Convenient, easy, and hassle-free. These are just some of the words that we often associate with a “safe” and “secure” banking experience. And despite cash being the primary method of payment for Filipinos, government authorities are now also urging an increased adoption of digital banking and debit cards, especially among the unbanked, to enhance financial inclusion.

The country, after all, is now witnessing a surge in digital-only banks and a preference for electronic payments, which is now driving growth in card payments. According to a GlobalData study, the country’s cards and payments market was valued at over US$45 billion last year, with an expected CAGR surpassing 7 per cent from 2023 to 2027.

OwnBank launches newest debit card in the market that simplifies financial management and transactions

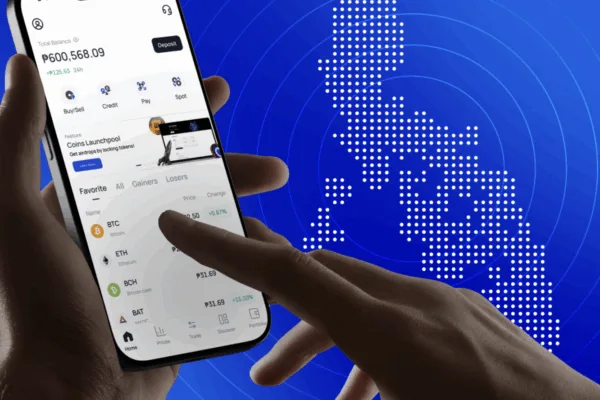

Cognizant of this trend, OwnBank, the newest mobile banking app in the country, has recently teamed up with Mastercard to serve customers with enhanced banking convenience, more rewarding card offers, and secure digital transactions.

This strategic partnership aims to foster financial inclusion and is poised to introduce new and sophisticated solutions that empower individuals and businesses across the country.

In a press statement, both OwnBank and Mastercard said that they have decided to join forces to be able to create a seamless banking experience for Filipinos.

Combining OwnBank’s commitment to financial inclusion and Mastercard’s global payment expertise, the collaboration will offer Filipinos expanded digital payment options, global transaction acceptance, as well as enhanced security measures and integrated app features, among many other advantages.

Start the year right with OwnBank and Mastercard

OwnBank and Mastercard’s collaboration expands digital payment options, enabling customers to access a wider array of digital financing solutions with Mastercard’s technology for secure, efficient, and convenient online transactions.

OwnBank through Mastercard will provide its users access to numerous international merchants and ATMs, thereby increasing transactional flexibility and convenience. OwnBank’s existing services will be integrated with Mastercard’s digital solutions, offering customers a comprehensive suite of financial services for managing transactions, transferring funds, and growing savings, all within a unified and streamlined banking environment.

Revolutionizing the debit card experience for Filipinos

OwnBank, in partnership with Mastercard, is launching a virtual and physical debit card that offers its users an enhanced debit card experience with unparalleled flexibility. The features of the OwnBank debit card include:

Free Debit Card: All OwnBank users will receive a virtual debit card. Furthermore, users who have fully upgraded their OwnBank accounts and met certain criteria are eligible for a free physical debit card, which will be conveniently delivered to their doorstep.

● Contactless Payment and Enhanced Security: The card features convenient contactless payment options and enhanced security with advanced EMV technology.

● Security Features: OwnBank offers a suite of options for enhanced control and security. Users can freeze their cards, set transaction limits, and reset their card PIN directly through the OwnBank app.

● Unified Card and Account Number: The OwnBank Debit Card uniquely combines the user’s card number and bank account number, simplifying financial management and transactions.

● Personalized Payment Experience: OwnBank allows users to personalize their payment experience with editable payment settings and card number customization. This enables users to tailor their money management according to their preferences.

Upcoming features and promotions

The OwnBank Virtual Debit Card is set to launch in the first quarter (Q1) of 2024, followed by the Physical Debit Card in the second quarter (Q2) of 2024. Stay tuned for an array of exciting features and exclusive promotions from OwnBank, including unique functionalities of the upcoming debit card and irresistible deals and offers.

OwnBank was launched in the local banking scene last October 2023 as a one-stop destination for Filipinos in search of an all-encompassing and more rewarding mobile banking service. It is BSP-regulated and PDIC-insured so you can be assured of banking with peace of mind.

Catch the latest updates from OwnBank. Download the app today on the App Store, Google Play Store, or Huawei AppGallery to elevate your mobile banking experience. For more information, visit OwnBank’s official website at www.ownbank.com or follow them on social media at Facebook, X, and Instagram.