by Jan Michael Carpo, Reporter

Globe Telecom Inc. (Globe), a leading telecommunications provider in the Philippines, is banking on its robust mobile business and burgeoning e-wallet platform, GCash, to propel its financial performance for the remainder of 2024.

While traditional fixed-line voice and internet services experience a decline, mobile data usage and GCash contributions are surging, painting a picture of a company strategically adapting to the evolving digital landscape.

Globe’s latest financial report revealed a 7% year-on-year increase in profit, reaching P20.56 billion for the first nine months of 2024. This positive growth hinges on two key factors: the resilience of its mobile network and the breakout success of GCash.

Globe Telecom’s ongoing network expansion efforts

While fixed-line voice services dipped by 10% and internet revenues by 6%, a direct consequence of users migrating towards fiber-optic connections, mobile data continues to be a bright spot.

Globe attributes this to its ongoing network expansion efforts, having upgraded 2,723 mobile sites to LTE and building 684 new cellular towers as of September. With over 60.2 million mobile subscribers, the company emphasizes the competitiveness of its mobile data packages.

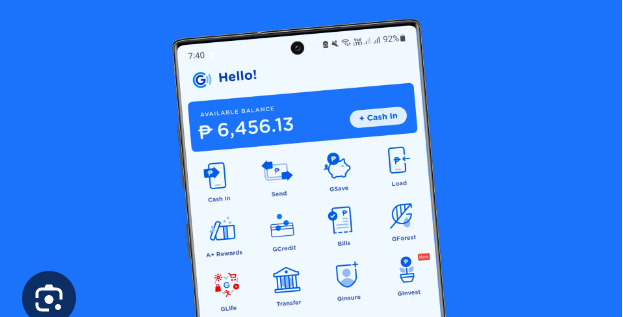

However, the true star of the show is undeniably GCash.

This e-wallet platform, owned by Globe Fintech Innovations Inc. (Mynt), has become a game-changer. GCash’s contribution to Globe’s pre-tax earnings soared to 14%, doubling from the previous year’s 6%.

This translates to a hefty P3.5 billion in equity earnings for Globe, showcasing the immense potential of the e-wallet market in the Philippines.

Earlier in September this year, the country’s leading e-wallet has launched ‘GLoan Sakto,’ an innovative nanoloan product aimed at providing quick, small-scale loans to meet essential expenses of low income consumers.

This development comes as part of GCash’s ongoing efforts to enhance its lending portfolio, positioning itself as a key player in the financial inclusion space.

GLoan Sakto offers users the ability to borrow as little as P100 or P300 with interest-free repayment terms of 14 days. These microloans are designed for users who require immediate cash for urgent expenses such as food, transportation, or minor bills.

However, there is a minimal processing fee: P6.50 for a P100 loan and P19.50 for a P300 loan. Despite these charges, GLoan Sakto’s aim is not merely to address short-term financial gaps but to serve as a stepping stone for users to improve their credit standing and access more substantial financial products.

“Our expanding array of digital goods and services, with GCash at the forefront, will be instrumental in maintaining our growth trajectory,” stated Ernest Cu, Globe President and CEO.

However, a significant leadership change is on the horizon. Carl Raymond Cruz, formerly CEO of Airtel Nigeria, will assume Cu’s role during the annual stockholders meeting to be held in April 2025.

In a press statement, Globe said that Cruz will be nominated as its president and CEO in the company’s annual stockholders’ meeting in 2025, replacing Cu, the incumbent president, who will then hold the chairmanship position at 917Ventures, GCash’s holding company Globe Fintech Innovations Inc., Kickstart Ventures Inc., and STT GDC Philippines.

By January 2025, Cruz will also assume the position as Globe’s deputy CEO prior to his appointment in April. Until then, he will remain to report to Cu.

“I am very honored to be given the opportunity to be part of the Globe organization. I look forward to working alongside Ernest and Globe’s talented team to drive growth, elevate customer experience, and shape the telco industry’s future,” Cruz, who has a solid track record as a strategic and transformational business leader who delivers business growth, was quoted to have said.

“I will remain focused on guiding our corporate strategy, ensuring we advance the broader growth agenda while Carl will assume the responsibilities of overseeing the day-to-day operations and take on an essential role to accelerate our momentum, enhance the execution of key strategic priorities, and further strengthen our leadership team,” he further stated.

In the meantime, Globe remains committed to bolstering its network infrastructure.

As fiber-optic internet becomes increasingly desirable, the company has already installed 55,076 fiber-to-the-home lines. With these strategic investments in mobile and fiber technology, and the continued success of GCash, Globe is well-positioned to navigate the dynamic Philippine telecommunications landscape.