by Jan Michael Carpo, Reporter

Philippine Savings Bank (PSBank) has intensified its focus on ensuring the safety of its customers by adding extra security features to its mobile banking app. The move is in response to observations that cybersecurity risks continue to grow as digital banking becomes more popular in the Philippines.

In a press statement, the bank said that these updates are part of the bank’s ongoing efforts to combat threats like phishing, fraud, and identity theft, which have increasingly targeted online banking users.

PSBank noted that the shift toward digital banking, while convenient, has made many consumers more vulnerable to cyberattacks. Among the most concerning threats is phishing, where fraudsters create fake emails and websites to steal personal information. The bank emphasized that the security of its mobile banking services is a top priority.

“As more customers transition to digital banking, they face heightened risks of fraud, phishing schemes, and identity theft,” the bank said in a statement. “To combat these threats, we are continuously enhancing security measures, including two-factor authentication, account monitoring, biometric authentication, and robust password policies, ensuring our customers’ mobile banking experience remains safe.”

Last July 19, a catastrophic software update from security company CrowdStrike brought global IT disruptions in the Philippine banking sector, highlighting the dangers of relying heavily on a few tech giants.

PSBank: Strengthening security for mobile banking users

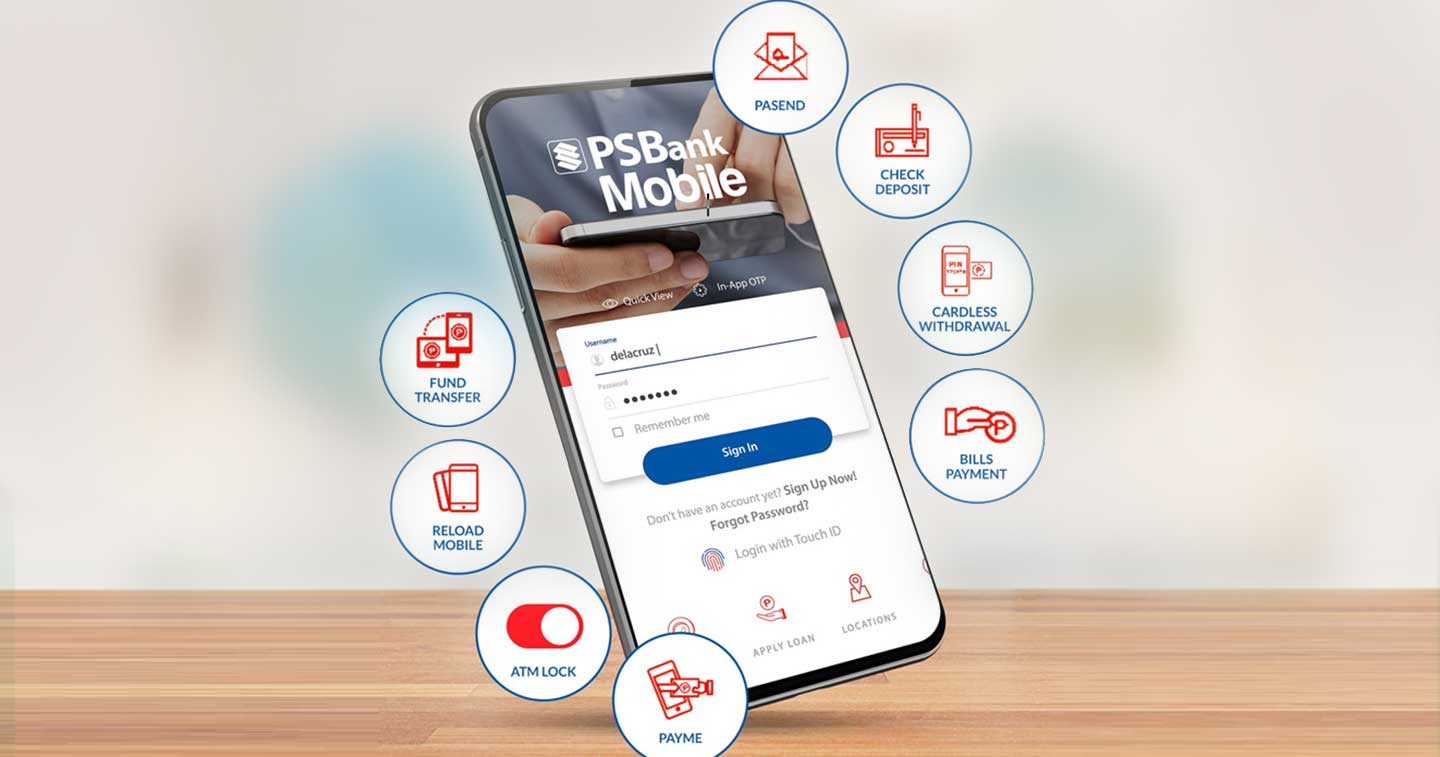

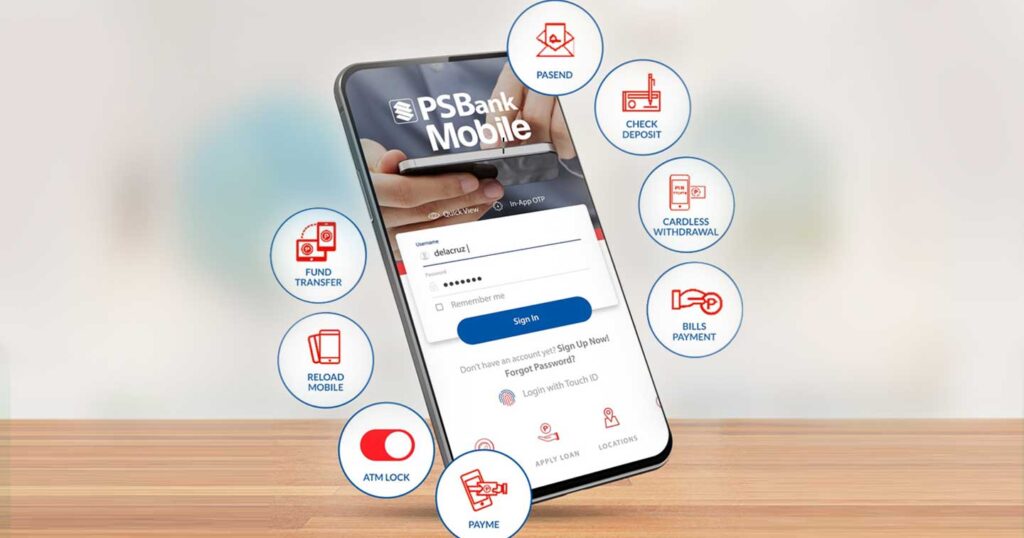

PSBank’s decision to prioritize cybersecurity has resulted in the latest update to its mobile banking app. The enhanced app now offers users more control over their accounts, with features designed to limit access to preferred devices and add extra layers of protection against unauthorized transactions.

“PSBank clients can now restrict access to their accounts on platforms they don’t usually use, ensuring that their accounts are only accessible via the channels they trust,” the bank explained in a press release. This security feature allows users to lock or unlock access to their PSBank accounts on certain platforms, reducing the risk of unauthorized logins.

Another critical addition is the ability for PSBank users to lock or unlock their ATM cards directly from the app. This feature provides an additional safeguard against fraudulent transactions. If a customer suspects that their card has been compromised, they can immediately lock it through the app, preventing any unauthorized use.

“Our goal is to give customers more control over their online banking experience,” the bank added. “With these new security features, our customers can manage their banking activities with peace of mind, knowing their accounts are better protected.”

A revamped, user-friendly mobile banking experience

Beyond security, PSBank has focused on improving the overall functionality and user experience of its mobile banking app. The updated interface offers a range of new features designed to make banking more convenient for both new and experienced users.

The redesigned app boasts a cleaner, more intuitive interface that allows users to easily store and share transaction receipts. It also offers access to detailed information on loan accounts and the ability to personalize the home screen. Customers can choose between a comprehensive view of all their accounts or a simplified, single-account display, depending on their preferences.

Additionally, PSBank mobile users can now apply for new loans, open time deposit accounts, and deposit checks directly through the app. These features make it easier for customers to manage their finances without needing to visit a physical branch.

The app also offers a personalized banking experience, featuring customizable displays with commonly used options and vibrant images of well-known Philippine locations. “We want to make the banking experience as engaging and convenient as possible for our customers,” the bank stated.

Commitment to financial inclusion and growth

As part of its mission to advance financial inclusion in the Philippines, PSBank has also streamlined the process for opening new accounts through its mobile app. The bank’s aim is to make banking accessible to all Filipinos, regardless of their location or financial background.

“PSBank is dedicated to advancing financial inclusion by making universal banking services easily accessible,” the bank said. “We’ve simplified the account opening process to make it easier for Filipinos to start their banking journey with us.”

This focus on digital innovation and financial accessibility has contributed to PSBank’s continued growth. In the first half of 2024, the bank’s earnings rose by 18%, reaching P2.56 billion, up from P2.17 billion during the same period the previous year. This increase was driven by improved credit quality and strong demand for consumer loans.

As the retail banking arm of Metropolitan Bank and Trust Co., PSBank is well-positioned to serve its expanding customer base, with 250 branches and 557 in-branch and offsite ATMs across the country. The bank’s commitment to enhancing its digital services and strengthening cybersecurity will be critical as it continues to navigate the evolving financial landscape.

With its newly updated mobile banking app, PSBank is not only responding to the growing cybersecurity challenges but also reinforcing its role as a leader in promoting digital financial services in the Philippines.