In a monumental achievement that signals a seismic shift in the financial services sector, Singlife Philippines has announced it has issued over one million policies, effectively protecting an equal number of lives since its launch in 2020.

The milestone, reached in just five years, solidifies the digital life insurer’s position as a market leader and a trailblazer in making financial protection accessible to a new generation of Filipinos.

Lester Cruz, CEO of Singlife Philippines

This landmark accomplishment isn’t just a number; it is a powerful testament to the company’s ability to deliver on its promise. Beyond the policies issued, Singlife has paid out more than P100 million in claims, providing crucial financial support to families during some of their most challenging moments. This rapid and transparent claims process stands in stark contrast to the often-slow and complex traditional insurance experience, proving that a digital-native model can deliver trust and reliability at scale.

“We didn’t build Singlife to follow the old playbook; we built it for a digital world,” said Lester Cruz, CEO of Singlife Philippines. “We anticipated a shift where Filipinos would want financial protection that’s on-demand, transparent, and completely in their control. These numbers prove that this model doesn’t just work — it’s what this generation has been waiting for.”

Singlife Philippines: Unlocking financial control with a tap

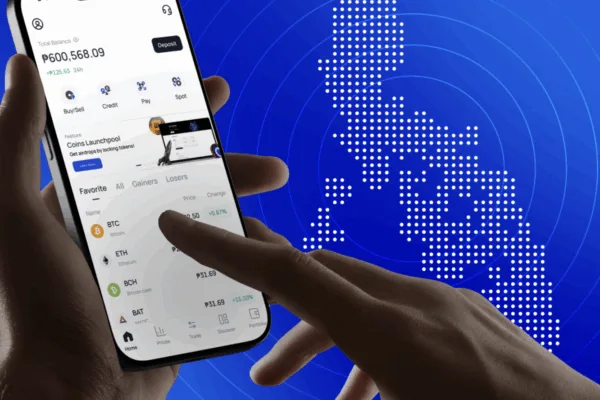

At the core of this unprecedented growth is the Singlife Plan & Protect app, which was launched in 2023. As the country’s first fully digital, end-to-end insurance platform, the app has redefined how Filipinos purchase and manage their policies.

Bypassing the need for physical paperwork or traditional agents, it has garnered an impressive 1.4 million installs and facilitated over 45,000 policy issuances directly from a user’s smartphone. This streamlined, self-service approach has resonated deeply with a tech-savvy population, empowering them to take charge of their financial well-being on their own terms.

The company’s momentum shows no signs of slowing down. Singlife has reported a sevenfold year-on-year growth in app-driven business, which now accounts for the majority of its new premiums.

This trajectory continued to accelerate into the first half of 2025, with the company seeing strong double-digit growth in premium income compared to the same period last year. The total sum assured has also risen by a significant 20 percent, representing a massive increase in the total coverage provided to Filipino families.

Building trust in a digital financial world

The success of Singlife isn’t an isolated event; it mirrors the broader digital transformation underway in the Philippine financial services industry. The company’s journey highlights a critical maturation of the country’s fintech ecosystem, where consumers are not only adopting digital payments and e-wallets but are now showing a strong willingness to trust and engage with more complex financial products, like insurance, through mobile platforms.

This signals a major win for the government’s push for financial inclusion, as insurtechs like Singlife dismantle traditional barriers to access and prove that convenience and security can coexist.

Singlife’s digital-native model offers fully customizable life, health, and investment-linked plans, all accessible with a few taps. The all-in-one app seamlessly integrates savings tools, policy management, and claims processing, providing a holistic and user-friendly experience. This level of convenience and control is a key differentiator in a competitive market, attracting both young professionals and families looking for a modern approach to financial planning.

As it commemorates its fifth anniversary in the Philippines, Singlife is undergoing a significant brand refresh. The update moves away from playful caricatures and towards a more human, relatable visual identity and storytelling approach. This strategic evolution aims to further deepen the company’s connection with Filipinos by focusing on real-life stories and the tangible benefits of achieving financial independence.

“This is year five and we are just getting started. With over one million lives protected and counting, we remain focused on our purpose of providing financial independence for Filipinos,” Cruz stated. “We’ll keep pushing boundaries so more Filipinos can thrive financially — wherever they are, and whenever they need us.”