The Philippine economy entered mid-2025 grappling with external headwinds, as the country posted a balance of payments (BOP) deficit in the first half of the year.

Yet amid these challenges, brighter prospects emerged with J.P. Morgan placing Philippine government bonds on its positive watchlist for inclusion in the world’s most-followed emerging market bond index.

From surplus to deficit

Latest data from the Bangko Sentral ng Pilipinas (BSP) showed that the country’s BOP swung to a US$2.6 billion deficit in the second quarter of 2025, reversing the US$1.2 billion surplus recorded in the same period last year.

The BOP, which tracks the flow of money in and out of the economy, is made up of the current account (mainly trade), financial account (investments and loans), and capital account (smaller transfers like grants).

For the first half of the year, the deficit widened to US$5.6 billion, a sharp turnaround from the US$1.4 billion surplus posted in January to June 2024. The reversal was largely attributed to weaker financial account inflows and a wider current account gap.

On the financial side, net inflows declined as portfolio investments slowed and local banks extended more loans to non-residents while paying off foreign obligations. Meanwhile, direct investments also moderated as global uncertainty dampened investor confidence.

The current account deficit also widened, driven by higher imports fueled by strong domestic demand. While trade in goods improved, net receipts from services fell, adding pressure to the overall external position.

A silver lining: Global Bond Index watchlist

Despite the external deficits, investor sentiment toward the country showed signs of resilience.

On September 12, J.P. Morgan placed Philippine peso-denominated government bonds (RPGBs) on its positive watchlist for inclusion in its flagship Government Bond Index-Emerging Markets (GBI-EM) series.

The GBI-EM is the world’s most-watched benchmark for local-currency sovereign bonds, used by global fund managers to guide investments across 19 emerging economies. If included, the Philippines would carry an estimated 1 percent weight in the GBI-EM Global Diversified Index.

Such a move would not only attract new foreign investments into the country’s peso bond market but also boost liquidity and potentially lower borrowing costs for both the government and private sector.

Market reforms pay off

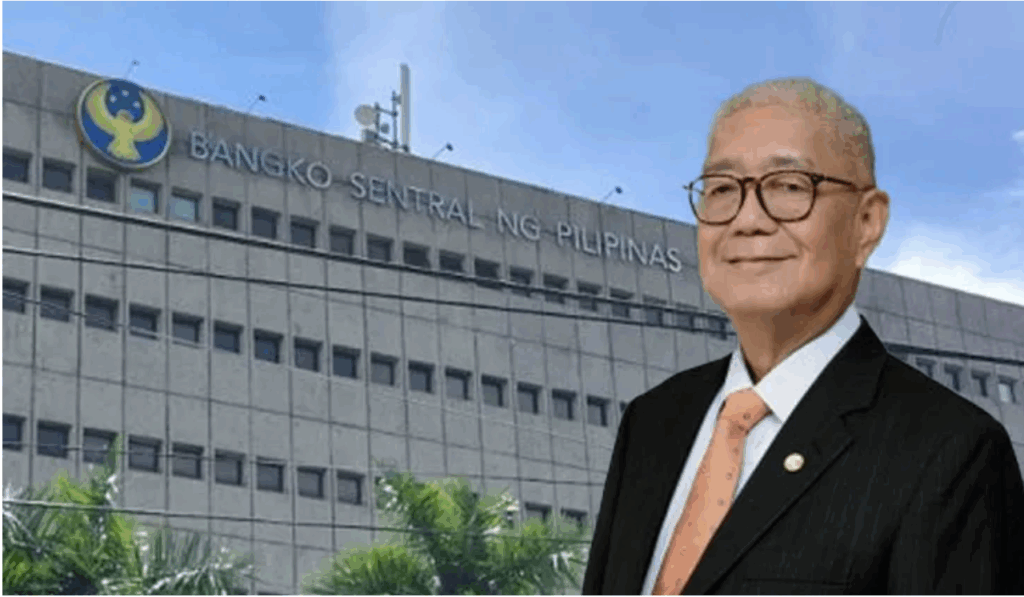

BSP Governor Eli M. Remolona, Jr. welcomed the announcement, calling it a recognition of the government’s efforts to deepen the local capital market.

“Getting on the positive watchlist is a testament to the work the government and financial market leaders have done especially in the last few years to expand our capital markets, particularly our local bond market,” he said. “This serves as further impetus to execute more reforms.”

J.P. Morgan cited several proactive reforms that helped strengthen investor confidence:

- Streamlining of tax treaty procedures

- Reviving the domestic repo market

- Launching the Philippine peso interest rate swap market

- Bureau of the Treasury’s consolidation of benchmark bonds to improve liquidity

These reforms have already borne fruit, with foreign ownership of RPGBs more than doubling from 1.8 percent in 2021 to 5.2 percent by mid-2025.

Balancing risks and opportunities

While the BOP deficit underscores the vulnerability of the Philippines to global economic shocks, the country’s improving capital market infrastructure and growing attractiveness to foreign investors provide a counterweight.

Economists note that inclusion in the GBI-EM would be a game-changer. It could channel billions of dollars into peso-denominated bonds, giving the Philippines more stable access to funding even amid volatility in global markets.

J.P. Morgan is expected to complete its assessment within six to nine months, with a decision likely by the first quarter of 2026.

For now, the Philippines faces a delicate balancing act: managing short-term external pressures while capitalizing on long-term opportunities to strengthen its financial markets.