Palawan ProtekTODO, the microinsurance arm of trusted financial services provider Palawan Group of Companies, has officially launched ProtekSure, an embedded insurance feature within the PalawanPay app that provides users with instant, affordable, and accessible accident coverage.

ProtekSure offers a simple yet powerful solution, allowing users to secure personal accident insurance when they pay bills via the PalawanPay app. Unfortunately, many Filipinos still hold sentiments like, “Mahal naman ang insurance,” or “Hindi para sa’kin ’yan, marami pa akong kailangang unahin.”

As a result, many Filipinos shy away from getting insurance policies. 2025 data from Statista shows that the Philippines has an underdeveloped insurance market with a penetration rate of less than two percent.

Palawan ProtekTODO: Integrating affordable insurance into everyday transactions

Palawan ProtekTODO aims to help address this gap by making insurance affordable, relevant, and accessible — embedding low-cost, high-value protection into a platform that users already trust and use daily.

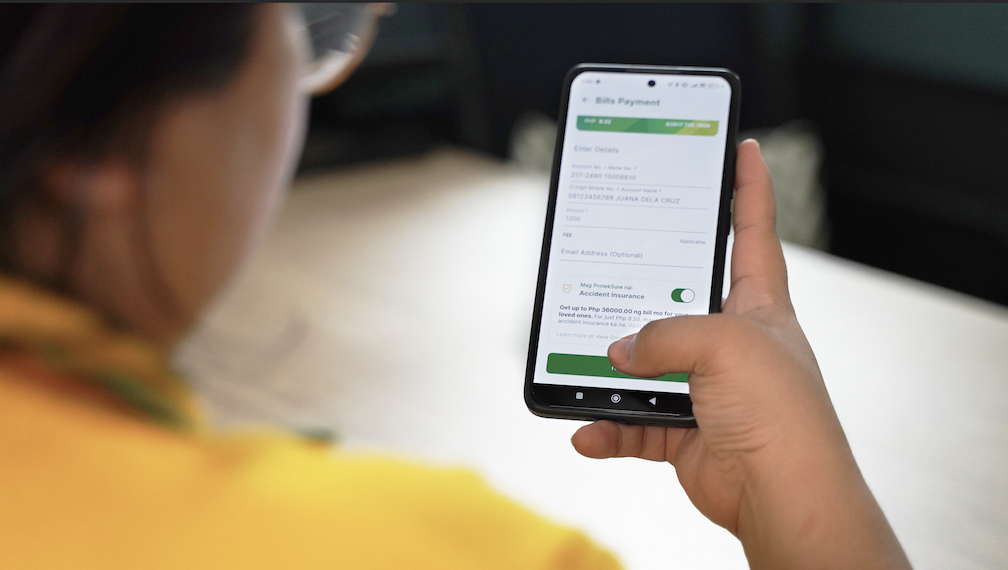

With this innovation, PalawanPay users can now easily opt in to ProtekSure during their bill payment process. For just 0.85% of their bill amount, they get 30 days of personal accident insurance — with coverage worth 36 times the value of their payment.

For example, paying a ₱1,000 bill unlocks up to ₱36,000 in accident coverage for just ₱8.50. By adding a small amount, users gain instant protection from Palawan ProtekTODO — making coverage more accessible without the usual financial or procedural barriers.

Karlo M. Castro, President and CEO of Palawan Group of Companies, emphasized that ProtekSure is a step toward more inclusive protection: “In line with our mission to serve more sukis, we introduce ProtekSure to offer a practical and empowering way to provide protection for Filipinos. To make the process even easier, we have embedded insurance options as our PalawanPay sukis do their transactions, such as bill payments.”

Building on the strong and sustained success of ProtekPadala — an innovative PalawanPay feature that protects users from fraud and other unlawful online activities — ProtekSure represents the next step in PGC’s mission to make insurance more accessible and relevant to everyday Filipinos.

Palawan Group expands inclusive protection by embedding insurance daily

ProtekPadala proved that embedding insurance into familiar, everyday transactions like remittances works: thousands opted in because the protection was affordable, convenient, and seamlessly

integrated into something they were already doing.

Now, with ProtekSure, Palawan Group is extending that model to bill payments, further reinforcing its commitment to delivering inclusive, tech-enabled financial tools to underserved communities.

By integrating affordable accident coverage directly into daily financial activities, Palawan ProtekTODO is redefining how insurance is perceived and accessed in the Philippines. ProtekSure enables users to take small, practical steps toward lasting financial security, proving that peace of mind doesn’t have to come at a high cost.

The Palawan Group of Companies includes products and services such as Palawan Pawnshop, Palawan Express Pera Padala, Palawan ProtekTODO, Palawan Credit, and PalawanPay. A brand trusted by Filipinos for almost four decades, Palawan Group is one of the fastest-growing financial institutions in the country. With its strength in remittance and pawning services, the company is the market leader in the industry and has over 70,000 branches, Pera Padala outlets, and PalawanPay Money Shops nationwide.

Palawan Group offers a wide range of services, including pawning, domestic and international

remittances, microinsurance, bill payment, electronic mobile phone loading, cash-in and cash-out of e-wallets, money exchange, ATM withdrawal, and cash disbursements. Additionally, the company sells jewelry and gold bars, catering to customers looking to invest in valuable assets.

Palawan Group introduced PalawanPay, an e-wallet app that allows users to send and receive

remittances anytime, anywhere.

PalawanPay is the company’s latest digital solution, offering faster, safer, and more convenient transactions. In addition to remittances, the app provides access to other financial services, including bill payments, mobile load top-ups, and scan-to-pay QR Ph codes. The app also features integrated functionality for pawn renewal, purchasing jewelry and gold items, ProtekTODO personal insurance, and claiming international remittances.

The Palawan Group of Companies is supervised by the Bangko Sentral ng Pilipinas.

For more information, go to Palawan Pawnshop and PalawanPay Websites.