The rapid advancement of artificial intelligence (AI) is placing unprecedented demands on traditional data infrastructures, forcing businesses in the banking, financial services and insurance (BFSI) sector to prioritize between security, quality and sustainability.

A report by Hitachi Vantara reveals that a staggering majority of these leaders fear catastrophic data loss as AI strains existing infrastructure, while a significant portion already recognize AI’s critical role in their operations.

The findings, part of Hitachi Vantara’s global “State of Data Infrastructure 2024 Report,” which includes insights from regional IT and business leaders, underscore the urgent need for financial institutions to address security, quality, and sustainability in their AI deployments.

While 36% recognize the importance of data quality for AI success, security concerns remain paramount for financial leaders as it can potentially hinder AI performance and long-term return on investment (ROI).

Joe Ong, Vice President and General Manager for ASEAN at Hitachi Vantara

“Financial institutions worldwide are accelerating AI adoption, but many are realizing their data infrastructure isn’t ready to support it,” stated Joe Ong, Vice President and General Manager for ASEAN at Hitachi Vantara.

“This global research reflects what we’re also hearing in Southeast Asia — that the real barrier to AI success isn’t the technology itself, but the ability to manage data securely, accurately, and at scale. Financial organizations must focus on strengthening their foundations to ensure AI delivers real, sustainable impact,” he added.

Data security a top AI implementation concern for BFSI leaders

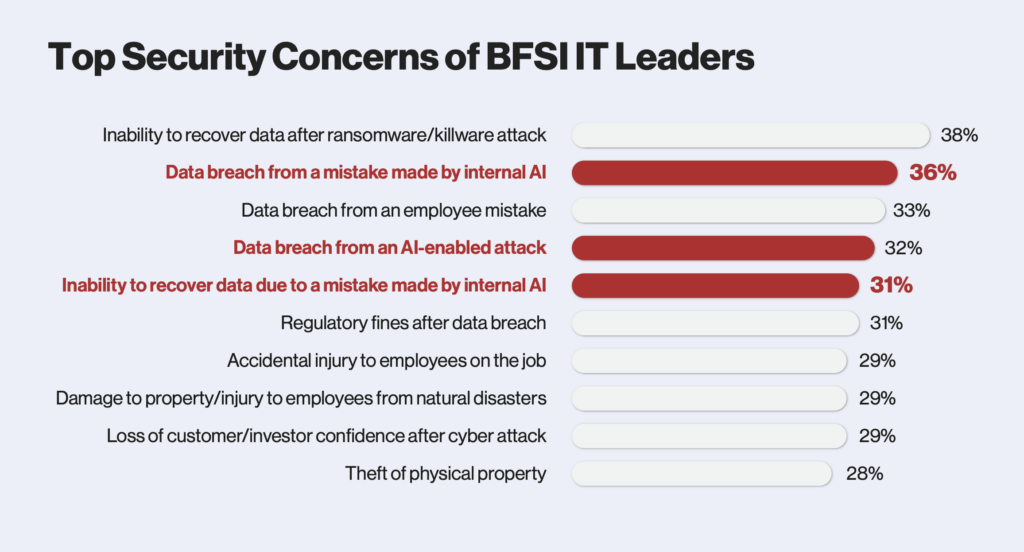

The survey further reveals that nearly half (48%) of the respondents cite security as their top AI implementation concern, reflecting the need to safeguard against both internal and external threats. This is understandable considering that 84% of respondents admit that losing information to an attack or mistake would be catastrophic.

However, the same study results showed that ignoring data quality also comes at a cost for BFSI institutions, including:

- Availability and accuracy: In BFSI companies, data is only available when and where it is needed a quarter of the time (25%), and BFSI AI models are accurate only 21% of the time.

- Internal and external threats: 36% are concerned about the risk of a breach from internal AI, and 38% are concerned about inability to recover data from ransomware.

- AI-enabled attacks: Although ransomware attacks are top-of-mind for BFSI IT leaders, 36% cite security breaches caused by AI mistakes as a top concern, and 32% fear AI-enabled attacks.

“The business model in financial services is inherently tied to trust. Reputational harm is a significant risk, and so in our industry, the interaction between security and accuracy is a critical and complex challenge,” said Mark Katz, CTO of Financial Services, Hitachi Vantara.

“For instance, if a chatbot inadvertently discloses sensitive information that was included in the training, that will have serious repercussions. Additionally, the cost of a wrong answer or a hallucination poses a significant risk; if someone were to act on bad information, it raises all sorts of questions about liability,” Katz added.

AI adoption accelerating in the Philippines

Despite these challenges, AI adoption is accelerating in the Philippines. However, many institutions are deploying AI without adequate preparation, with 71% resorting to testing and iterating on live systems, while only 4% utilize controlled sandbox environments.

The report recommends key strategies for building a resilient, AI-ready infrastructure:

- Responsible experimentation: Encourage testing in secure sandbox environments to mitigate risks and explore AI’s potential.

- Sustainability: Integrate sustainable practices into data storage, software, and AI strategies.

- Simplified and unified systems: Manage hybrid environments uniformly and automate security tasks.

- Data Resilience and AI-Powered Defense: Implement redundancy systems and AI-driven security measures.

This report, derived from Hitachi Vantara’s “2024 Global State of Data Infrastructure Survey,” provides critical insights for BFSI leaders navigating the complexities of AI adoption in the Philippines.

Hitachi Vantara, a subsidiary of Hitachi, Ltd., empowers organizations to innovate with data. Through data storage, infrastructure systems, cloud management, and digital expertise, they enable sustainable business growth. For more information, visit www.hitachivantara.com.