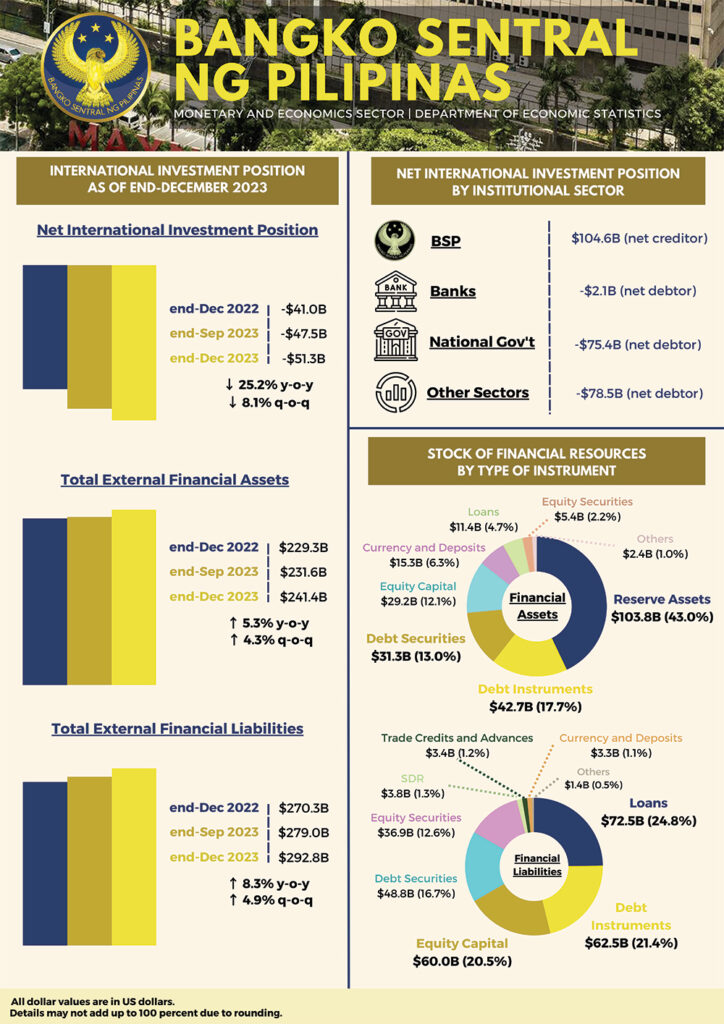

In its latest report, the Bangko Sentral ng Pilipinas (BSP) announced that preliminary data on the country’s net International Investment Position (IIP) had indicated a net liability position of US$51.3 billion by the end of December 2023, higher by 8.1 per cent than the US$47.5 billion recorded by the end of September this year.

IMAGE CREDIT: https://stock.adobe.com/

The International Investment Position (IIP) is a statistical statement that shows at a point in time the value of financial assets of residents of an economy that are claims on non-residents or are gold bullion held as reserve assets and the liabilities of residents of an economy to non-residents.

The difference between the assets and liabilities is the net position in the IIP and represents either a net claim on or a net liability to the rest of the world. The current end-quarter net IIP is computed as follows: previous end-quarter net IIP plus current quarter Balance of Payments net flows and other changes (e.g., market price and exchange rate changes).

BSP’s latest report on PH’s net external liability position

Fourth Quarter 2023 developments

According to the BSP, this development was driven by the 4.9 per cent expansion in the country’s external financial liabilities, outpacing the 4.3 per cent growth in external financial assets.

As of the end of December 2023, the country’s total outstanding external financial liabilities reached US$292.8 billion, while total outstanding external financial assets amounted to US$241.4 billion.

The country’s total stock of external financial liabilities as of end-Q4 2023 rose, as all components registered an increase, except for financial derivatives. In particular, other investments in the form of foreign loans increased by 7.9 per cent to US$72.5 billion from US$67.2 billion. Foreign portfolio investment (FPI) also increased by 5.7 per cent to US$85.8 billion from US$81.1 billion on the back of strong investor interest in bond issuances by the National Government (NG).1

Moreover, foreign direct investment (FDI) rose by 3.7 per cent to US$122.6 billion from US$118.2 billion.

The increase in the stock of the country’s external financial assets as of end-December 2023 was driven mainly by the accumulation of reserves assets to reach US$103.8 billion from US$98.1 billion as of end-September 2023. The higher level of reserves was attributed to the upward adjustments in the BSP’s foreign currency-denominated reserve assets (or non-gold reserves) and gold holdings, the NG’s net foreign currency deposits with the BSP, net income from the BSP’s investment abroad, and the BSP’s net foreign exchange operations.2

In addition, the residents’ net direct investments in foreign debt instruments and net deposits of currency and deposits in banks abroad rose by 3.8 per cent (to US$42.7 billion) and 11.5 per cent (to US$15.3 billion), respectively.3

On a year-on-year basis, the country’s net external liability position expanded by 25.2 per cent from US$41.0 billion as of end-December 2022. This was on account of an increase in total external financial liabilities by US$22.5 billion, which outpaced that of total external financial assets by US$12.2 billion.

Total external financial liabilities grew by 8.3 per cent year-on-year stemming from the collective growth in the other investments (by 13.4 per cent to US$84.1 billion), FDI (by 8.2 per cent to US$122.6 billion), and FPI (by 4.0 per cent to US$85.8 billion).

In particular, residents’ net outstanding loans from nonresident creditors rose by 16.2 per cent (to US$72.5 billion from US$62.4 billion). Intercompany borrowings also rose by 12.1 per cent (to US$62.5 billion from US$55.8 billion).

Furthermore, non-residents’ outstanding investments in portfolio debt securities increased by 10.5 per cent (to US$48.8 billion from US$44.2 billion) as of end-Q4 2023.4

The expansion in FDI and FPI reflects investor confidence in the Philippine economy on the back of the country’s growth and improved domestic inflation dynamics.

Meanwhile, the 5.3 per cent growth in total external financial assets was mainly on account of the increase in the country’s reserve assets (to US$103.8 billion from US$96.1 billion) combined with the increase in residents’ net direct investments abroad, both in the form of debt instruments (to US$42.7 billion from US$40.1 billion) and equity capital (to US$29.2 billion from US$27.1 billion).

External financial assets

The BSP continued to hold the largest share of residents’ total external financial claims on the rest of the world at 44.9 per cent, amounting to US$108.5 billion as of the end of December 2023. This level was 5.9 per cent higher than the US$102.4 billion posted in end-September 2023.

The other sectors accounted for 41.0 per cent of the country’s outstanding external financial assets at US$99.0 billion.5

The banks accounted for the remaining 14.1 per cent of the country’s total external financial assets, amounting to US$33.9 billion.

External financial liabilities

The other sectors accounted for US$177.5 billion or 60.6 per cent of the country’s total external financial liabilities as of the end of December 2023. This level was 4.2 per cent higher than the end-September 2023 level of US$170.3 billion.

The NG, likewise, recorded a 7.0 per cent growth in its outstanding external financial liabilities to reach US$75.4 billion, which represents 25.7 per cent of the Philippines’ total external financial liabilities. The banks’ share accounted for 12.3 per cent of the country’s total external financial liabilities at US$36.0 billion as of the end of 2023.

Meanwhile, the BSP held a marginal portion or 1.3 per cent of the country’s total external financial liabilities at US$3.8 billion, which were mostly in the form of Special Drawing Rights (SDRs).

1 The Republic of the Philippines (RoP) issued Sukuk Bonds amounting to US$1.0 billion in December 2023.

2 The Central Bank is excluded from the Deposit-taking Corporations Sector.

3 Debt instruments under the Direct Investment account consist mainly of intercompany borrowing/lending between direct investors and their subsidiaries/affiliates.

4 Debt securities under the Portfolio Investment account consist mainly of placements in negotiable instruments serving as evidence of a debt, which are issued by enterprises that are not affiliated with the investors.

5 Other Sectors cover the following economic sectors: (a) other financial corporations, which include private and public insurance corporations, holding companies, government financial institutions, investment companies, other financial intermediaries except insurance, trust institutions/corporations, financing companies, securities dealers/brokers, lending investor, Authorized Agent Banks (AAB) forex corporations, investment houses, pawnshops, credit card companies, offshore banking units (OBUs); (b) non-financial corporations, which refer to public and private corporations and quasi-corporations, whose principal activity is the production of market goods or non-financial services; and (c) households and non-profit institutions serving households (NPISHs).