Payoneer (NASDAQ: PAYO), a fintech titan bridging the gap for small and medium-sized businesses (SMBs) worldwide, has unveiled a stellar 2024 performance, marking a year of unprecedented growth and profitability.

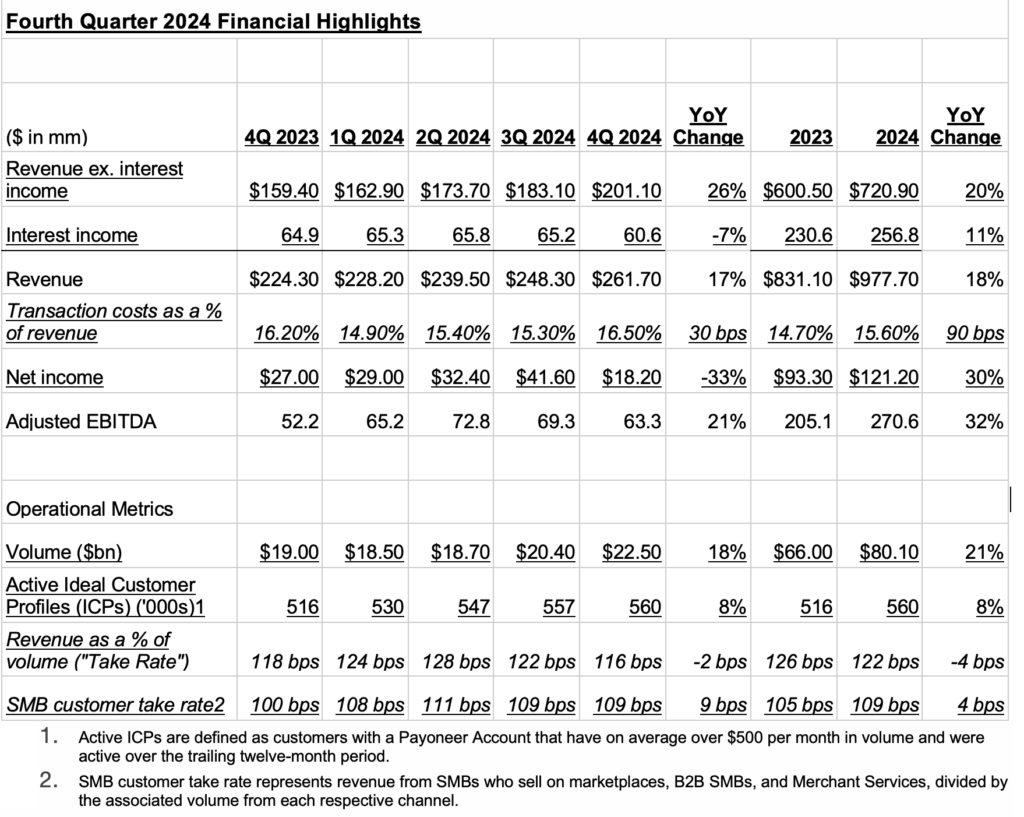

The company’s latest financial results reveal a record-breaking US$80 billion in annual volume, a surge of 18% in revenue, and a significant leap in profitability, signaling a robust expansion of global commerce.

Payoneer as a crucial facilitator, empowering SMBs

In a world where digital borders are increasingly blurred, Payoneer has emerged as a crucial facilitator, empowering SMBs to navigate the complexities of international transactions. This year’s financial triumph underscores the company’s strategic focus on expanding its financial stack and deepening its regulatory foothold, particularly in key markets like China.

“2024 was a defining year for Payoneer,” declared CEO John Caplan. “We didn’t just meet expectations; we surpassed them, achieving new records across the board. This is a testament to our scalable business model, the vast opportunities before us, and the relentless execution of our team.”

The numbers paint a vivid picture of Payoneer’s ascendancy.

A 21% year-over-year increase in total volume, with B2B volume skyrocketing by 42%, highlights the company’s growing dominance in facilitating business-to-business transactions. The surge in adoption of high-value products, particularly Payoneer cards, which saw a 36% increase in usage, reflects the company’s ability to cater to the evolving needs of its diverse clientele.

More SMBs going global with Payoneer as their partner

“We’re seeing a clear trend: SMBs are going global, and Payoneer is their trusted partner,” Caplan added. “Our focus on enhancing our financial stack, coupled with strategic acquisitions like Skuad, is enabling us to provide a comprehensive suite of services that empowers businesses to thrive on the global stage.”

The acquisition of Skuad, a global workforce and payroll management company, is a strategic move that aligns with Payoneer’s vision of providing a seamless, integrated financial ecosystem for international SMBs.

Furthermore, the company’s strategic financial management, including the investment of US$1.8 billion in US treasury securities and term-based deposits, and the implementation of interest rate derivative instruments, demonstrates a proactive approach to mitigating financial risks.

“We’ve taken significant steps to fortify our financial position and ensure long-term stability,” stated CFO Bea Ordonez. “Our 2025 guidance reflects our confidence in our ability to sustain this momentum and deliver continued strong growth and profitability.”

Payoneer’s fourth-quarter performance further solidifies its market leadership, with an 18% increase in volume, driven by robust growth in B2B transactions, marketplace sales, merchant services, and enterprise payouts. The company’s record US$1.5 billion in card spending underscores the growing reliance of SMBs on Payoneer’s financial solutions.

Looking ahead, Payoneer is poised for further expansion, with the anticipated completion of its acquisition of a licensed China-based payment service provider in the first half of 2025. This strategic move will enhance Payoneer’s presence in one of the world’s largest and most dynamic markets.

“We’re excited about the opportunities that lie ahead,” Caplan concluded. “Our focus on innovation, strategic partnerships, and customer-centric solutions will continue to drive our growth and solidify our position as the leading financial technology partner for global SMBs.”

Payoneer’s 2024 results are more than just numbers; they represent the stories of millions of entrepreneurs and businesses worldwide, empowered to transcend borders and achieve their global ambitions. As the company continues to innovate and expand its services, it is not just facilitating transactions; it is fueling the engine of global commerce, one SMB at a time.