Xiaomi Corporation (HKEX: 1810) today unveiled astonishing first-quarter results for 2025, revealing a strategic masterclass in premiumization that has propelled the tech giant to unprecedented financial heights.

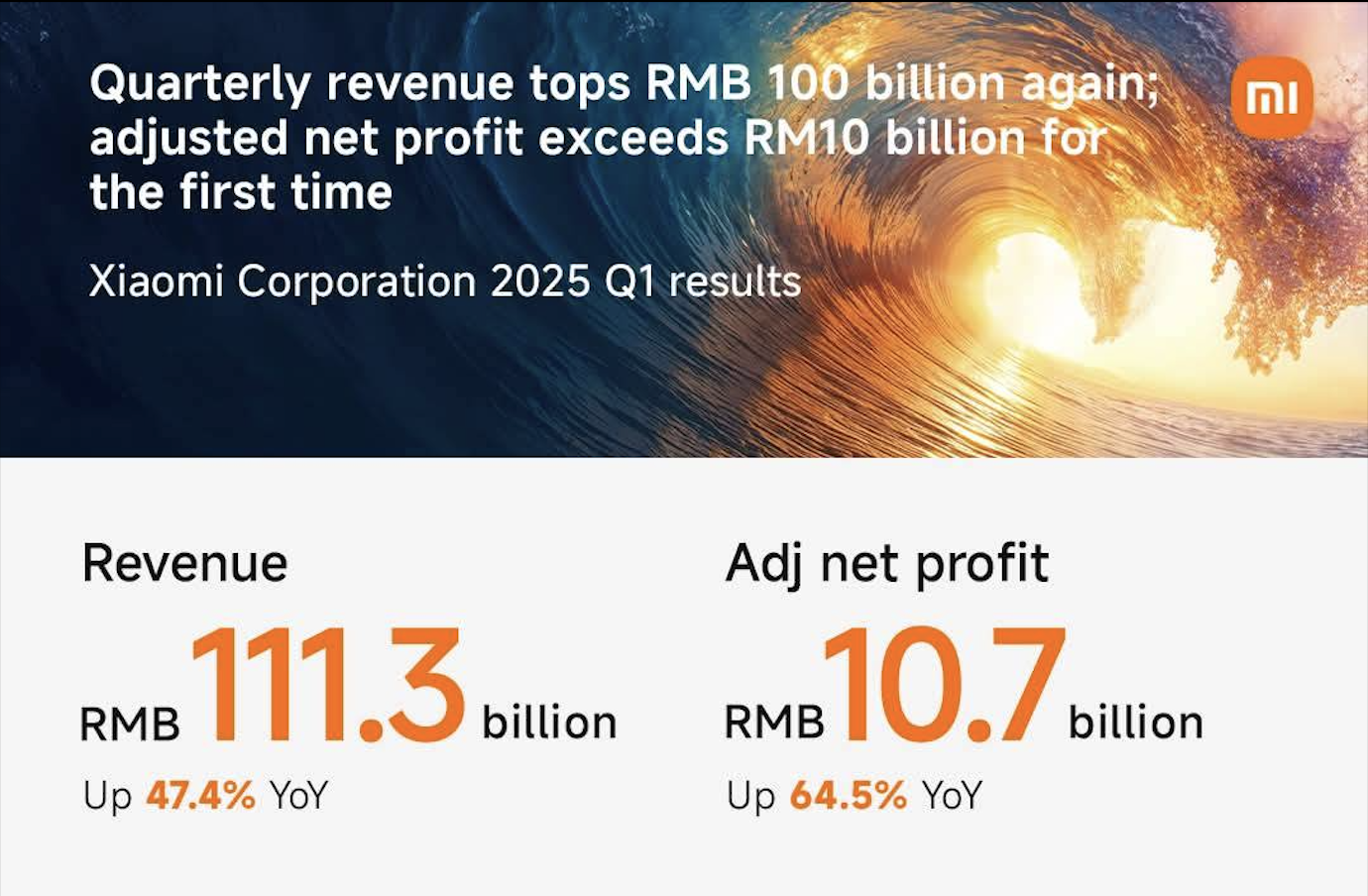

For the second consecutive quarter, revenue has surged past the RMB100 billion mark, reaching an impressive RMB111.3 billion, a staggering 47.4% year-over-year increase.

But the real showstopper is the adjusted net profit, which for the first time ever, has soared past RMB10 billion, hitting a record-breaking RMB10.7 billion – a remarkable 64.5% jump from the same period last year. These figures not only blew past market expectations but also firmly establish the company’s formidable start to 2025.

The premium play: A strategy in full bloom

Xiaomi’s relentless pursuit of premiumization across its diverse product portfolio is clearly paying dividends. This strategic pivot has fueled robust growth across all business segments, signaling a maturing market presence and a clear path toward sustained profitability.

The company’s smartphone division, a cornerstone of its empire, saw revenue climb by 8.9% year-over-year to RMB50.6 billion. Global smartphone shipments reached 41.8 million units, marking seven consecutive quarters of year-over-year growth.

According to Canalys, the smartphone brand maintained its Top 3 global shipment ranking for the nineteenth consecutive quarter, holding a solid 14.1% market share.

Crucially, the average selling price (ASP) of Xiaomi smartphones hit a new record of RMB1,211 in Q1 2025. The success of premium models like the Xiaomi 15 Ultra, launched in February, further underscored this trend, with sales growing by an astounding 90% compared to its predecessor in the same period.

Reclaiming the crown: Xiaomi dominates in mainland China

Perhaps one of the most significant triumphs for the smartphone brand in Q1 2025 is its resurgence in its home market. After a decade, the company has reclaimed the top spot in mainland China’s smartphone market, capturing an impressive 18.8% market share. This marks the fifth consecutive quarter of year-over-year growth in market share, a testament to the company’s strategic prowess and renewed consumer trust.

Xiaomi’s deepening penetration into the premium smartphone segment in mainland China is particularly noteworthy. Third-party data reveals that smartphones priced at RMB3,000 and above now account for 25% of the company’s total smartphone sales in the region, a 3.3 percentage point increase year-over-year.

For devices priced at RMB4,000 and above, the smartphone brand’s market share reached 9.6%, up 2.9 percentage points year-over-year, indicating strong traction among discerning consumers.

IoT and lifestyle products: A home run

Beyond smartphones, the company’s Internet of Things (IoT) and lifestyle products segment has witnessed explosive growth, with revenue surging by 58.7% year-over-year to RMB32.3 billion. This segment also achieved new records for both revenue and gross margin, which improved by 5.4 percentage points year-over-year to 25.2%.

Even in what is traditionally an off-season for home appliances, the company’s smart large home appliances defied expectations. Air conditioner shipments exceeded 1.1 million units (up over 65% year-over-year), refrigerator shipments surpassed 880,000 units (up over 65% year-over-year), and washing machine shipments soared over 100% year-over-year to 740,000 units.

Both refrigerator and washing machine shipments hit all-time highs, with a new smart home appliance factory set to further boost production this year.

The smartphone brand’s tablet business also maintained strong momentum, achieving a top-three global ranking for the first time, while its wearable bands and TWS earbuds continue to dominate, ranking No.1 globally and No.2 globally, respectively, in their categories. The number of connected IoT devices on the company’s AIoT platform (excluding smartphones, tablets, and laptops) expanded to 943.7 million, up 20.1% year-over-year, showcasing the ever-growing reach of its smart ecosystem.

Electric vehicles and beyond: Powering into the future

Xiaomi’s foray into the smart electric vehicle (EV) market is also accelerating with impressive speed. Revenue from smart EV, AI, and other new initiatives reached RMB18.6 billion in Q1 2025.

Deliveries of the highly anticipated Xiaomi SU7 Series totaled 75,869 vehicles during the quarter, with the company firmly committed to its full-year target of 350,000 deliveries. Xiaomi’s EV sales and service network is rapidly expanding, with 235 sales centers across 65 cities in mainland China as of March 31, 2025.

The success of the Xiaomi SU7 Ultra, with prices starting above RMB 500,000, and the upcoming “high-performance luxury SUV” Xiaomi YU7, further solidify Xiaomi’s ambition in the premium EV sector.

A future built on innovation: RMB200 billion for R&D

Xiaomi’s commitment to foundational core technologies is unwavering, with Q1 2025 R&D expenses reaching RMB6.7 billion, a 30.1% year-over-year increase.

The company boasts a record-high R&D personnel count of 21,731 and over 43,000 patents worldwide.

Looking ahead, Xiaomi plans to invest an astounding RMB200 billion in R&D over the next five years, reinforcing its dedication to innovation in “chip, AI, and OS” technologies.

The recent unveiling of Xiaomi’s self-developed Xiaomi XRING O1 3nm SoC signifies a major leap, marking the full deployment of Xiaomi’s core foundational technologies across its products.

This strategic investment in cutting-edge innovation is poised to establish a long-term technology moat, solidifying Xiaomi’s position as a global leader in the evolving technological landscape.

Xiaomi’s Q1 2025 results paint a vivid picture of a company not just growing, but thriving through strategic premiumization, relentless innovation, and a keen understanding of consumer desires. With its strong financial performance and ambitious future plans, Xiaomi is clearly driving full speed ahead into a future powered by smart technology.