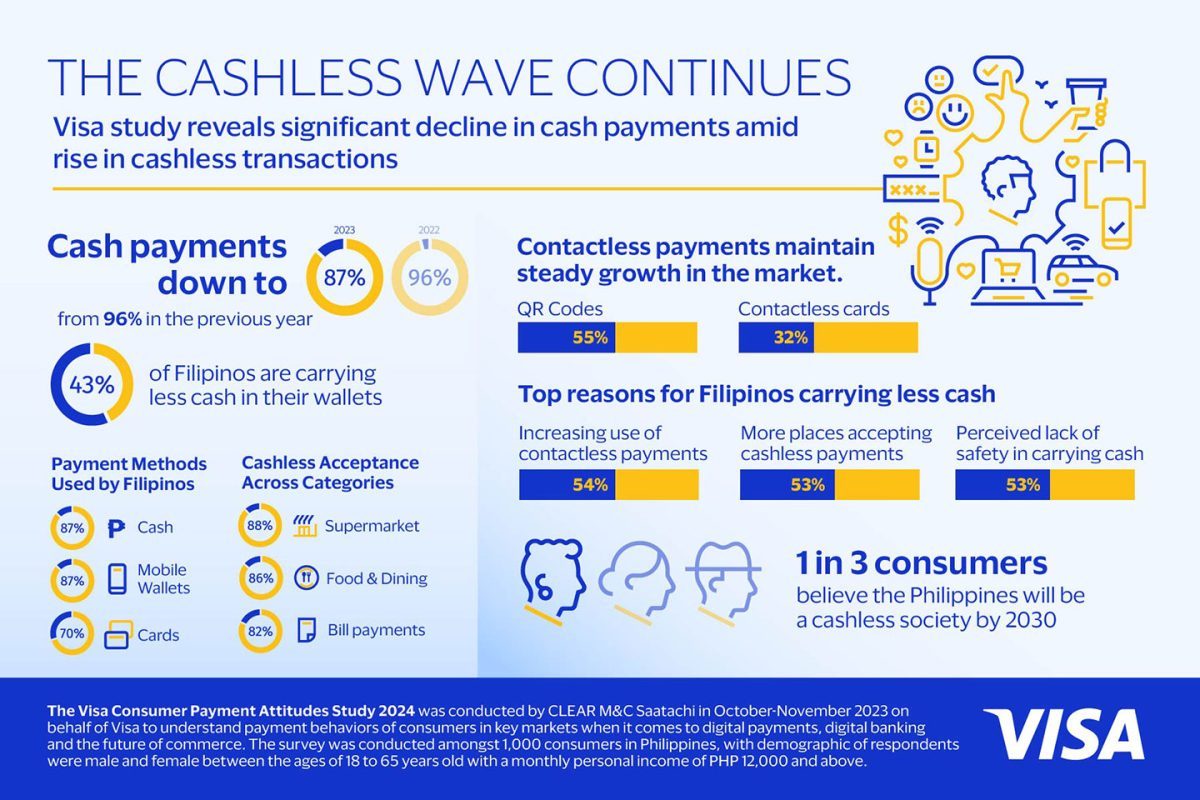

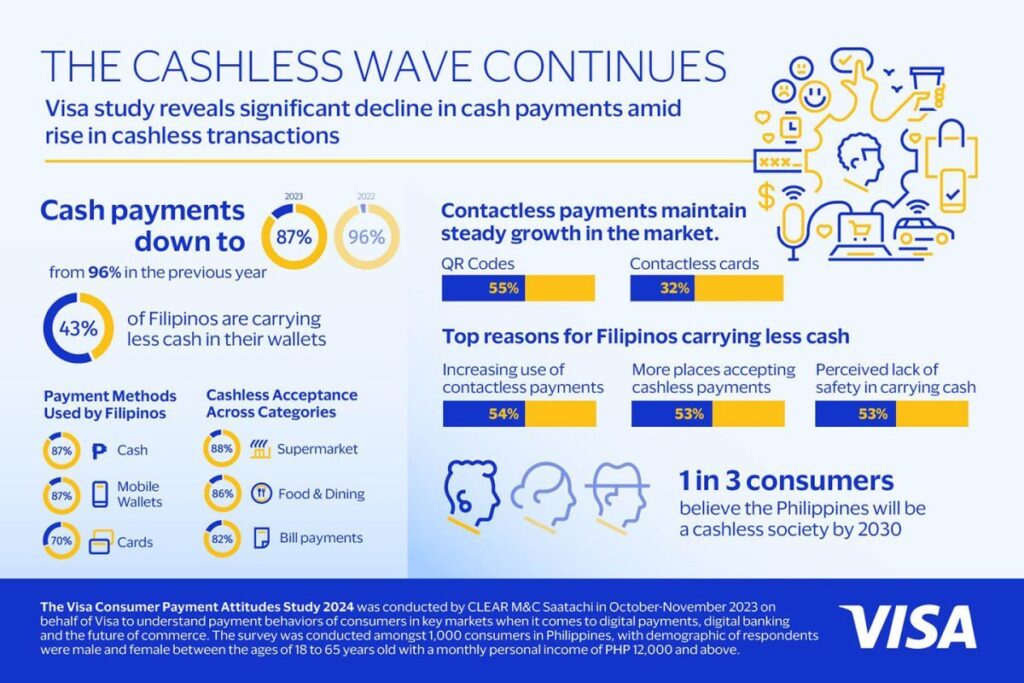

According to Visa’s latest Consumer Payment Attitudes Study, the “cashless wave” continues to gain momentum in the Philippines as consumer spending habits shift away from cash dependence and move towards using cashless payments.

IMAGE CREDIT: https://www.visa.com.ph/

The report found that one in three consumers, or 37 per cent of those surveyed, believes that the majority of Filipinos will soon be using cashless payments by 2030 as consumers become more comfortable using mobile wallets and cards.

On the other hand, the usage of mobile wallets and cards increased to 87 and 70 per cent, respectively.

The Visa study also showed that Filipinos are now carrying less cash since more and more establishments are now accepting cashless payments. This trend could also be due to a perceived lack of safety for those who carry traditional currency in their wallets.

For contactless payments, Filipinos also have more bias in using QR codes than contactless cards.

IMAGE CREDIT: https://www.visa.com.ph/

The Visa Consumer Payment Attitudes Study is an annual study covering payment behaviours of Filipino consumers regarding digital payments, digital banking, and the future of commerce. The latest edition is in its 10th year running and was based on interviews conducted from October to November 2023. The survey involved at least 1,000 Filipino consumers who are between 18 and 65 years old, spread across different cities/regions and income brackets, and with a minimum monthly income of PHP 12,000.

Gen Z and Gen Y consumers now embracing cashless transactions

Driven by the younger (Gen Z and Gen Y) and more affluent segments, Filipino consumers increasingly embrace cashless transactions, going without cash for an average of 10 days. Specifically, card payment usage was reported to have reached 70% (including swipe/insert, online, and tap-to-pay/contactless payments) in 2023, while mobile wallet usage stood at 87%, at par with cash transactions.

43% of Filipinos surveyed now carry less cash in their wallets, mainly due to the growing consumer habit of using cashless and contactless payments, alongside the increasing acceptance of cashless payments among stores & merchants.

Supermarkets (88%), food and dining (86%), and bill payments (82%) are the leading merchant categories that consumers observed to have opened up acceptance of cashless payment methods compared to a year ago.

“In the past, there has been a big disparity between cash, mobile, and cards. What we are seeing now is that mobile payment has become more or less synonymous with cash at 87 per cent,” said Jeffrey Navarro Visa country manager for the Philippines.

According to him, Filipinos are now becoming much more comfortable with cashless payments, and Visa is confident that they will continue to embrace innovations in the digital payments landscape.

“Our study shows that the cashless wave is maintaining its momentum in the Philippines. We are moving closer to achieving a cashless Philippine society, but we still have some way to go,” he said.

With growth attributed to increasing payment acceptance across merchants for cards and mobile wallets, Visa says it remains committed to ensuring a seamless transition to a cash-lite society by providing secure and convenient digital payment solutions.

“Visa plays a strategic role in the payment ecosystem to drive financial and digital inclusion by partnering with the government, banks, financial institutions, and fintechs to support the development of digital payments in the Philippines. We are supporting the digitization journey in the Philippines by providing consumers and businesses with convenient, seamless, and safe digital payment solutions,” Navarro ends.