According to Capstone-Intel Corporation, a private research and intelligence agency, cryptocurrency awareness among Filipinos is rapidly growing, with many now using digital currency to pay for online purchases. There are also those who engage in crypto trading as an option to make money quickly.

IMAGE CREDIT: www.coinatmfinder.com

To dive deeper into these findings, the research and intelligence firm surveyed 1,200 people in the Philippines between May 1 to May 10, 2023.

The goal of the study is “to give a thorough understanding of the Filipinos’ knowledge, attitudes, and investment habits in relation to cryptocurrencies and NFTs (non-fungible tokens),” stated Dr. Guido David, Chief Data Scientist at Capstone-Intel Corporation.

Capstone-Intel transforms data and information into ground-breaking insights and useful intelligence outputs by utilizing cutting-edge research technology, tools, and methodologies. Here, personal information about the people taking the poll is usually not gathered. The participants’ responses are also carefully compiled without revealing their private information.

According to David, this strategy is meant to develop a sense of respect and credibility with the people being polled. It is also meant to successfully reduce the possibility of the respondents disclosing their personal values through their comments.

Key findings from the survey

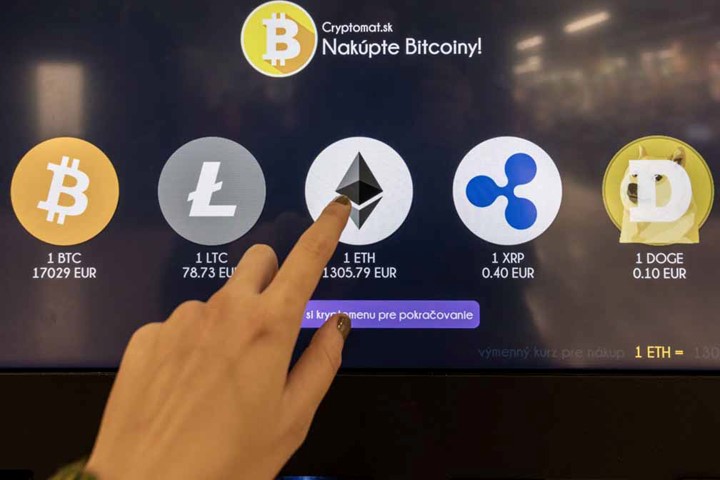

According to the survey, ninety-three percent of the respondents said they were aware of Bitcoin, making it the most commonly known listed digital asset of this type among the participants.

Bitcoin was followed in the list by these other cryptocurrencies: Binance USD (53%), Ethereum (54%), Dogecoin (33%), USD coin (32%), XRP (28%), Tether (26%), BNB (22%), Solana (19%), Cardano (15%), Polygon (16%), and Polkadot (2%).

The data also showed that people’s knowledge of the many accessible digital currency kinds and their decisions to wager on them varies.

More than half (51 percent) of those polled cited the possibility of a higher return on investment as their number one motivation for investing in cryptocurrencies; 43%, however, were hesitant due to a lack of knowledge on the first steps to take.

The study also revealed the respondents’ levels of awareness in relation to their sex, age, and educational backgrounds, among other demographic characteristics, throughout 17 different regions of the nation.

As for breakdown by area, 15 percent of the survey participants came from Region 1V-A, twelve percent were from the National Capital Region, and another twelve percent were based in Region III.

The rest of the breakdown is as follows: Region VI (7%), Region VII (7%), Region V (6%) as well as Region XII (5%), Region X (5%), Region I (5%), Region XI (5%), Region IX (4%) and Region VIII (4%) as well as Mimaropa (3%), Region XIII (3%), Region II (3%), BARMM (3%) and CAR (2%) per location.

When it comes to their acquaintance with digital currency, the gender split is quite even, with 50.4 percent of them being women and 49.6 percent being men.

The youngest participants (22%) are between the ages of 18 and 24; 41% of the participants also have cryptocurrency investments totaling less than P1,000.

Other age groups with similar appetites were those between 25 and 34 years old (28%), 35 to 44 years old (25%), and 53 to 54 years old (25%).

According to the report, three percent of seniors aged 65 to 75 are least familiar with cryptocurrencies. Surprisingly, investors in this age group invested anything between P5,001 to P10,000 in their favorite cryptocurrency.

In terms of academic achievement, 58 percent of the respondents have already graduated from college, 20 percent are college students, 12 percent have completed high school, and 5 percent had a technical trade certificate.

High school graduates who participated in the survey had the lowest response rate at 2 percent although post-graduate students, who were thought to have a higher level of knowledge and stronger interest in investing, only had a response rate of three percent.

Roman Catholics made up 70% of the respondents who were identified as religiously affiliated, followed by Born-Again Christians (12%), Muslims (4%), and Iglesia ni Kristo (4%). Two percent said that they have no religious affiliation while another 2% opted not to divulge any information about their religious beliefs. The remaining seven percent were members of other religious groups.

Economically speaking, the participants’ primary sources of income are salary-labor (53 percent), followed by self-employment (23 percent), business ownership (14 percent), and commission-based or project-based work (12 percent).