WISE, the global fintech company, offers money-saving tips this holiday season to help you better manage your finances during the holidays.

The holiday season is a joyful but costly time for Filipinos, with expenses piling up for Simbang Gabi, noche buena, and family reunions.

For overseas foreign workers (OFWs) and freelancers, managing these costs is even tougher due to the financial strain of sending money home or receiving payments from abroad, where high fees and poor exchange rates can eat into their earnings.

Below are some tips to help you better enjoy the holiday season:

1. It’s WISE to set a realistic holiday budget

Creating a clear budget for all your holiday expenses — including gifts, decorations, food, and travel — is crucial. A budget can help prevent financial surprises, especially during the season of flash sales and unplanned gatherings.

Tracking each expense and including a buffer for last-minute reunions or extra gifts can keep you on track. Freelancers, who often experience fluctuating incomes, should set aside a buffer for unexpected costs to avoid financial stress.

2. Save on international money transfers

High fees and unfavorable exchange rates can significantly reduce your earnings when sending money to loved ones or receiving international payments. A recent WISE survey found that around 3 in 5 Filipinos engage in international transactions at least once a month, yet 21% of them are unaware of hidden fees such as exchange rate mark-ups.

Many consumers overlook the two main costs associated with foreign currency transactions — the transaction fee and the exchange rate. Some providers may offer low or zero upfront transaction fees but mark up the exchange rate, meaning customers pay more than necessary.

This applies whether you’re transferring money abroad, making international payments, or changing money from one currency to another.

For OFWs and Filipinos abroad, WISE offers a more affordable and transparent option. When transferring money overseas, customers pay a single upfront fee and get the mid-market exchange rate seen on Google, with no hidden charges. This transparency ensures that your hard-earned money goes further, maximizing your earnings for you and your family during the holiday season.

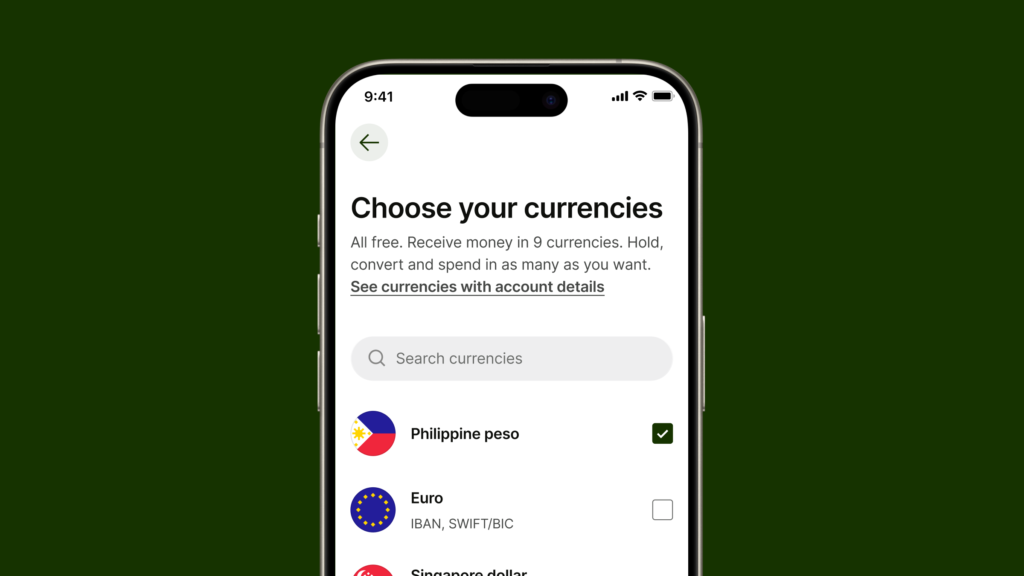

Philippine-based freelancers can also use WISE to receive payments in multiple currencies with zero fees and easily withdraw funds from their WISE account to a local bank account or digital wallet like GCash or PayMaya. This provides a fast and seamless payment experience.

3. Opt for group gifts and shop smart online

Online shopping has become a go-to for Filipinos, especially during major sales like 11.11 and 12.12. Many shoppers are drawn to international sites that offer unique products or better deals. However, buying from foreign retailers often comes with hidden fees, including foreign transaction charges and unfavorable exchange rates, which can inflate your total spend.

One way to manage these expenses is by pooling resources with family or friends for meaningful group gifts or organizing a “Monito Monita” (Secret Santa) exchange to keep gift-giving fun and affordable. Set a budget limit to avoid financial strain and focus on practical, thoughtful gifts like a kitchen gadget for your parents or a shared holiday experience.

To save more during your holiday shopping, it’s important to be mindful of the fees your card provider charges. Traditional credit cards often come with 1% to 3% foreign transaction fees and unclear exchange rates, which can add up. Also, avoid Dynamic Currency Conversion (DCC), where merchants charge you in your home currency instead of the store’s local currency.

While paying in Philippine pesos (PHP) may seem convenient, it often comes with hidden fees and unfavorable exchange rates. Always pay in the local currency to avoid extra costs.

Using a service like the WISE multi-currency account can also help. With WISE, you can shop from international retailers and pay in local currencies at the mid-market exchange rate, meaning no hidden fees and a clear understanding of what you’re spending. This simple approach helps make your money go further during the holiday season.

4. Cut down on holiday travel expenses

The holiday season is a cherished time for many Filipinos to reunite with family or take a well-deserved break. However, travel expenses can quickly add up, especially for international trips, so it’s important to find ways to stretch your budget.

Booking flights and accommodations early is a great way to secure the best deals. If you’re planning to travel abroad, the WISE card can be a useful companion, allowing you to spend in over 160 countries at the mid-market exchange rate without hidden fees.

The holiday season is all about celebration and family, but it doesn’t have to come at a high cost. By planning your budget, using WISE for international transactions and remittances, and being mindful of your purchases, you can maximize your savings while still enjoying the festivities.

Follow these tips to keep your spending in check and have a financially stress-free holiday season.

Recognizing the importance of remittances to the Philippines, the company launched the WISE Account and Wise Prepaid Card in the Philippines recently to help boost customer growth by targeting freelancers, travelers, and dependents of overseas workers.

According to the company’s press release, these products offer a more efficient, cost-effective, and affordable way to manage money internationally without hidden fees.

WISE is licensed and regulated by the Bangko Sentral ng Pilipinas (BSP), ensuring full compliance with local regulations. For more information on how WISE can help you manage your money, visit www.wise.com.