Home Credit could soon be expanding its consumer lending portfolio in the Philippines as it collaborates with its new shareholders — the Mitsubishi UFJ Financial Group (MUFG) of Japan and the Bank of Ayudhya (Krungsri) of Thailand.

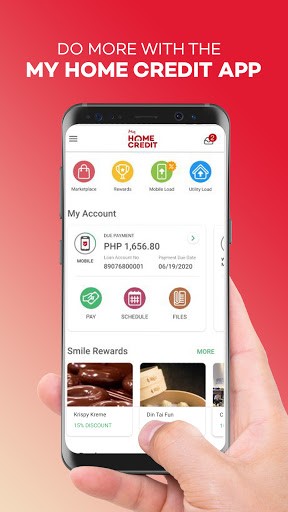

IMAGE CREDIT: www.homecredit.ph

Krungsri (Bank of Ayudhya PCL), the fifth largest financial group in Thailand, and Mitsubishi UFJ Financial Group (MUFG), a global financial leader from Japan, are set to acquire HCP for P24.4 billion.

PPF Group, the parent company of Home Credit Philippines (HCP) based in the Czech Republic, has just finalized an agreement with MUFG and Krungsri to acquire its Philippine chapter, which is set to celebrate its 10th anniversary this year.

Deal to give more Filipinos better access to loans

According to the company’s press release, the deal will help HCP expand its business operations and give more Filipinos access to loans while using Krungsri’s experience as one of Thailand’s top financial figures. Once the deal has been completed, Krungsri will be the majority stakeholder (with 75%), while MUFG will retain the remaining 25%

“The purchase of Home Credit Philippines is a testament to the strong business HCP has established in the nation and the growth opportunities that Krungsri and MUFG have seen for the company to further expand and maintain its dominance in the local consumer finance market,” said David Minol, CEO of Home Credit Philippines.

“By expanding on the excellent standards we have established over the previous nine years, we are starting the next chapter for Home Credit Philippines with our new shareholders. We have high hopes for our future in (this) partnership,” Minol further stated.

For his part, Home Credit Group CEO Radek Pluhar, said, “I would like to extend my congratulations to our colleagues at Home Credit Philippines for their incredible accomplishments.”

“Together, we have empowered nearly 10 million Filipinos to access the formal economy through our innovative products and services. We take pride in these achievements and eagerly anticipate the company’s future growth,” he added.

Taking advantage of the rising demand for consumer financial solutions

According to Kenichi Yamato, President and CEO of Krungsri, the effective implementation of its medium-term business plan with the acquisition of Home Credit Philippines marked another important milestone in the company’s expansion strategy in the ASEAN region.

“By adding Home Credit in the Philippines to its portfolio, the bank hopes to provide a full complement of cutting-edge consumer financing products and services to meet the changing financial needs of clients. This acquisition further cemented Krungsri’s status as a premier banking institution in the ASEAN, building on its strong foothold in a high-potential nation,” Yamato said.

He asserted that Krungsri, together with Home Credit, is now in a good position to take advantage of the rising demand for consumer financial solutions.

He also reiterated the bank’s firm commitment to offer only relevant goods and services that will enable people and promote sustainable market growth.

Home Credit Philippines has grown to become a market leader with the largest distribution network of more than 15,000 outlets countrywide. After ten years of operations in the country, its customer base of about ten million people continues to grow.