Mocasa, the Philippines’ first virtual credit wallet, is your partner in achieving robust financial goals as the new year approaches.

With the dawn of 2025 symbolizing fresh beginnings, it’s the perfect time to reassess your financial situation and set the tone for a prosperous future.

Whether it’s managing debt, saving for a significant purchase, or sticking to a budget, Mocasa is here with practical tips and tools to help you start the year on the right financial foot.

1) “Prioritizing debt repayment is a must” says Mocasa

Begin the year by addressing existing debts. High-interest debts can quickly become overwhelming, so consider consolidating them into a single, more manageable loan if possible. This strategy can help reduce the overall interest you pay and simplify your monthly payments.

By focusing on repaying what you owe, you can free up more of your income for other financial goals and reduce the stress associated with multiple bills.

2) Create a realistic budget

Effective financial management starts with a clear and realistic budget. Take a comprehensive look at your income and expenses to understand where your money is going. Allocate funds to essential expenses such as rent, utilities, and groceries first. Then, decide on a portion of your income to dedicate to savings or debt repayment. Breaking down your budget into monthly targets can help you avoid overspending and ensure you stay on track with your financial goals. A well-planned budget is a powerful tool for financial stability and growth.

3) Set clear financial goals

Having specific financial goals can provide direction and motivation throughout the year. Whether you’re saving for a vacation, investing in your education, or building an emergency fund, clearly defined goals help you stay focused. Write down your goals and break them into smaller, manageable steps. This approach makes it easier to track your progress and celebrate your achievements along the way. Knowing exactly what you’re working toward can make financial decisions more straightforward and purposeful.

4) Avoid impulse purchases

Impulse purchases can derail even the best financial plans. Before making a purchase, take a moment to consider its necessity and how it fits into your financial strategy. Ask yourself if the item is something you truly need or if it’s an impulse buy that could be avoided. Being mindful of your spending habits can help prevent financial setbacks and keep you aligned with your goals.

5) Monitor your progress

Regularly reviewing your financial situation is crucial for staying on track. Keep an eye on your spending and savings to gain insights into your financial habits. This practice can help you identify areas where you might need to make adjustments.

Aim to revisit your budget and financial goals at least once a month. By doing so, you can ensure that you remain aligned with your plan and make any necessary changes to stay on course. Monitoring your progress helps you stay accountable and motivated throughout the year.

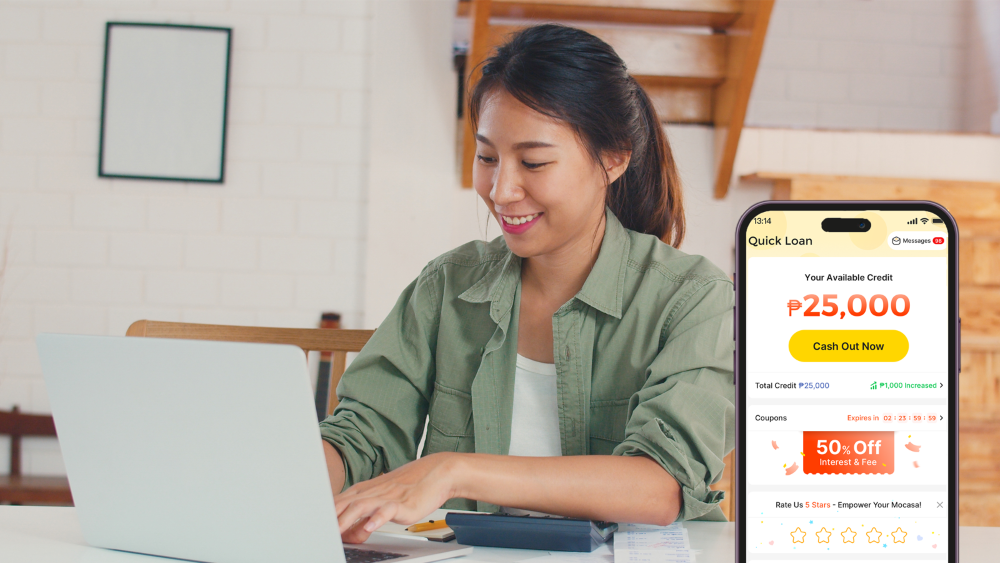

By following these tips, you can take control of your finances and set a solid foundation for a successful new year. Mocasa’s Quick Loan feature offers up to PHP 25,000 in credit repayable in three easy monthly installments, providing quick access to funds when needed and helping you manage your finances more effectively.

As the Philippines’ first virtual credit wallet, Mocasa is dedicated to empowering Filipinos with the financial tools and resources needed to achieve their goals and build a secure future. With Mocasa, you can confidently navigate your financial journey and make 2025 your best year yet. Download the Mocasa app in Google Play and App Store and enjoy the peace of mind that comes with smart financial planning.

Mocasa is a financial technology company duly licensed and regulated by the Securities and Exchange Commission (SEC) and an accredited accessing entity of Credit Information Corporation (CIC).

To learn more about the latest updates from Mocasa, visit www.mocasa.com. you can also check out its Facebook, Instagram and Tiktok accounts.