by Jan Michael Carpo, Reporter

Did you know that mining for cryptocurrencies is taking place in centralized mining pools and that it now comes with a significant amount of financial commitment rather than being a dispersed operation among individual computers?

Although mining pools are not necessarily negative for cryptocurrencies, what I don’t dig is the amount of energy that they consume, and the power and influence that are now being wielded by a few well-funded individuals. This, for me, makes mining pools a reason for concern.

Proof of stake and alternative consensus mechanisms

Research into alternative consensus mechanisms has since increased as a result of energy utilization and its impact on cryptocurrency control.

For instance, Ethereum was initially intended to employ proof-of-stake, a separate process that does not use mining for transaction verification and for block building.

Mining pools are less profitable under proof-of-stake, but staking is. In a nutshell, “staking” means to keep your bitcoin so it can be used as a transaction validator. Proof-of-stake is supposed to cut down on energy use and re-decentralize cryptocurrencies but the world has yet to see if it does.

Other consensus procedures like proof-of-elapsed-time, proof-of-claim, and proof-of-activity are now also being studied and used. I’ll share more info about these procedures in another piece.

Why Did Mining Pools Develop?

Financial decentralization is one of the main principles of cryptocurrencies. At least with proof-of-work blockchains like Bitcoin, anyone with a computer and an internet connection can potentially mine bitcoin for free in exchange for sustaining the network.

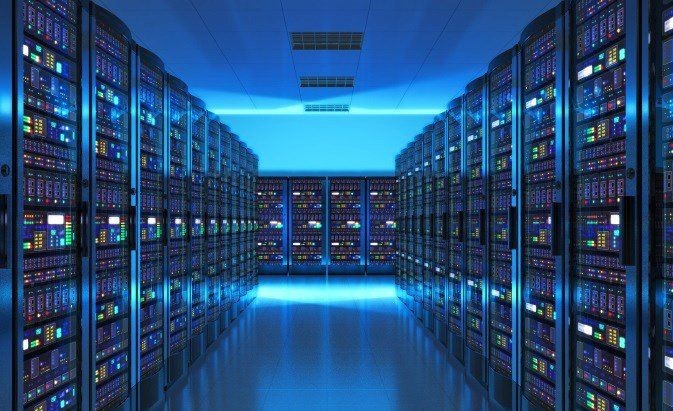

However, as Bitcoin’s acceptance and rewards have increased significantly, control has since transferred to organizations who have greater financial and computing resources. Large-scale cryptocurrency mining operations are where a majority of the proof-of-work-based cryptocurrencies are now mined. These are facilities that were built to stifle rivalry and control the mining market.

Small-scale miners are thus compelled to join mining pools established by these big mining companies in order to access bitcoins, which furthers centralization. Nevertheless, depending on your goals and tastes, mining pools might be advantageous or disadvantageous.

The benefits of mining pools

Faster Processing: In Bitcoin mining, each miner competes with the other participants in the network to add new blocks to the main blockchain and produce bitcoin as a reward. Since it minimizes latency (or delays) and accelerates computations, having multiple miners under the same network can speed up the discovery process.

Efficiency: A large number of mining systems working together in the same network improves mining efficiency.

The drawback of mining pools

- Centralization and Control: Mining farms and pools help centralize the creation and validation of cryptocurrencies. Since mining farms essentially control the rewards, control becomes a problem.

- Profit-Sharing and Fees: You’ll have to shell out ongoing fees and share any cryptocurrency that is successfully mined with the other members in the pool. Usually, your portion of the cryptocurrency that is given to the organization is used to pay fees.

- Increased Energy Use: From a technological perspective, using more powerful machinery might improve the process. However, these massive mining operations also entail utility bills, especially energy. While the cost of power varies by nation, miners are thought to pay an average global cost of $0.046 USD per kWh.

With these concepts in mind, can we say then that big mining pools are bad for cryptocurrencies?

The world of cryptocurrency is always changing and large mining pools are undoubtedly affecting and influencing it. My take is that massive mining pools may or may not be detrimental to cryptocurrencies. It all depends on how you look at it.

Just so you know, large cryptocurrency mining pools exist so users can pool their resources and boost their chances of winning coins. They can do so even if they lack the funds or computing power to mine competitively.

While mining alone is viable, the chances of getting paid increase when you join a mining pool.

In the end, it all boils down to your opinions on cryptocurrencies and the goals you’ve set for them.