Zed, a digital bank based in the Philippines, is reshaping the credit card landscape with its groundbreaking offering: a Mastercard credit card that comes free of interest and annual fees.

This innovative credit card is poised to eliminate several common charges, including foreign transaction fees, interest, and annual fees, potentially ushering in a new era of accessible financial services for the underserved population in the region.

IMAGE CREDIT: https://www.megabites.com.ph/

Operating under the regulatory oversight of the Bangko Sentral ng Pilipinas (BSP) and with headquarters in both San Francisco in the US and Manila in the Philippines, Zed is targeting the credit needs of young Filipino professionals while simplifying the credit card application process.

The response to Zed’s credit card offering has been overwhelmingly positive, with the waitlist attracting nearly 25,000 sign-ups in just three weeks.

A unique approach to banking

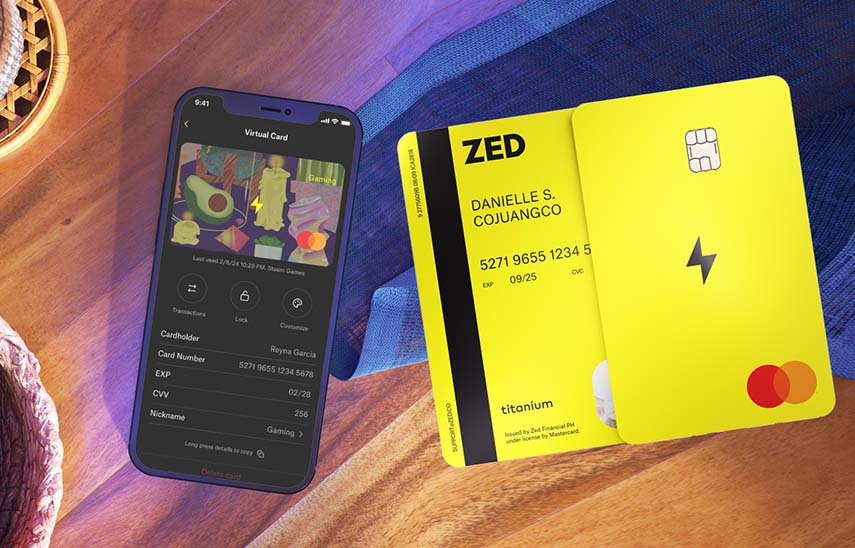

Behind this game-changing initiative are founders Danielle Cojuangco Abraham and Steve Abraham, both esteemed alumni of Y Combinator and Stanford engineers.

Their venture recently secured US$6 million in funding, with notable backing from Peter Thiel’s Valar Ventures, underscoring the innovative potential of Zed’s banking approach.

In a press statement, Zed highlighted the challenges young applicants face when navigating traditional application procedures. These include complex documentation and arbitrary underwriting methods and those who secure approval often find themselves burdened with high APRs, punitive fees, and even unsatisfactory customer experiences.

In addition to waiving interest and other fees, Zed promises its future customers a seamless and secure payment experience through its app, enabling the generation of an InstaPay QR code for transactions.

Furthermore, the streamlined application process ensures applicants can complete everything in minutes.

Transforming the credit card experience in Southeast Asia

According to Danielle Cojuangco Abraham, Zed’s co-founder, the neobank was born from the belief that young Filipinos deserve superior financial products, advanced technology, and exceptional service tailored to their lifestyles.

Zed’s mission goes beyond introducing a “no-fee” credit card — it also aims to transform the credit card experience in Southeast Asia.

With operations in San Francisco and Manila, Zed is navigating regulatory landscapes, asserting regulation by the BSP, and holding a principal membership with Mastercard.

Responding to inquiries about its regulatory status, Zed confirmed its registration under Zed Philippines, Inc., and its receipt of provisional approval from the BSP , enabling the launch of a pilot credit card program.

Reflecting on Zed’s launch, Danielle Cojuangco Abraham stated, “Launching Zed is very personal to me. I am thrilled to come home after 15 years in Silicon Valley to build a game-changing product for Filipinos.”