A recent survey by the Bangko Sentral ng Pilipinas (BSP) indicates that Philippine banks are likely to maintain or tighten their loan standards for both businesses and consumers.

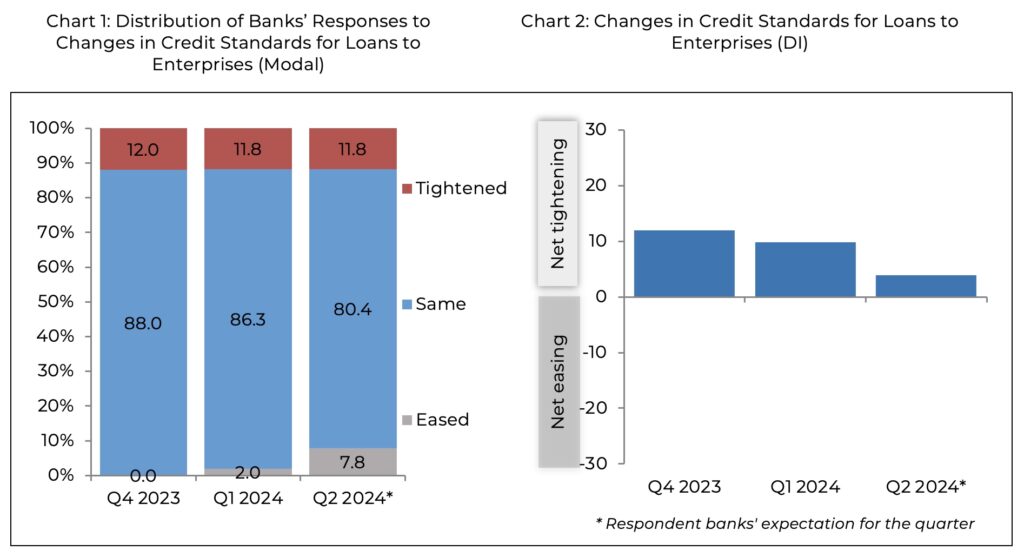

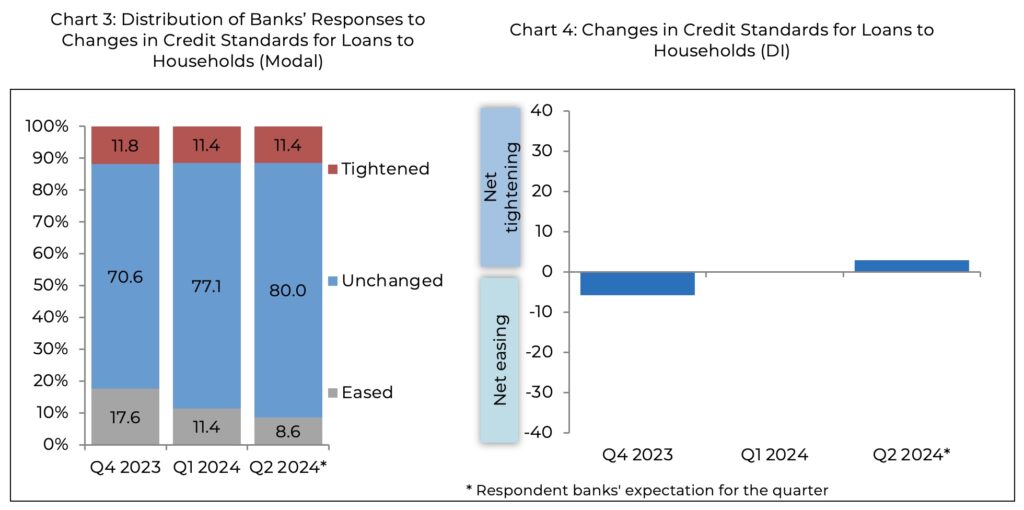

Results of the Q1 2024 Senior Bank Loan Officers’ Survey (SLOS) were interpreted using the modal approach while the diffusion index (DI) method was used to reflect a net tightening of lending standards for loans to businesses and credit standards for loans to households.

According to the modal approach, the survey found that 86.3 per cent of banks have maintained their loan standards for firms. However, the DI approach also indicated a net tightening of lending standards across various sizes of borrower firms due to factors like deteriorating borrower profiles, profitability concerns, and reduced risk tolerance among banks.

Despite this, the rate of tightening was significantly lower compared to the previous quarter.

Lending standards for business loans

For Q1 2024, 86.3 per cent of banks retained their loan standards for firms using the modal approach.

The DI approach, however, showed a net tightening across all firm sizes due to deteriorating borrower profiles and profitability of bank portfolios, as well as lower risk tolerance.

Looking ahead to the next quarter, the modal approach suggests that banks expect to maintain lending standards for enterprises, while the DI approach anticipates further tightening due to concerns over profitability, liquidity, and borrower profiles.

Lending standards for household loans

Banks maintained lending standards for household loans in Q1 2024, driven by unchanged risk tolerance, stable profitability of asset portfolios, and a positive economic outlook.

Both the modal and DI approaches confirmed this stability.

For the next quarter, the modal results show that most banks anticipate maintaining loan standards for households, although the DI approach indicates a potential net tightening due to expectations of deteriorating profitability, borrower profiles, and reduced risk tolerance.

Housing loans and commercial real estate loans (CRELs)

In Q1, 75 per cent of respondents reported maintaining credit standards for housing loans, with similar expectations for Q2.

For CRELs, 88 per cent of banks maintained overall credit standards according to the modal approach, while the DI approach indicated a net tightening.

Going into Q2, many banks foresee either maintaining or tightening their lending standards for CRELs.

To know more, check out the BSP website at https://www.bsp.gov.ph/SitePages/MediaAndResearch/.