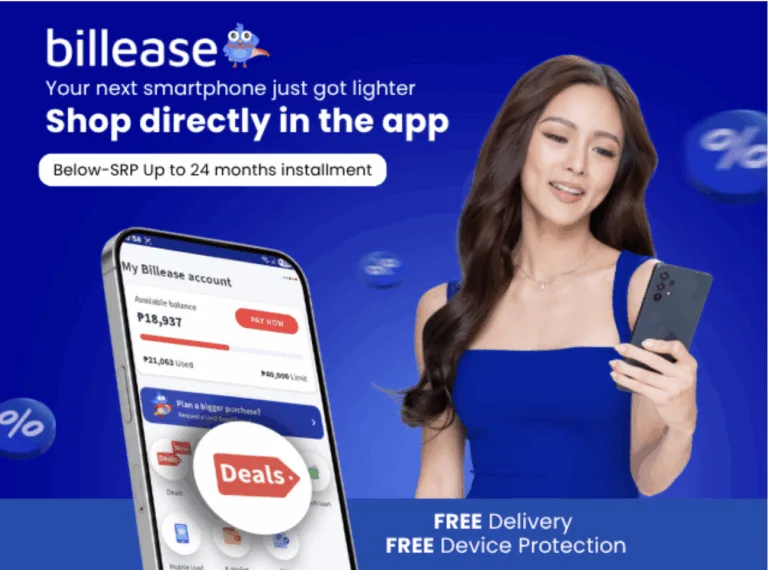

PayRex expands BillEase BNPL to thousands of PH merchants

PayRex, a fast-growing payments platform in the Philippines, is now bringing BillEase’s “buy now, pay later” (BNPL) service to thousands of merchants across the country.. Read More...