Here’s good news for those who have grown accustomed to topping up their e-wallets using their BPI accounts.

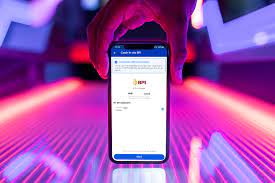

Just recently, the Bank of the Philippine Islands (BPI) announced that cash-in transactions using GCash will still remain free of charge. This is definitely a welcome development for Filipinos who have since started to adapt to digital technology and are now relying on their e-wallets to make cashless transactions.

Making cash-in transactions at BPI has also been made more efficient in two easy ways.

- Simply select “Payments/Load” in the menu section of your BPI mobile and choose “Load E-wallet.” Fill in the required details and select your preferred e-wallet service. The app will then confirm the details of the transaction. Once confirmed, users will then be asked to enter a mobile key to get system approval. You can then cash in using your e-wallet. It’s that simple!

- From the GCash app, under the user’s “My Linked Accounts,” select “BPI.” Enter the amount that you need and select an account. Once you get system approval, all you’ll need to do next is just enter the one-time pin and you will soon be ready to cash in.

Remember, you can fund your e-wallet directly from your BPI account for all your cashless needs. You can also ensure the safety of your transactions with the bank’s One-Time PIN (OTP) verification. With your BPI online login credentials, you can then link and cash in your BPI account to an e-wallet. It’s that easy!

What is a mobile e-wallet service?

Simply put, the mobile e-wallet service is the digital version of a wallet that you can carry in your pocket. It stores payment details like a credit or debit card. It allows you to pay when you’re shopping using your device so that you won’t need to carry your cash around. What’s more, it can give you an update on your remaining cash balance so you don’t overspend when making online purchases.

After successfully entering and storing your credit card, debit card, or bank account details, you can then start using your device to pay for any goods or services.

Mobile e-wallets use app-based solutions to safely and conveniently conduct financial transactions from a phone or on the desktop.

These forms of financial digitalization may have slight differences in their specific use and scope. Recent technological developments, however, have since created many grey areas in these definitions.

For example, GCash is considered a mobile e-wallet where anyone can send money, receive funds, pay bills, shop online and transfer money from one user to another. Another e-service, PayMaya, used to be known as an e-wallet. Recently, however, it started to offer a wider range of services including a crypto trading feature that is now part of its app. PayMaya is thus, now considered a digital bank.

A third provider is Tonik, a “neobank” that offers retail financial products including deposits, loans, savings accounts, payments, and cards on a highly secure platform. Unlike GCash or PayMaya, however, it lacks the flexibility and wide range of merchants on its platform.