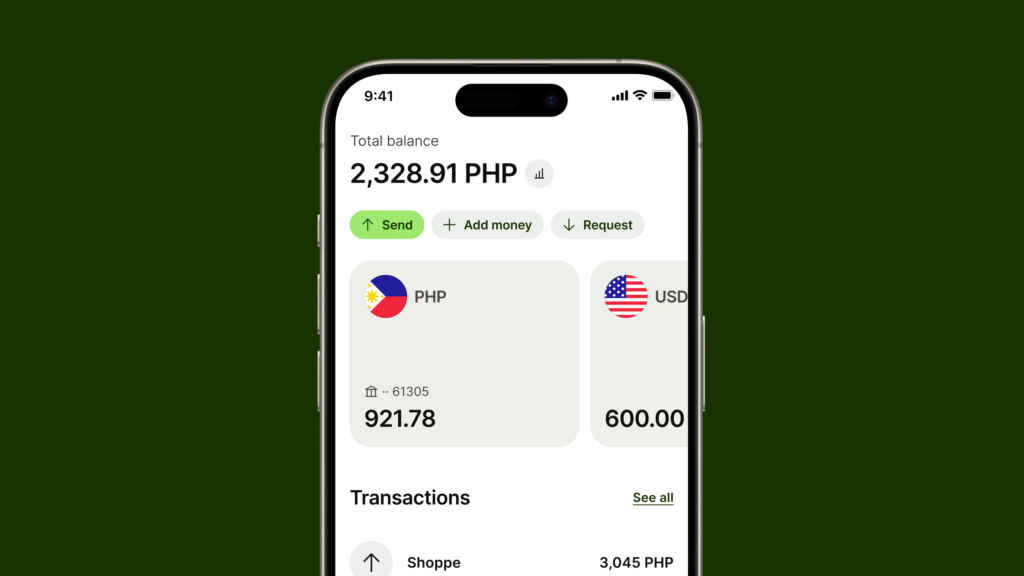

Wise, the global technology company focused on simplifying international money movement and management, has unveiled a game-changing feature for its Filipino customers: PHP Account Details.

This innovation empowers freelancers, international students, and expats in the Philippines to receive payments in Philippine Pesos (PHP) seamlessly and without fees directly into their Wise accounts. This development marks a significant step towards democratizing access to financial tools and eliminating the need for traditional bank accounts or local addresses for many Filipinos.

The introduction of PHP Account Details underscores the global technology company’s unwavering commitment to making international payments fast, affordable, and transparent for everyone. Since its launch in the Philippines in May 2024, it has consistently expanded its offerings to better serve the needs of Filipinos navigating the global financial landscape.

Simplifying how Filipinos manage their money

The global technology’s recent integration with InstaPay, the Philippines’ instant payment infrastructure, already allows for near-instantaneous (under 20 seconds) top-ups to Wise accounts and card transactions via bank transfers and popular e-wallets like GCash and Maya. Now, with PHP Account Details, the company is further simplifying how Filipinos manage their money.

This new feature effectively levels the playing field, enabling Filipinos – whether they are freelancers receiving international payments, students studying abroad, or expats working in the country – to receive local payments just like any resident. It also eliminates the complexities and often high costs associated with traditional international money transfers. Imagine a freelancer receiving payment from a client abroad without hefty transfer fees eating into their earnings, or a student receiving financial support from family overseas without delays or complicated procedures.

The addition of PHP Account Details brings the total number of available account details on Wise to 23, encompassing major currencies like GBP, AUD, CAD, EUR, HUF, NZD, SGD, USD, and TRY.

Each user receives unique account details, which they can share with friends, family, companies, or clients anywhere in the world to receive money seamlessly. This global accessibility combined with the local convenience of PHP account details makes Wise a powerful financial tool for Filipinos.

“At Wise, we are constantly evolving to meet the needs of our Filipino customers,” says Areson Cuevas, Country Manager for Wise Philippines. “PHP account details, and the ability to instantly top up Wise accounts and card transactions through InstaPay, are among the most highly-requested features from our users. We believe these added capabilities will help users to seamlessly manage their finances and enjoy a convenient payment experience.”

The impact of these features is particularly significant for the growing gig economy in the Philippines. Freelancers who often receive payments from international clients can now consolidate their earnings in a Wise account, avoiding the complexities and costs of multiple bank accounts or relying on less secure payment methods.

Similarly, international students can manage their finances more efficiently, receiving allowances and paying for expenses without the burden of high foreign exchange fees. Expats working in the Philippines also benefit, as they can receive salaries and manage their local expenses with ease.

Wise: Beyond just receiving payments

Wise’s offerings extend beyond just receiving payments. Filipino customers can hold, send, and receive money in over 40 currencies instantly, without any holding fees or minimum balance requirements.

The Wise Card further enhances financial flexibility, allowing users to spend internationally in over 160 countries and online at the mid-market exchange rate – the fairest exchange rate available – with no hidden fees. This transparency in pricing sets Wise apart from traditional financial institutions and empowers users to make informed decisions about their money.

The launch of PHP Account Details and the continued expansion of Wise’s services in the Philippines signal a shift in the landscape of personal finance. Wise is not just providing a service; they are empowering Filipinos to take control of their financial lives, regardless of their background or location.

In a world that is becoming increasingly interconnected, Wise is building the infrastructure that allows individuals and businesses to thrive in the global economy.

This latest development solidifies Wise’s position as a leading force in fintech innovation and its commitment to serving the evolving needs of its Filipino customers.