Mocasa, the Philippines’ first virtual credit wallet, makes the holiday season an exciting time for small businesses. After all, the holiday season is not just a time of celebration but also a golden opportunity for small businesses to grow and thrive.

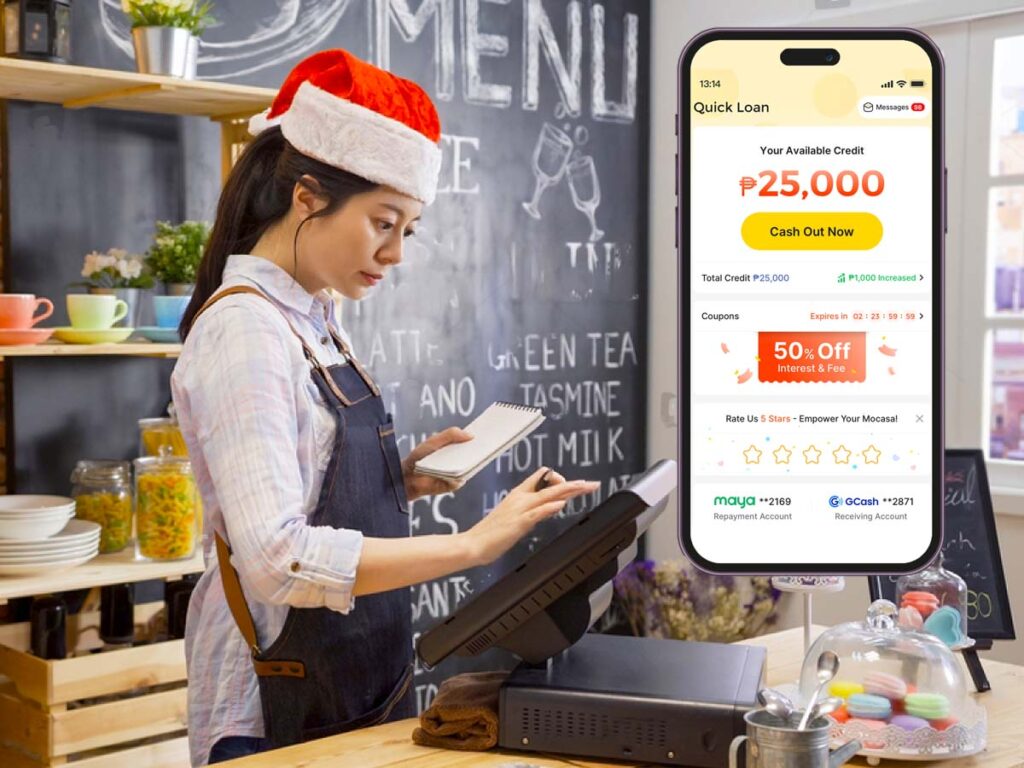

From festive Christmas parties to Noche Buena preparations, people are in a spending mood, making it an exciting time for entrepreneurs. However, with high demand comes the need for extra funds — to stock up on supplies, boost marketing efforts, or expand operations. That’s where Mocasa’s Quick Loan can help.

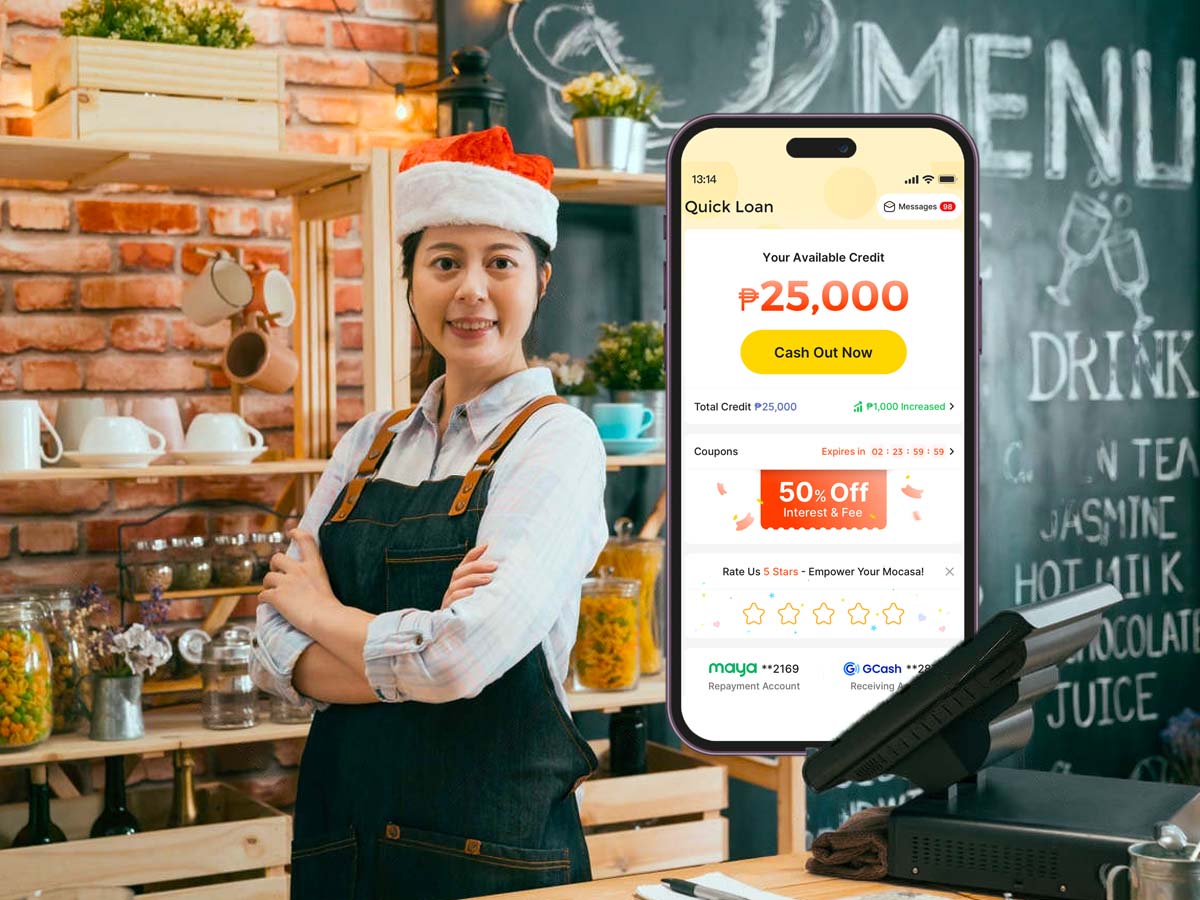

Mocasa is here to help small business owners capitalize on this busy period with its convenient Quick Loan, offering up to PHP 25,000, repayable in three easy monthly instalments. Mocasa also understands the unique challenges of this season and offers insightful tips to help Filipinos plan, save, and navigate the holidays with confidence, ensuring they enjoy the celebrations while staying on track with their financial goals.

Here are 5 easy ways you can take advantage of the season and boost your business using Mocasa’s Quick Loan:

- Stock Up on Holiday Food Supplies — if you’re in the food business, the holidays are prime time for sales. Whether you’re baking holiday pastries like bibingka and puto bumbong, or offering catering services for Noche Buena and corporate Christmas parties, demand will be high. A quick loan can help you buy ingredients in bulk so you’re always prepared for big orders. You don’t want to run out of stock when customers are lining up for your special leche flan or roasted ham!

- Expand Your Business for the Season — the holidays are the perfect time to try something new. Have you ever thought about opening a seasonal pop-up stall at the local Christmas bazaar? Maybe you want to offer catering services for big gatherings or introduce a special holiday menu for your restaurant. Applying for a Quick Loan can help you cover the initial costs of renting space, hiring extra staff, or investing in new equipment like ovens or coolers. Expanding your business during the holidays can increase your exposure and income in a big way.

- Level Up Your Holiday Marketing — standing out during the Christmas season is key to driving more sales. With so many businesses vying for attention, it’s the perfect time to invest in holiday promotions, especially on social media. Whether you’re selling handmade crafts, Christmas hampers, or special food packages, you can use a Quick Loan to fund a targeted social media marketing campaign. Get creative by offering bundle deals, running giveaways, or even collaborating with local influencers to promote your products. Social media ads can significantly boost your visibility and engagement, helping you reach more customers and drive holiday sales.

- Manage Holiday Cash Flow — the holiday season can bring in a lot of cash, but it can also mean a lot of expenses. If you’re running a food delivery business or a party supply store, you might need extra funds to cover last-minute expenses like buying more packaging, hiring riders, or restocking supplies. Availing a Quick Loan can help smooth out your cash flow by giving you access to funds when you need them the most. The 3-month installment plan makes repayment manageable, even after the holiday rush.

- Be Ready for Last-Minute Orders — the holidays in the Philippines are filled with last-minute surprises—customers who need food trays for Christmas Eve or companies suddenly ordering giveaways for their employees. With a Quick Loan, you’ll be financially prepared to handle those unexpected orders. For example, if you run a small bakery and suddenly get bulk orders for cakes and pastries, you can use the funds to purchase extra ingredients and packaging without missing a beat.

Why Mocasa’s Quick Loan is the perfect fit for you

Mocasa’s Quick Loan is designed to provide hassle-free financial support for Filipino entrepreneurs, especially during the high-demand holiday season.

With loans of up to PHP 25,000, small business owners can manage their holiday expenses efficiently. The entire loan process is fast and can be completed via the Mocasa app, meaning approval is quick and you can access the funds you need without the long wait times associated with traditional loans.

What’s more, there is no collateral required, and the flexible repayment terms allow you to pay back the loan in three easy monthly instalments, making it ideal for the holiday rush.

The holidays are a time of opportunity for small business owners in the Philippines. Whether you’re baking festive pastries, launching a seasonal pop-up, or managing bulk orders, having access to extra capital can help you seize the moment.

With Mocasa’s Quick Loan, you can seize the opportunity, boost your business, and make this holiday season your most successful one yet.

Download the Mocasa app in Google Play and App Store and take better control of your finances for the remainder of the year.

Mocasa is a financial technology company duly licensed and regulated by the Securities and Exchange Commission (SEC) and an accredited accessing entity of Credit Information Corporation (CIC).

To learn more about the latest updates from Mocasa, visit its website, www.mocasa.com or its Facebook, Instagram and Tiktok accounts.