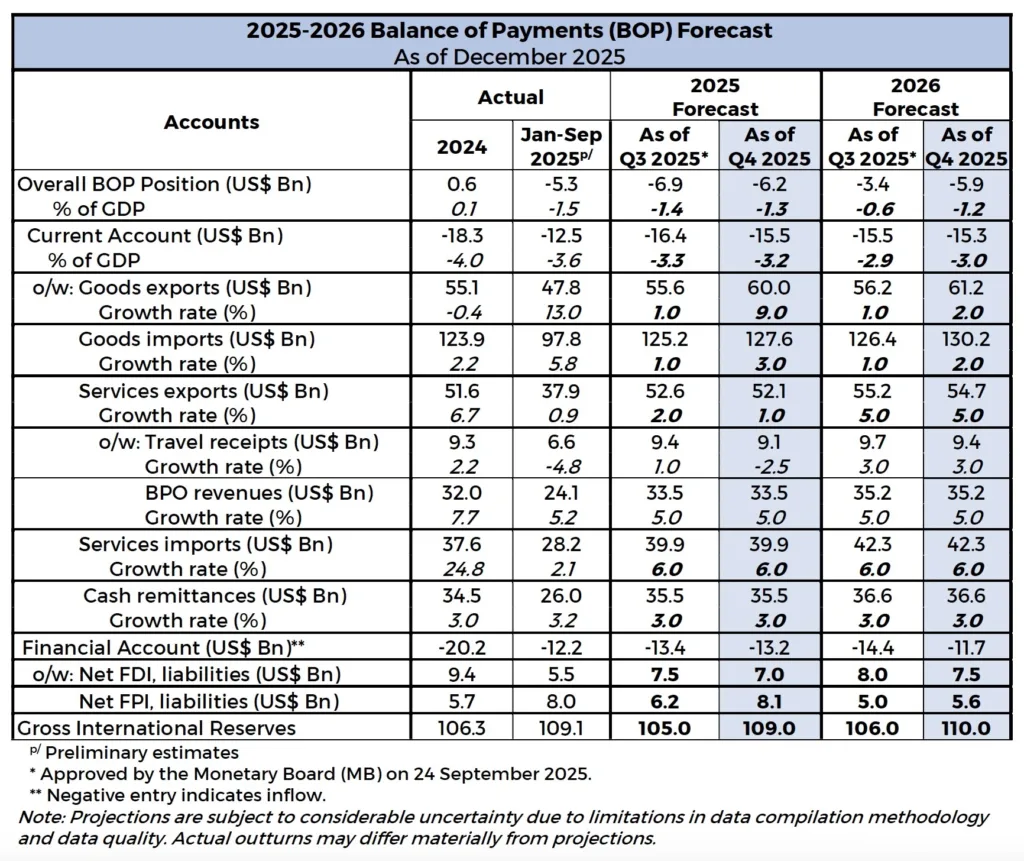

On the external front, the BSP projects the country’s balance of payments to shift to deficits in 2025 and 2026, reversing the modest surplus recorded in 2024.

The expected deterioration is driven mainly by a persistent current account deficit, reflecting a sustained trade-in-goods gap and weaker services receipts. Foreign direct investments and external borrowings have also moderated amid global financial volatility and policy uncertainty.

Goods trade is expected to remain soft due to weaker global demand, easing commodity prices, and slower domestic growth. While frontloading ahead of anticipated US tariffs provided a temporary lift to exports in early 2025, structural issues — such as logistical bottlenecks, skills mismatches, and high input costs — continue to weigh on competitiveness.

Services, remittances offer partial buffer

Services exports are likewise projected to slow, as higher operating costs erode competitiveness in key sectors such as business process outsourcing and tourism. Rising rental rates, utilities, wages, and accommodation costs have made Philippine services less cost-competitive relative to regional peers.

In contrast, overseas Filipino remittances are expected to remain resilient, supported by strong global labor demand and the continued shift toward formal transfer channels. The BSP said the proposed US tax on remittances is expected to have minimal impact.

Investment reforms seen as medium-term upside

Foreign direct investments are projected to ease from 2024 levels, reflecting cautious investor sentiment. However, the BSP noted potential medium-term upside from recently passed and proposed reforms, including the CREATE MORE law, Capital Markets Efficiency Promotion Act, Investors’ Lease Act, reforms in large-scale mining, and initiatives to improve digital connectivity such as the Konektadong Pinoy Act.

The central bank stressed that timely and effective implementation of these measures will be critical to restoring investor confidence and supporting longer-term growth.

Despite near-term pressures, the BSP emphasized that the Philippines remains resilient to external shocks, citing manageable external financing needs and adequate gross international reserves. Early warning indicators on currency and debt sustainability continue to point to a stable external position as of the fourth quarter of 2025.

As inflation stabilizes and policy easing winds down, the BSP said it will continue engaging with stakeholders and closely monitoring risks, underscoring its commitment to maintaining macroeconomic and financial stability in an increasingly uncertain global environment.