Rizal Commercial Banking Corporation (RCBC) has unveiled its groundbreaking RCBC Tap-to-Phone service in a move that is poised to dramatically reshape the landscape of small business transactions.

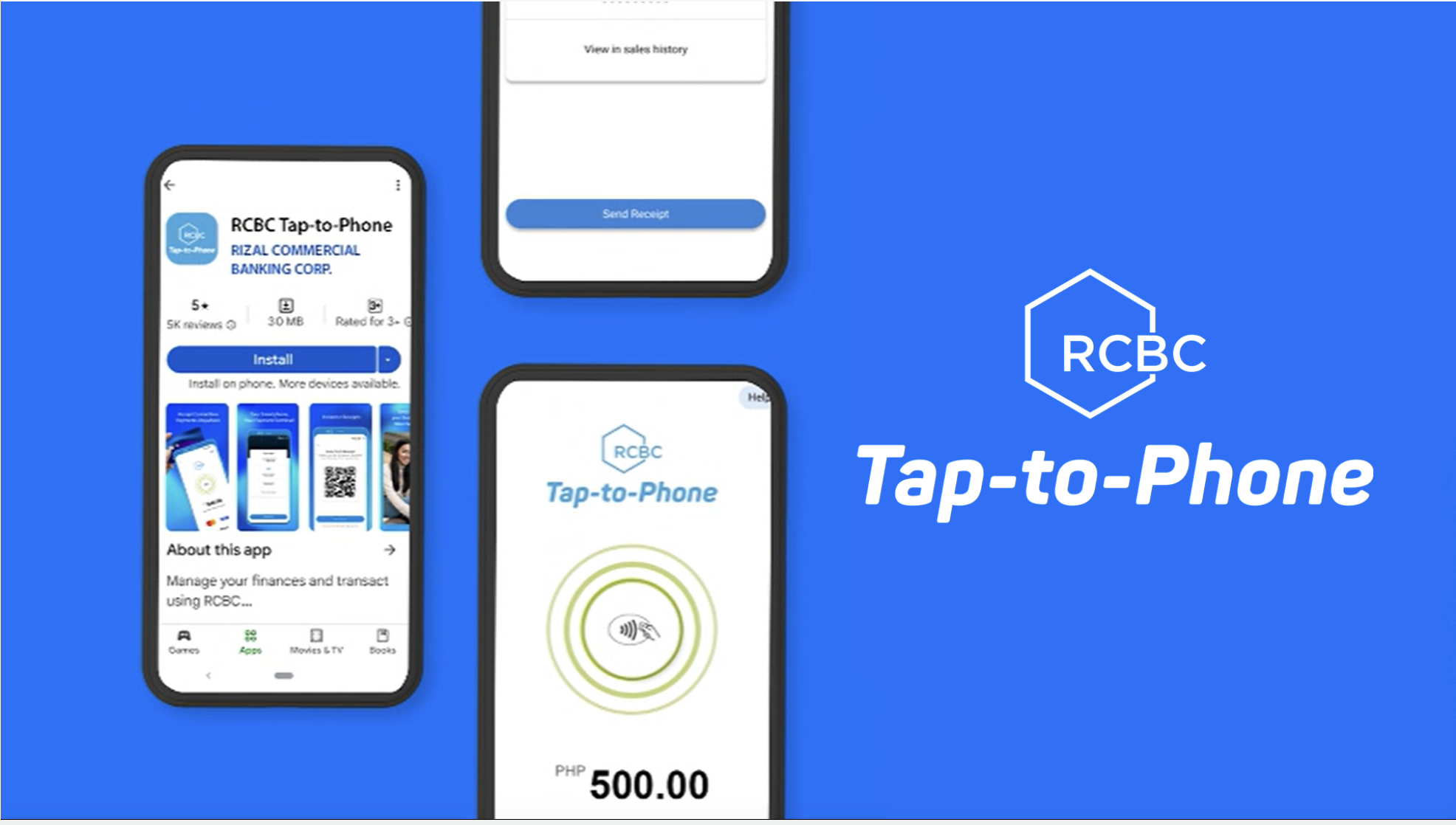

This innovative solution transforms ordinary Android smartphones into fully functional payment terminals, empowering micro, small, and medium enterprises (MSMEs) to seamlessly accept card payments.

The launch of RCBC Tap-to-Phone, developed in partnership with fintech-as-a-service (FaaS) provider Soft Space, directly addresses the persistent challenges faced by MSMEs in accessing affordable and efficient digital payment solutions.

By eliminating the need for bulky and expensive traditional point-of-sale (POS) terminals, RCBC is leveling the playing field and fostering greater financial inclusion.

RCBC: Breaking down barriers that traditionally hinder MSMEs

“Our goal is to break down the barriers that have traditionally hindered MSMEs from fully participating in the digital economy,” stated RCBC in a press release on its website. “RCBC Tap-to-Phone allows these businesses to leverage the power of their smartphones to accept Mastercard and Visa payments, be it credit, debit, or prepaid, in a secure and convenient manner.”

The technology, powered by Soft Space’s Fasstap, a SoftPOST solution, utilizes the near-field communication (NFC) capabilities of Android smartphones. Merchants simply tap a customer’s card against their phone to process the payment.

Upon successful transaction, a QR code is generated, serving as an electronic receipt for both the merchant and the customer. This streamlined process not only simplifies transactions but also contributes to a more sustainable, paperless environment.

The timing of this innovation is particularly significant given the critical role MSMEs play in the Philippine economy.

According to data from the International Monetary Fund (IMF), MSMEs contribute over 40% to the country’s GDP, representing a staggering $470 billion. However, many of these businesses operate primarily on cash transactions, limiting their growth potential and leaving them vulnerable to the inefficiencies and security risks associated with physical currency.

“The introduction of RCBC Tap-to-Phone is a game-changer for MSMEs,” said Judy Dasigan, a local business owner who participated in the pilot program.

“Previously, the cost of traditional POS terminals was a significant hurdle. Now, with just my smartphone, I can accept card payments, which not only enhances convenience for my customers but also expands my market reach,” he added.

A game-changer for MSMEs

The simplicity and accessibility of the RCBC Tap-to-Phone service are expected to drive rapid adoption among MSMEs across the Philippines. It eliminates the need for extensive technical expertise or specialized equipment, making it ideal for small businesses operating in diverse sectors, from retail and food services to transportation and personal services.

Furthermore, the secure nature of the technology, backed by the robust infrastructure of RCBC and Soft Space, provides merchants and customers with peace of mind. The use of NFC technology and secure encryption protocols ensures that all transactions are protected against fraud and unauthorized access.

RCBC’s initiative aligns with the broader national agenda of promoting digital transformation and financial inclusion. By empowering MSMEs with accessible and affordable digital payment solutions, the bank is contributing to the creation of a more vibrant and resilient economy.

The financial institution encourages interested MSMEs to explore the RCBC Tap-to-Phone service and take advantage of the opportunity to modernize their payment systems. They reiterate that the technology is designed to be simple, secure, and accessible to all.

As the Philippine economy continues to navigate the challenges of the digital age, innovations like RCBC Tap-to-Phone are crucial for driving sustainable growth and empowering MSMEs to thrive in an increasingly competitive market. In December last year, the bank had also been selected as one of Tesla’s financing partners in the Philippines in a groundbreaking collaboration that underscores RCBC’s commitment to innovate in the digital age.

The transformation of smartphones into powerful payment terminals marks a significant step forward in the country’s journey towards a more inclusive and digitally driven future.