In an era of rapid change and global uncertainty, the Philippines’ top financial regulators are deepening their collaboration to safeguard the nation’s economic stability. The Financial Sector Forum (FSF), [1]a powerful alliance of key government bodies, has just concluded its Fourth Financial Conglomerate Supervisory College, a crucial, months-long program to strengthen oversight of the nation’s largest and most interconnected financial entities.

This initiative is a proactive response to the complexities of modern finance.

Unlike the past, where a bank, an insurance firm, or a stock brokerage firm operated in silos, today’s financial giants are often conglomerates — massive organizations with a wide web of subsidiaries across different sectors.

This interlinkage, while creating efficiency, also introduces new and complex risks that could ripple across the entire system if left unchecked.

The FSF, comprised of the Bangko Sentral ng Pilipinas (BSP), the Securities and Exchange Commission (SEC), the Insurance Commission (IC), and the Philippine Deposit Insurance Corporation (PDIC), is leading the charge.

During the Supervisory College, which began in October 2024 and concluded in May 2025, the regulators convened to share data, align their risk assessments, and create a unified strategy for monitoring the most influential players in the market.

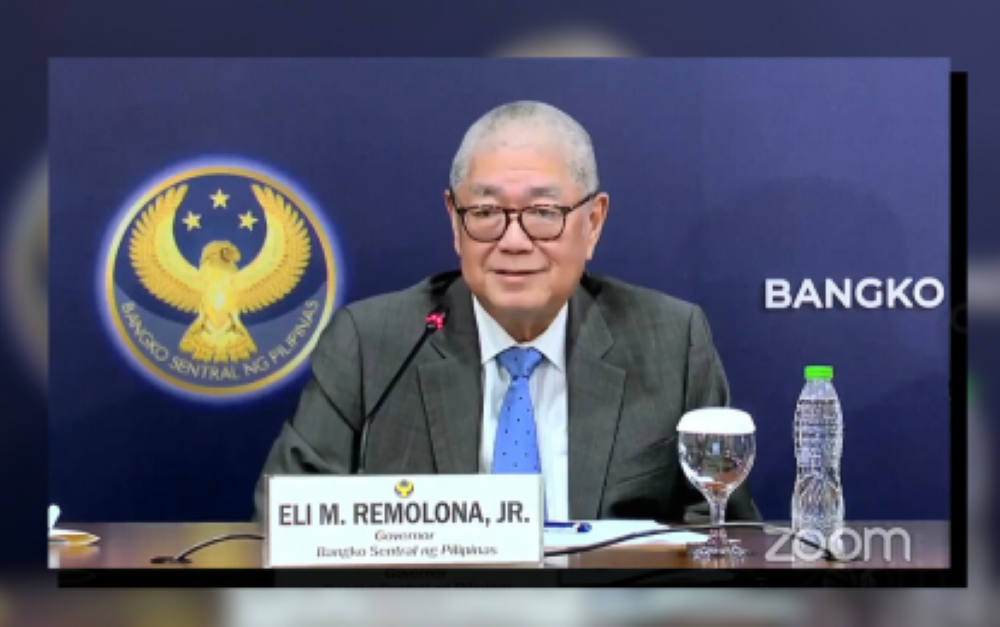

“The supervisory college program demonstrates our commitment to effective oversight of financial conglomerates through collective action,” said BSP Governor Eli M. Remolona, Jr., who chairs the forum. “Sustained collaboration enables us to advance a harmonized, cross-sectoral approach to managing conglomerate risks.”

In this program, the country’s financial regulators conduct months-long discussions and studies to ensure comprehensive monitoring of the risks faced by each financial conglomerate. They discuss key risks, align their supervisory risk assessment frameworks, [2] and develop a supervisory plan [3] that prioritizes subsidiaries and affiliates that have material contributions to a conglomerate’s business and strategies.

The Fourth Supervisory College built on previous supervisory colleges that established standardized policies [4]and structured data analysis to ensure consistent risk evaluations across sectors.

A coordinated approach to mitigating risks

The college operates as an institutionalized “war room” for the financial sector.

Experts from each regulatory body spend months analyzing the key risks faced by each conglomerate, from credit and market exposure to operational and cyber threats. A key output of this process is the harmonized supervisory risk assessment framework, which ensures that every regulator uses a consistent set of tools and criteria to evaluate risks.

This shared framework prevents gaps in oversight and guarantees that a problem spotted by one agency is understood and acted upon by all.

Another vital result of the college is a joint supervisory plan. This plan outlines key activities, timelines, and shared responsibilities for monitoring a conglomerate. Rather than each agency focusing only on its own piece of the puzzle, the FSF collectively prioritizes the subsidiaries and affiliates that have the most material contributions to a conglomerate’s overall business strategy.

This allows for more targeted and efficient supervision, ensuring that resources are focused on the areas that pose the greatest potential risk to the financial system.

BSP: Building on a strong foundation

The Fourth Supervisory College wasn’t a one-off event. It built on the work of three previous colleges that established standardized policies and structured data analysis to ensure consistent risk evaluations. This continuous effort highlights the regulators’ commitment to an ever-evolving approach, recognizing that new challenges require new solutions.

The FSF’s work is driven by a deep understanding of the market’s dynamics and a commitment to keeping it resilient. Their collective action is not just about reacting to problems; it’s about proactively identifying vulnerabilities and building a stronger, more stable foundation for the Philippine economy.

As the forum moves forward, its commitment remains the same: to advance consolidated supervision, enhance its capacity, and align its frameworks to protect the resilience of financial conglomerates. The decision to conduct the fifth college in the second half of 2025 signals an ongoing dedication to this mission.

This structured, collaborative effort is a powerful message to investors and the public that the Philippine financial system is under constant and collective watch, ready to adapt and respond to any new challenge on the horizon.

—

[1] FSF is a voluntary interagency body, comprising the Bangko Sentral ng Pilipinas, Securities and Exchange Commission, Insurance Commission, and the Philippine Deposit Insurance Corporation, aimed at facilitating consultations and exchange of information among its members on matters relating to the supervision and regulation of financial institutions, and coordinating the regulatory and supervisory policies and efforts of the member agencies.

[2] Harmonized assessment refers to a coordinated evaluation of a conglomerate’s financial condition, risk profile and governance, agreed upon by all member-agencies. It follows the Reference Guide for Risk Assessment (RGRA) which provides a structured framework to ensure consistency in how regulators assess risks.

[3] Supervisory plan refers to a joint plan by the member-agencies outlining key supervisory activities, timelines, and responsibilities for monitoring and overseeing the conglomerate over a specific period.

[4] Standardized Policies refer to common supervisory approaches or regulatory expectations adopted by agencies to ensure consistent oversight. Supervisory College agencies use the RGRA and shared templates for risk assessment and reporting.