Twenty percent of small businesses fail in the first year. Fifty percent go belly up after five years. Only 33% make it to 10 years or longer, according to the Small Business Administration (SBA). The most common reason businesses fail is lack of capital.

So how can you call your business a startup if you can’t even get it to start? How do you raise capital without selling an arm, a leg, a kidney, and your soul to a bank? Fortunately, 21st-century fintech has brought disruption to the old world order of things. Banks no longer have a monopoly on the financing market.

Below are my top recommendations for sources of funding as a small business owner who once struggled to find capital.

In the spirit of our title, we are not going to talk about high-interest loans that will bleed you dry before you can even see a drop of profit. No to cash advances. No to credit card loans. No to invoice factoring. No to banks.

Strap on your boots because here is your itinerary to get financing for your startup:

1. Family and friends

Your first stop should be family and friends. You have to give them the chance to join you on your journey to success. Sam Walton started Walmart with a $25,000 loan from his father-in-law. There are now 11,443 Walmarts around the world.

Sell your dream first to your family and friends. They will support you more often than not. If they don’t, nobody can’t say you didn’t invite them.

Then work hard to make your dream a reality. It’s also great that you pay little to no interest on that money you borrowed from your parents and best friend. Just remember to pay them and then some when profits start coming in regularly.

2. Angel investors

Angel investors are extremely rich persons. They are looking for investments with higher returns than more traditional ones.

They have extra money that they can afford to lose. It’s usually not more than 10% of their total portfolio. Relatives are places where you may find angel investors.

Angel funders are in it for the money. Not because they were divinely sent. They do take risks that no other investor will. They understand that if your business goes belly up, they lose their money.

Banks will take you out to the cleaners even if you lose your business to get their loan back with interest.

Angel investors will seek partial ownership of the company up to a given period of time. They may provide funds as a one-time deal. Seed money to get your company off the ground.

More than finances, an angel investor will mentor you. They will introduce you to people who can help. Provide ideas that have proven to be successful in their own companies.

3. Venture Capital

If angel investors are individuals, venture capitalists are groups of persons who pooled money from pension funds, large corporations, and investment companies to form a VC firm. This company provides seed capital to startups.

VCs will protect their investment. They are accountable for the investment. Their terms will be stricter than angel funders.

They will help set up the right connections with you. They may bring in consultants or teams to help you with marketing, product development, IT, and finance.

VCs look at funding companies in the millions. The average investment for VCs is $11.7 million. VCs will typically want higher ROI in the 25% to 35% range.

VCs will ask for a seat on your board and regular reviews of your business. These are good things and will keep you on your game.

Value their guidance since VCs advise companies bigger than yours.

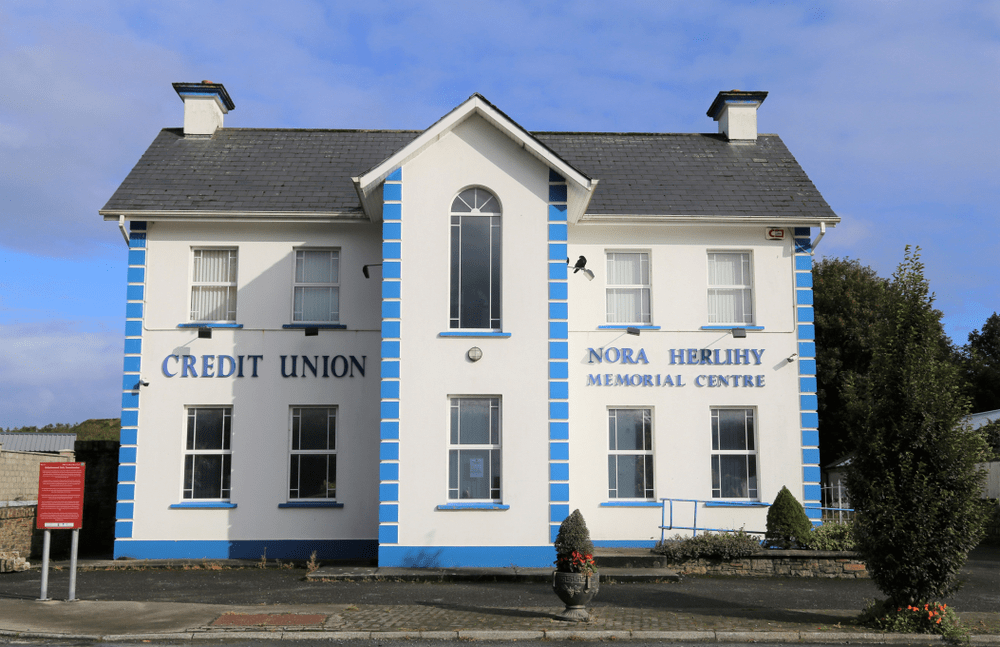

4. Credit unions

There are thousands of them across the US and maybe millions across the world. Cooperatives or credit unions play a vital role in the development of local communities. They create economic activities in rural towns that big brands consider too small to be profitable.

Cooperatives are sources of financing for local businesses or households. They source workers, goods, and produce from local communities.

Cooperatives invest in local utilities such as power distribution and water. Their profits revitalize the local economy since members are from the community.

Credit unions provide financing at very affordable interests. They are part of ATM networks and offer online banking services also.

You only need to open an account at a nominal amount. You are then a member and part-owner. You can avail of member privileges.

The longer you are a member with good credit standing, the more credit line you can get. Part of the profits that the coop generates are given back to the members as dividends.

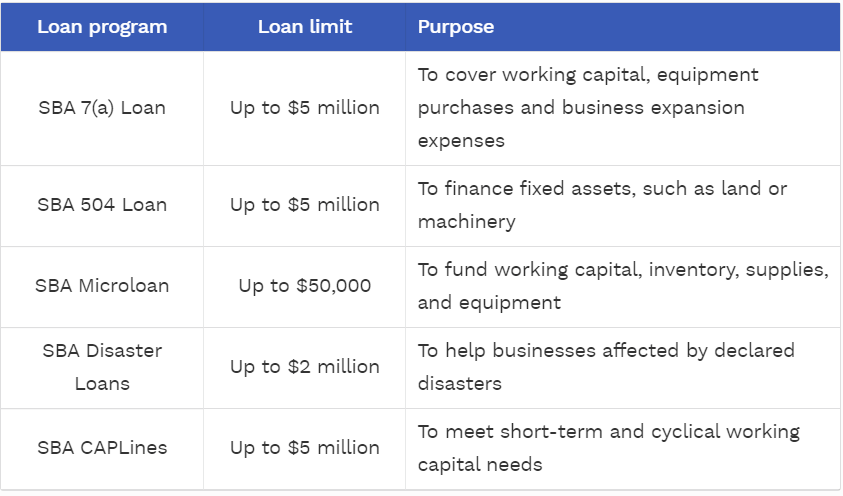

5. SBA loans

Small Business Administration or SBA Loans#Loans are not for startups. Your business must be at least two years old. Then you must prove that you are getting $100,000 in annual revenues. Aside from that, your credit score must be above 700 points. Anything lower and you are out the door.

The loan itself is not given out by the SBA. They just guarantee up to 85% of the loan given by their partner lender such as a bank. The SBA can come after your business, including your personal assets, to recoup their losses. Be careful with them.

SBA loans have low-interest rates and long payment periods from 5 to 25 years. Ten years would be the average. These are the two primary reasons why people try to get them.

SBA loans are difficult and restrictive. You can only use them to fund your business over a rough patch. Make sure you can prove this or you will be in trouble.

You can give an SBA loan a shot if your business has been around for the last two years. Just go to a nearby bank, lending company, or credit union and ask about the SBA loan.

6. Crowdfunding

Global crowdfunding is set to grow by 16% during the next five years. A lot of startups, musicians, filmmakers, and other projects have gotten off the ground because of crowdfunding.

This is when a large number of individuals each give small amounts of money over the Internet to fund your startup or project. Large companies and organizations sometimes give donations via crowdfunding.

There are different kinds of crowdfunding.

a. Loan-based crowdfunding – You repay the money because it’s a loan with set interest. It is also known as peer-to-peer or peer-to-business lending.

b. Reward-based crowdfunding – You give a non-monetary reward in return for the donation. These are products, services, or tokens connected to your business or project.

c. Donation-based crowdfunding – People donate to your charity or cause, with no expectation of getting anything in return. Charitable causes are a prime example.

e. Equity-based crowdfunding – You get the funding you need in return for giving part-ownership of your business.

Crowdfunding is a low-risk way of getting the funding you need to start your business. For backers, it’s an easy way to invest in things that you are passionate about.

Aside from the no or low-interest fund, there are non-monetary benefits to crowdfunding.

You get great engagement from an audience that is interested in your product. This also generates awareness even before your product hits the market. You get to test your concept with the crowdfunding audience.

Which crowdfunding platforms should you join? Kickstarter is the biggest and most popular with startups. It has raised $5.6 billion for over 197k projects since it started in 2009.

Republic does vetting so that backers are protected. It processes more than $150 million a year in investments. It allows anyone to invest in its vetted startups. Republic says that less than 3% of startups pass their due diligence and investment committee.

Patreon is best for artists and creative people. Check out this platform if you are a YouTuber filmmaker, musician, painter, podcaster, and any type of content maker.

You can engage with your followers and fans by giving them snake peeks, exclusives, and giveaways. In return, people can keep funding you so that you can keep doing what you love best.

You don’t have to rely on ad revenues anymore because Patreon gives you a monthly recurring income.

LendingClub provides up to $40,000 for personal loans and up to $500,000 for business loans. It is easier to get approved than most lending institutions. You can pay your loan from 1 year to 5 years. The main hurdles are you should be in business for at least 2 years and make $50k in revenues.

Our last one is Indiegogo. It has funded more than 800k ideas all over the world.

That’s right. Indiegogo is available worldwide.

Indiegogo integrates with Facebook and Google, to promote your campaign with super ease. With their track record in getting funding for startups, you should be very confident with Indiegogo.

The most important key to crowdfunding success is having a high-quality video. It just answers a lot of questions and doubts backers may have about your business.

People are going to be more engaged and trusting when they see your product, your staff, and your face on video. You can talk about your business goal, sustainability, and target fund.

Conclusion

Getting funds for your world-changing idea doesn’t have to be a journey through hell and back. What you need is an open mind and a lot of grit to stay the course.

With the options that I gave you above, you will find one that will work for you both in the short and long term.