UnionDigital Bank, the digital banking arm of Union Bank of the Philippines, has strengthened its defenses against online fraud by deploying biometric identity solutions from London-based iProov.

The partnership aims to combat rising threats such as account takeovers and mule activity, which have become increasingly sophisticated amid the global surge in AI-driven cyberattacks.

The move comes as organizations worldwide mark “Cybersecurity Awareness Month,” underscoring the growing urgency for financial institutions to bolster digital resilience.

For UnionDigital Bank, which serves many of the country’s underbanked and mobile-first users, security is a critical foundation for trust.

“We’re building a secure, trusted, and accessible digital bank for all Filipinos, and that requires deploying infrastructure capable of addressing sophisticated fraud,” said Russell Hernandez, Chief Information Security Officer at UnionDigital Bank. “As we shift toward risk-based authentication, we need a flexible and future-ready solution. iProov’s proven combination of ease of use, speed, and strong assurance enables us to sustain customer trust while evolving our fraud defenses.”

iProov founder and CEO Andrew Bud, for his part, stated: “We are delighted to have been chosen by UnionDigital Bank to support its mission to deliver secure and truly inclusive digital banking across the Philippines. Our technology provides the highest level of identity assurance on virtually any device to provide that protection. This ensures UnionDigital Bank can secure all its customers with an effortless and resilient solution, which is especially crucial for underbanked communities who rely on mobile devices for their financial needs.”

Tackling account takeovers and mule accounts

In recent years, Philippine banks have faced an uptick in account takeovers — cases where criminals gain illegal access to customer accounts — and mule activity, in which individuals allow their accounts to be used for laundering illicit funds.

Regulators such as the Bangko Sentral ng Pilipinas (BSP) have urged the sector to strengthen authentication frameworks to prevent these crimes.

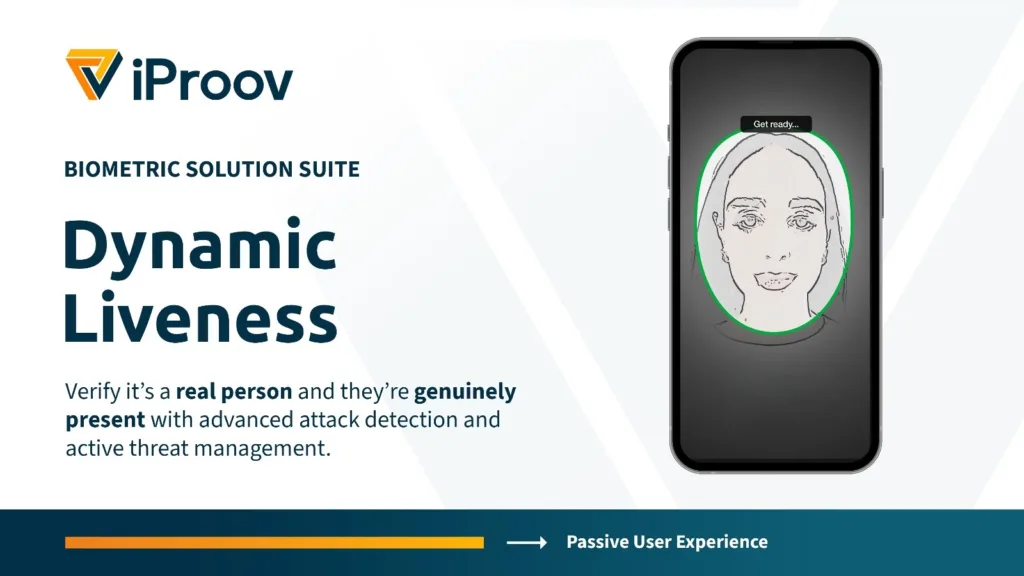

UnionDigital Bank’s adoption of iProov’s Dynamic Liveness and Express Liveness solutions replaces traditional device-based biometrics, marking a major step toward risk-based authentication.

This model allows the bank to dynamically adjust the level of identity verification depending on the transaction’s risk profile — heightened checks for high-value or high-risk activities, and seamless verification for routine actions.

The system, powered by iProov’s proprietary “science-based” biometric technology, can detect deepfakes, spoofing, and other fraudulent attempts with high accuracy while keeping the process fast and frictionless for users.

Balancing security with inclusion

Launched in 2022, UnionDigital Bank has positioned itself as a digital-first bank focused on inclusion, reaching underserved communities that rely heavily on mobile devices for daily financial needs.

Its partnership with iProov reflects that mission — delivering strong protection without compromising ease of access.

With iProov’s dual-layer system, customers can be authenticated securely across a range of scenarios. Express Liveness supports quick verifications for actions like increasing transaction limits, while Dynamic Liveness provides deeper fraud detection for riskier activities such as logging in from new devices.

This layered approach enables UnionDigital to apply “the right level of assurance for every interaction,” according to iProov, giving customers a seamless yet secure banking experience.

Building digital trust

For iProov, which counts the U.S. Department of Homeland Security, U.K. Home Office, and GovTech Singaporeamong its clients, the deal reinforces its presence in Asia’s fast-growing digital banking landscape.

“Proving that someone is who they claim to be online is at the heart of digital trust,” said Andrew Bud, founder and CEO of iProov. “Our technology provides the highest level of identity assurance on virtually any device, ensuring UnionDigital Bank can secure all its customers with an effortless and resilient solution. This is especially crucial for underbanked communities who rely on mobile banking for their financial needs.”

The partnership also aligns with the BSP’s broader push toward cyber resilience and consumer protection, as the Philippines experiences rapid digitalization in financial services.

A model for future digital security

As UnionDigital Bank continues to scale its operations, the bank said it plans to expand its risk-based authentication model to more products and services.

The goal is to strike a balance between frictionless user experience and robust fraud prevention — a challenge many digital banks face as financial crime grows more complex.

“Our vision is for every Filipino to use UnionDigital Bank to empower their lives,” Hernandez said.

“As we shift toward risk-based authentication, we need a flexible and future-ready solution. iProov’s proven ability to deliver ease of use, speed, and high security assurance — backed by reliable vendor support — ensures that we can evolve our fraud defenses while sustaining customer trust and confidence,” he added.