IMAGE CREDIT: https://www.getzype.com/

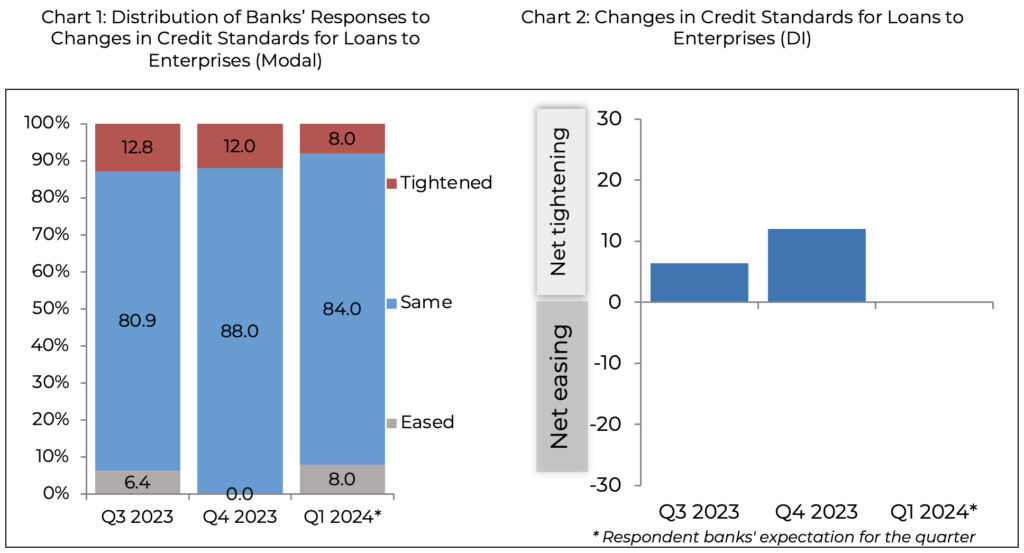

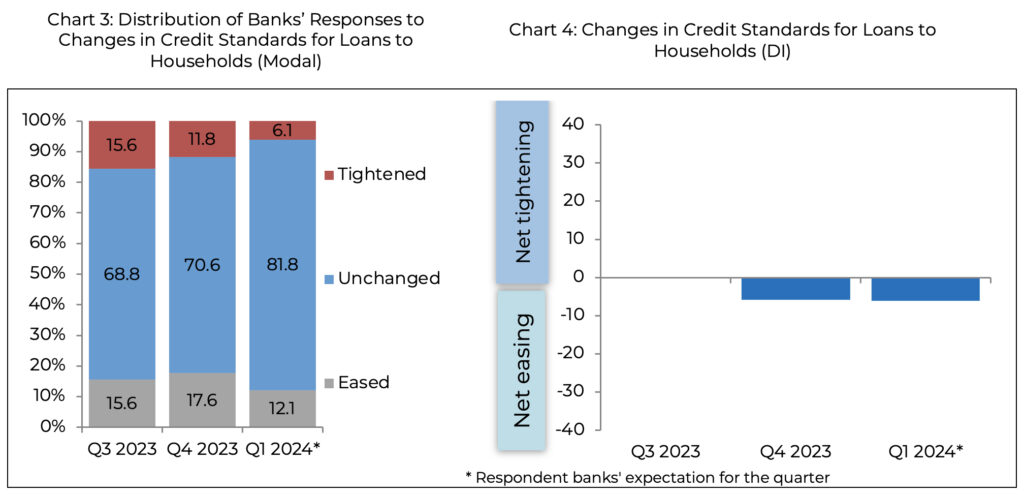

Results of the Q4 2023 Senior Bank Loan Officers’ Survey (SLOS) indicated that most of the respondent banks in the Philippines were able to keep their credit standards for lending to businesses and consumers “generally unchanged” based on the modal approach. 1

Meanwhile, the diffusion index (DI) method 2 showed varied results reflecting a net tightening of credit standards for firms and a net easing of loan standards for households.

The SLOS consists of questions on the loan officers’ perceptions relating to the overall credit standards of their respective banks, as well as to factors affecting the supply and demand for loans to both enterprises and households. Analysis of the results focused on the quarter-on-quarter changes in the perception of the respondent banks.

The responses for the Q4 2023 SLOS were gathered between December 6, 2023, to January 12, 2024, with 51 respondent banks out of 61 surveyed banks. The response rate of 83.6 per cent is higher compared to the response rate of 77.4 per cent in the previous quarter.

Lending standards for loans to enterprises

Based on the modal approach, results for Q4 2023 indicated that the majority of the participant banks (88%) maintained credit standards for businesses. Meanwhile, the DI approach showed a net tightening of overall credit standards across all borrower firm sizes due to banks’ lower risk tolerance, deterioration of borrowers’ profiles and profitability of banks’ portfolios, along with stricter financial system regulations.

Over the next quarter, both the modal and DI methods indicated respondents’ expectations of generally unchanged credit standards for enterprises amid banks’ sustained tolerance for risk and stable outlook for the overall economy as well as for industries and firms, along with the steady profiles of borrowers.

Commercial Real Estate Loans. Q4 2023 SLOS results showed a higher proportion of respondents (82.9 per cent) that maintained overall credit standards for commercial real estate loans (CRELs).

However, results from the DI method pointed to a net tightening of credit standards for CRELs mainly due to a deterioration in borrowers’ profiles and banks’ reduced tolerance for risk. In the next quarter, a larger number of participating banks anticipate keeping their loan standards for CRELs unchanged based on the modal approach, while the DI-based results show expectations of net tightening credit standards for CRELs.

Lending standards for loans to households

The majority of the surveyed banks (70.6 per cent) retained their lending standards for household loans in Q4 2023. On the other hand, DI-based results pointed to net easing credit standards for consumer loans6 mainly associated with the improvement in profitability of banks’ portfolios, higher risk tolerance, and less uncertain economic outlook.

For Q1 2024, modal results showed a higher number of bank respondents anticipating maintained loan standards for households, while the DI approach indicated a continued net easing of credit standards driven by banks’ expectations of improved profitability of their portfolios, higher risk tolerance, and more favorable economic outlook.

Housing Loans. Results of the Q4 2023 SLOS revealed a larger percentage of respondent banks (64.5 per cent) that have generally unchanged credit standards for housing loans. Meanwhile, the DI results indicated net easing lending standards for housing loans largely due to higher profitability in banks’ portfolios, more desirable borrowers’ profiles, and banks’ increased risk tolerance.

Over the following quarter, most respondent banks anticipate unchanged lending standards for housing loans while the DI results pointed to expectations of net easing in housing loan standards.

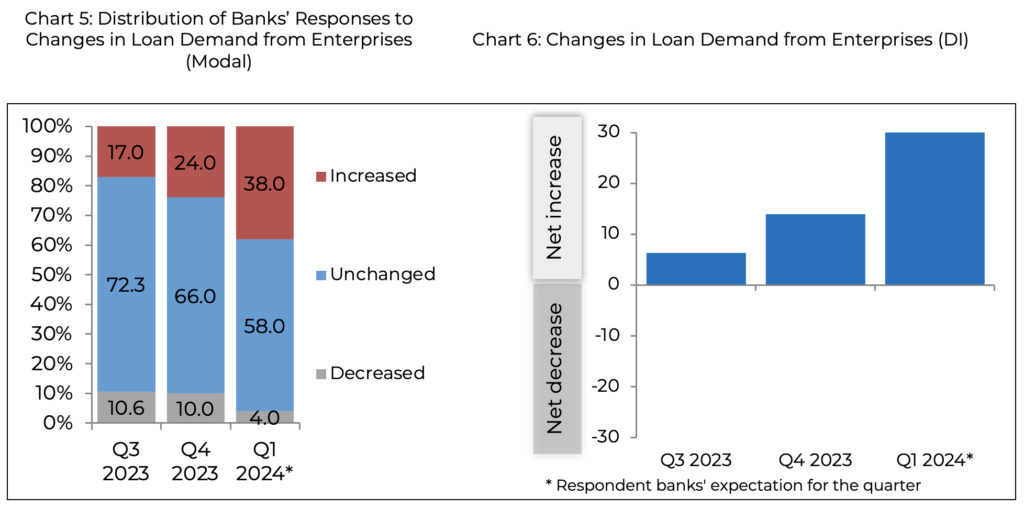

Loan demand from enterprises

In Q4 2023, most of the surveyed banks (66.0 per cent) pointed to a generally steady demand for credit from businesses based on the modal method. However, the DI approach showed a net increase in loan demand from across all firm classifications driven by bank clients’ more optimistic economic outlook, increased customer inventory financing and accounts receivable needs, including a lack of other sources of funds.

In the next quarter, most of the respondent banks expect broadly steady loan demand from businesses. Meanwhile, the DI method indicated that participating banks anticipate a net rise in credit demand from businesses for Q1 2024 driven by customers’ more positive economic prospects along with higher customer inventory financing and accounts receivable needs.

Commercial Real Estate Loans. The modal approach indicated that loan demand for CRELs is generally unchanged in Q4 2023 and is also expected to be maintained in Q1 2024. Meanwhile, the DI-based results pointed to a net increase in demand for CRELs in Q4 2023 and in the succeeding quarter which is attributed to the improvement in customers’ economic prospects, higher customer inventory and accounts receivable financing needs, bank’s more attractive financing terms, and manageable interest rates.

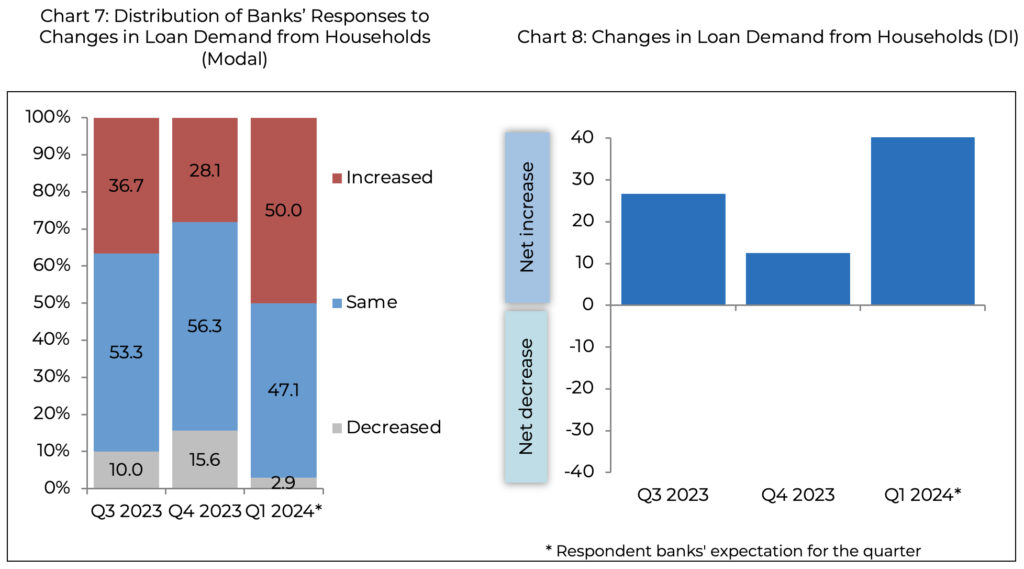

Loan demand from households

A higher percentage of participating banks (56.3 per cent) indicated generally steady loan demand from consumers in Q4 2023 based on the modal approach. The DI method, however, pointed to a net increase in consumer loan demand across all major loan categories due to higher household consumption and banks’ more attractive financing terms.

For Q1 2024, about half of the bank respondents expect higher demand for credit from households (50.0 per cent) using the modal approach. The DI approach also pointed to a net increase in consumer loan demand driven by expectations of higher household consumption and housing investment, banks’ more attractive financing terms, and lower-income prospects.

Housing Loans. Bank respondents noted an increase in demand for housing loans in Q4 2023 and expect the same situation in Q1 2024 using both modal and DI approaches. The higher residential real estate loan demand in the current quarter and the next quarter is due to rising household consumption and housing investment, as well as banks’ attractive financing terms.

————

1 In the modal approach, the results of the survey are analyzed by looking at the option with the highest share of responses. The three options for the modal approach are either: 1) tightening, 2) easing, or 3) unchanged credit standards for loans to enterprises and loans to households.

2 In the DI approach, a positive DI for credit standards indicates that the proportion of respondent banks that have tightened their credit standards exceeds those that eased (“net tightening”). In contrast, a negative DI for credit standards indicates that more respondent banks have eased their credit standards compared to those that tightened (“net easing”). Meanwhile, unchanged credit standards in the DI approach indicate that the proportion of the respondent banks that have tightened their credit standards is equal to those that eased their credit standards.