In a world where the Internet is changing everything, small business owners should be keeping a watchful eye on trends that can make a positive difference in their businesses. One of these is online banking, although it has been around since the 80s, its familiar form came about in 1995.

So what is online banking and how can it help small businesses thrive?

Online, e-banking, web banking, or Internet banking is a form of fintech that allows people to access banking services via a computer or smartphone. Clients can make withdrawals, deposits, funds transfer, apply for loans, and other financial transactions through the Internet. People don’t have to go to the bank branch. Whether at home, at work, or on vacation, a client should be able to access their online banking service.

To open an online bank account, clients are required to register via the bank’s online portal. People can also enlist their bank accounts if they already have one. The client then creates a password to keep their accounts secure. Variations in the registration process may depend on the bank, but this is generally the process. After successfully registering, the client can now use all available online banking services.

There are now full virtual banks. These are financial institutions that don’t have a physical bank where people can go. Virtual banks reside fully on the Internet and are fully legit.

New generations of entrepreneurs who grew up familiar with the Internet are comfortable with the online banking setup. This is especially true for brands with a strong online presence.

The advantages of online banking.

What are the advantages of online banking? Most online banks don’t charge service fees for online banking transactions. That right there is a big plus. If you do a variety of transactions as a business owner, online banking will save you the cost of paying for bank fees which can amount to hundreds of over weeks or thousands in a year.

Another advantage of online banking is convenience. You don’t have to go on bank runs, find parking space, and spend precious time waiting in line. You don’t have to rush. Online banking never shuts down. It is open 24/7.

Yes, sometimes the system would be down but you get the idea. It doesn’t matter what time is it, day or night, you can access your bank account. You can withdraw funds and deposit money from one account to another. Even if you are on the other side of the world, should you need to.

You can monitor your account anytime. This safeguards your finances from possible fraud. Customers can quickly freeze their accounts should they spot any suspicious or unauthorized activity. Instant notifications are sent to your smartphone and email each time a transaction occurs in your accounts.

Online banking is also fast. Funds from one account to another can be transferred quickly, especially if both accounts are in the same bank. Some banks allow online applications for credit cards or debit cards. Some banks have apps that allow people to deposit checks through their smartphones. Just take a picture of the checks and enter the details in the bank’s app. Then press send.

Online banking is designed to be traceable. Records can be downloaded into popular spreadsheets or financial programs. I suggest you use a different account for your business and personal finances under the same online bank. Come tax season, it will be easier to get organized and file for deductions.

Online banking makes it easier for small businesses to engage with multinational companies. More big companies are going fully digital in their financial transactions. Suppliers with traditional billing processes that rely on paper invoices will find it difficult to do business with major brands.

These multinational companies prefer to carry out all transactions with their suppliers online. They maintain a database of accredited suppliers with complete details including e-payment information submitted by the supplier.

The purchasing department emails a request for pitch (RFPs) to relevant accredited suppliers. Suppliers then submit their cost estimates via email or submission to the customer’s website.

Approval is done digitally, after which an e-purchase order is issued to the winning supplier. Confirmation of delivery or service is done by the business unit that originated the RFP. This triggers the approval of the e-invoice and transfer of funds to the supplier’s bank account.

Online banking allows small businesses to receive payments directly into their accounts. This keeps cash flow open and stable. If you are easy to do business with, these multinational customers will likely retain your services.

There are some laws in a few countries that require companies to maintain electronic copies of all financial transactions. This prevents illegal activities such as money laundering, shell companies, and dummy accounts.

When small businesses adopt online banking, they are actually able to enlarge their footprint digitally. Physical boundaries and large distances are no longer a problem as far as business transactions are concerned. Third-party payment facilities such as PayPal and Stripe are able to receive and transfer funds to and from most banks in the world.

Opening a PayPal or Stripe account is easy. All you need is an email and a good password. It doesn’t have to be a company email. Any Google, MS Outlook, or Yahoo email will do.

For merchant accounts, that is if you are looking to receive payment for goods and services, you will need your online bank account number ready, and the name of your online bank.

Businesses such as drop shippers, e-commerce, service providers, software developers, and other forms of businesses should have online banking. These are companies where it is not critical to have a brick-and-mortar shop.

But a typical store that depends on walk-in customers should also have an online bank. This is because people are increasingly using e-payment systems and e-wallets even if they are purchasing items inside an actual shop.

This is especially true for Old Millenials. These are people who are in their late 20s and early 30s. They had the profound experience of having an analog childhood and digital adulthood.

Old Millenials now have money and are entrepreneurs, or senior-level executives leading their company’s charge into the digital world. A very important group. One which every business should strive to serve.

Having fintech acumen or at least online banking capabilities will allow small businesses to stay relevant in the lives of these digitally savvy people groups.

What are the disadvantages of online banking?

Like all things, there are some disadvantages of online banking. Technology has yet to overcome these cons.

One thing is the human factor. Novice online bankers may feel overwhelmed just by looking at the online bank dashboard. It can also take some time to get used to the idea of moving cash without actually seeing and counting the money. This is why some people still prefer to see their favorite teller in person.

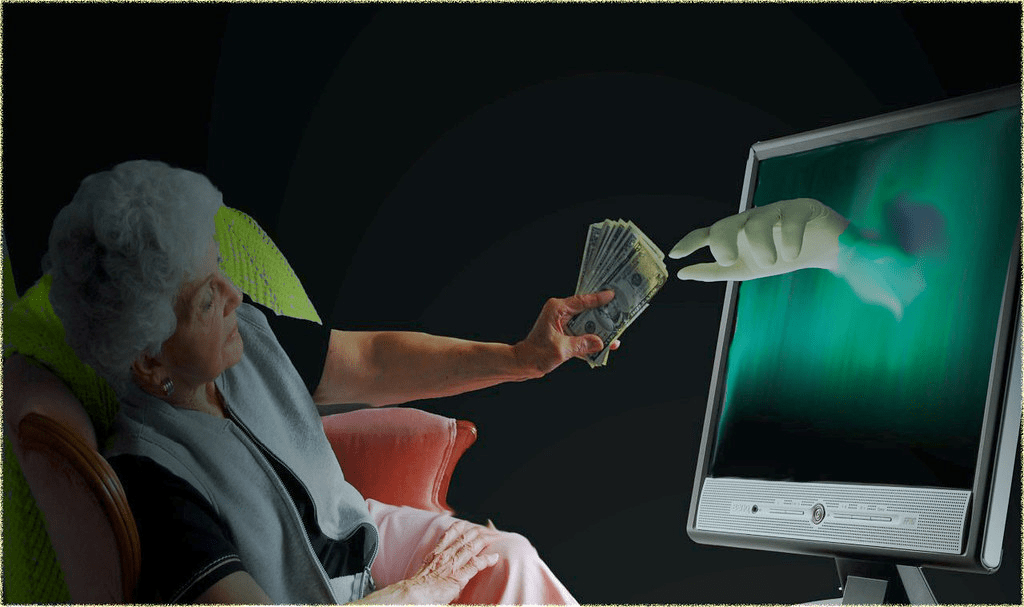

This takes us to another disadvantage which is security. While this has improved a lot, hackers are a persistent bunch. This is because no matter what precautions banks take, people can take online security for granted until they become a victim.

It is not advisable to conduct online banking on public WIFIs, better do it on your own home or office connection. Passwords sent on public WIFIs can be easily intercepted by digital crooks who have no qualms about stealing other people’s hard-earned money.

Phishing is one of the oldest tricks of digital thieves. It is also probably the most or one of the most effective scams. There is no shortage of information about phishing and its variations but people still get sucked in.

Never open email or download attachments from unknown sources, no matter how large the alleged money they got out of some African country. Banks will never ask their client for sensitive information through email.

Business owners should regularly reinforce best practices in online security to their employees. Employees are the last line of defense when it comes to cyber security.

People can also lose their smartphones and laptops can get stolen. If passwords are stored on these devices and they get lost, those who find these passwords can do some harmful stuff to your online bank accounts. You can call the banks and get these shut down, but it will be quite a hassle for you to gain access again.

Having mentioned the advantages and disadvantages of online banking, should business owners do online banking? That is a Yes, with a capital “Y”. Online banking advantages far outweigh the disadvantages.

As part of fintech, online banking is now a permanent fixture in our lives. It will only grow even bigger as an industry.

Online banking is and will continue to disrupt traditional financial institutions. As a small business owner, better be part of the disruptor than the disrupted.