The Bangko Sentral ng Pilipinas (BSP) has just released a media advisory announcing the results of the country’s latest economic performance which, according to the Department of Finance, grew faster (5.9%) in the 3rd quarter of 2023.

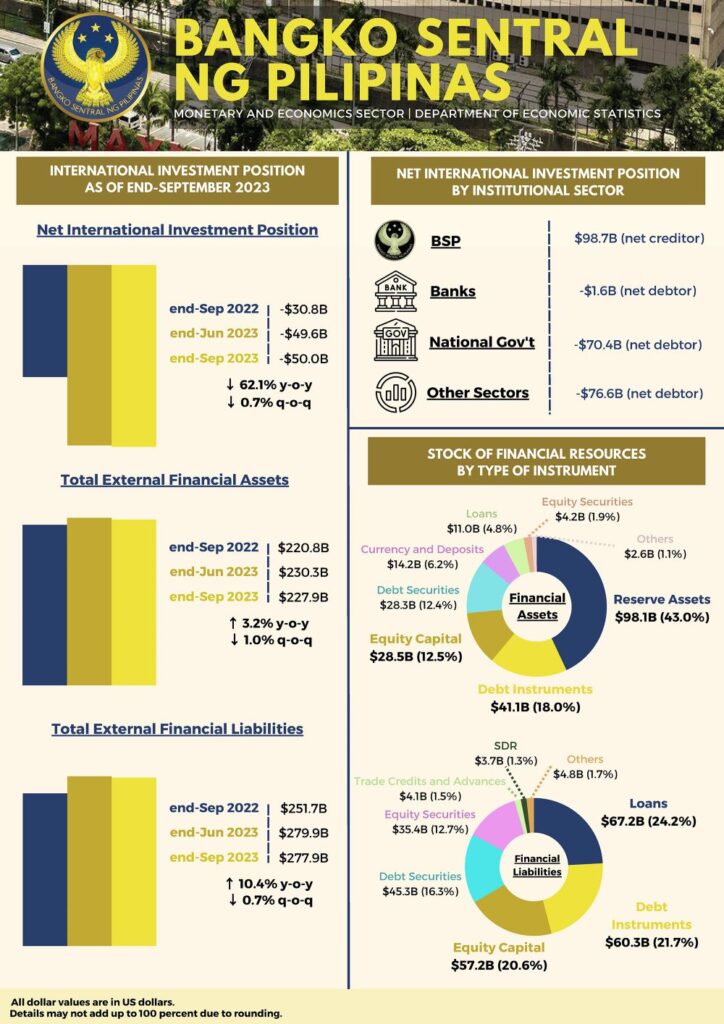

According to the advisory, however, preliminary data on the country’s net international investment position (IIP) also indicated a net liability position of US$50.0 billion as of the end of September 2023.

This is slightly higher by 0.7 per cent than the US$49.6 billion recorded by the end of June 2023. This development was driven mainly by the 1.0 per cent contraction in the country’s external financial assets, offsetting the 0.7 per cent decline in external financial liabilities.

As of end-September 2023, total outstanding external financial assets stood at US$227.9 billion, while total outstanding external financial liabilities amounted to US$277.9 billion.1

The decline in the country’s total stock of external financial assets during the quarter was driven mainly by combined decreases in the outstanding value of reserve assets to US$98.1 billion (from US$99.4 billion), portfolio investments to US$32.5 billion (from US$33.5 billion), and other investments to US$26.9 billion (from US$27.5 billion). The lower level of reserves was attributed to the national government’s (NG) payments of its foreign currency debt obligations, coupled with the downward adjustments in the valuation of the BSP’s foreign currency-denominated reserves (or non-gold reserves) and gold holdings.

In addition, the residents’ net withdrawal of their investments in foreign debt securities, and net repayment of loans by nonresidents to the local banks also contributed to the lower total outstanding level of external financial assets during the review period.2

Meanwhile, the slight decrease in the country’s total stock of external financial liabilities during the quarter was due mainly to the 5.2 per cent contraction in the residents’ outstanding foreign portfolio investments (FPI) to US$80.7 billion (from US$85.2 billion).

This development emanated mainly from the decline in nonresidents’ net investments in equity securities (by 6.2 per cent) and debt securities (by 4.5 per cent) amid the global slowdown and high-interest rate environment, which weighed down on investment activity, coupled with downward valuation adjustments during the period.3

This decline, however, was muted partly by the 3.8 per cent growth in residents’ outstanding foreign loans to US$67.2 billion from US$64.7 billion.

On a year-on-year basis, the country’s net external liability position rose by 62.1 per cent from US$30.8 billion in the previous year, with the increase in total external financial liabilities of US$26.3 billion outpacing that of the US$7.1 billion increment in total external financial assets.

The 10.4 per cent annual growth in the total external financial liabilities emanated mainly from the combined increases in the outstanding value of all components of the liability account apart from financial derivatives.

Foreign direct investments (FDI) grew by 12.3 per cent (to US$117.5 billion from US$104.6 billion) as nonresidents’ net placements in equity capital and intercompany borrowings from affiliates abroad increased by 13.2 per cent and 11.4 per cent, respectively.4

Other investments rose by 9.4 per cent (to US$79.4 billion from US$72.5 billion) following the 11.4 per cent growth in residents’ outstanding loans. Further, FPI also increased by 9.0 per cent (to US$80.7 billion from US$74.1 billion) as nonresidents’ net investments in debt and equity securities during the review period grew by 8.7 per cent and 9.4 per cent, respectively.5

Likewise, the total external financial assets grew by 3.2 per cent from the previous year mainly on account of the country’s accumulation of reserve assets (to US$98.1 billion from US$93.0 billion), combined with the increase in residents’ net direct investments abroad, particularly in the form of debt instruments (to US$41.1 billion from US$38.4 billion) and equity capital (to US$28.5 billion from US$26.4 billion).

External Financial Assets

The BSP continued to hold the largest share of residents’ total claims on the rest of the world at 44.9 per cent, amounting to US$102.4 billion as of end-September 2023. This, however, was 1.3 per cent lower than the US$103.8 billion asset holdings registered in the previous quarter. The Other Sectors accounted for 40.6 per cent of the country’s outstanding external financial assets at US$92.6 billion as of end-Q3 2023.6 Banks held the remaining 14.4 per cent of the country’s total external financial assets, amounting to US$32.9 billion.

External Financial Liabilities

The Other Sectors accounted for US$169.3 billion or 60.9 per cent of the country’s total external financial liabilities as of end-September 2023. The level, however, was slightly lower by 0.1 per cent than the end-June 2023 level of US$169.4 billion. The NG, likewise, recorded a 1.4 per cent decrease in its outstanding external financial liabilities to US$70.4 billion, which represents 25.3 per cent of the Philippines’ total external financial liabilities.

The banks’ share, meanwhile, accounted for 12.4 per cent of the country’s total external financial liabilities at US$34.5 billion. Meanwhile, the BSP held a marginal portion or 1.4 per cent of the country’s total external financial liabilities at US$3.8 billion, which were mostly in the form of Special Drawing Rights (SDRs).

—

1 The International Investment Position (IIP) is a statistical statement that shows at a point in time the value of a) financial assets of residents of an economy that are claims on nonresidents or are gold bullion held as reserve assets and b) financial liabilities of residents of an economy to nonresidents. The difference between the assets and liabilities is the net position in the IIP and represents either a net claim on or a net liability to the rest of the world. (Source: Balance of Payments and International Investment Position Manual, 6th Edition). The current end-quarter net IIP is computed as follows: previous end-quarter net IIP plus current quarter Balance of Payments net flows and other changes (e.g., market price and exchange rate changes).

2 The Central Bank is excluded from the Deposit-taking Corporations Sector.

3 The downward valuation of FPI mirrored the decline in the Philippine Stock Exchange index (PSEi) to 6,321.24 in Q3 2023 from 6,468.07 in Q2 2023.

4 Debt instruments under the Direct Investment account consist mainly of intercompany borrowing/lending between direct investors and their subsidiaries/affiliates.

5 Debt securities under the Portfolio Investment account consist mainly of placements in negotiable instruments serving as evidence of a debt, which are issued by enterprises that are not affiliated with the investors.

6 Other Sectors cover the following economic sectors: (a) other financial corporations, which include private and public insurance corporations, holding companies, government financial institutions, investment companies, other financial intermediaries except insurance, trust institutions/corporations, financing companies, securities dealers/brokers, lending investor, Authorized Agent Banks (AAB) forex corporations, investment houses, pawnshops, credit card companies, offshore banking units (OBUs); (b) non-financial corporations, which refer to public and private corporations and quasi-corporations, whose principal activity is the production of market goods or non-financial services; and (c) households and non-profit institutions serving households (NPISHs).