Singlife Philippines has unveiled SinglifeNextGen, a groundbreaking whole life protection plan that aims to help Filipinos build a lasting legacy through financial empowerment. The new product expands Singlife’s portfolio of innovative and best-in-class financial solutions designed to make life insurance more meaningful, digital, and accessible to every generation.

Grounded in the Filipino value of providing as an expression of love, SinglifeNextGen empowers individuals to ensure that their care and commitment to family endure long after their lifetime.

Lester Cruz, Singlife Philippines Chief Executive Officer, reflected on the company’s journey, saying, “We’re using the power of technology to make insurance work for real people in real life. Every product we design, every experience we create is built to support the real needs of Filipinos and their families” Cruz said, emphasizing Singlife’s mission to simplify financial protection through digital innovation.

“With just a few clicks and an easy, fully digital guided journey, anyone can get up to ₱6 million in coverage — making lasting security accessible, intuitive, and within reach. It’s designed for those who want real protection, not just for themselves, but for the people who matter most,” he added.

The launch event gathered financial advocates, media representatives, and digital innovators who share Singlife’s goal of making insurance simple and relevant in today’s tech-driven world.

Photo shows (from left): host James Deakin, guest speaker Dette Zulueta of Millennial MomsPH, Lester Cruz, CEO of Singlife Philippines, and Ber Marquez, Head of Products and Propositions.

Protection that lasts a lifetime

With SinglifeNextGen, customers can enjoy lifetime protection by paying premiums for only five or ten years, yet receive coverage that extends up to age 120. This flexible payment option helps customers secure long-term protection while managing their financial goals at different life stages.

The plan provides coverage of up to ₱6 million per person, ensuring that families can maintain stability even during unforeseen events. Policyholders may use the cash benefit to cover daily expenses, support their children’s education, or pursue future plans such as starting a business.

Lester Cruz, CEO of Singlife Philippines, discussing the benefits of their new product

Beyond financial protection, the plan complements a family’s existing resources, helping them sustain their lifestyle, achieve their goals, and continue celebrating milestones with confidence and peace of mind.

“We’re here to keep pushing boundaries to make protection even more seamless. And to keep empowering more Filipinos to live confidently,” Cruz added. “SinglifeNextGen designed to address real needs and give Filipinos more control over their financial future.”

Simple, digital, and designed for every Filipino

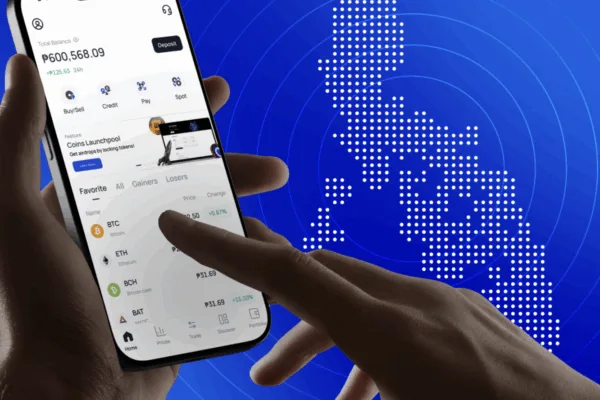

Staying true to Singlife’s commitment to digital empowerment, SinglifeNextGen offers a fully online application process.

With just a few clicks through the Singlife Plan and Protect App, customers can easily access quotes, complete applications, and secure their coverage — all without paperwork or in-person consultations.

This seamless experience reflects the company’s larger mission: to make financial independence simple, meaningful, and accessible for every Filipino. By leveraging technology, Singlife removes barriers that often discourage people from getting insured — such as long forms, complicated terms, and intimidating processes — and replaces them with a user-friendly platform that puts control in the hands of customers.

Lester Cruz, CEO of Singlife Philippines

“Filipinos deserve financial solutions that are not only reliable but also easy to understand and access,” said Cruz. “Through SinglifeNextGen, we are simplifying the path toward lifelong protection, so that more people can focus on what truly matters — their loved ones.”

Turning love into a lasting legacy

Through SinglifeNextGen, Singlife Philippines reinforces its vision of reshaping how insurance fits into modern Filipino life — transforming it from a product of necessity into a symbol of love, foresight, and empowerment.

As the company continues to innovate, it remains committed to responding to the ever-changing needs of its customers. Singlife’s suite of digital financial products continues to grow, providing tools that help Filipinos secure their futures, protect their families, and turn their love into a legacy that lasts for generations.

SinglifeNextGen underscores the belief that protection is not just about preparing for the unexpected, but about building a future rooted in love, security, and confidence. You too can now experience a new way of protecting what matters most with just a few clicks. Simply download the Singlife Plan & Protect App today to avail of SinglifeNextGen and help secure lifelong protection for your family.

For the latest updates, follow Singlife Philippines on Facebook, Instagram, and TikTok.