GCash, the Philippines’ leading mobile wallet and double unicorn, has reaffirmed the integrity of its systems amid circulating claims of a data breach involving millions of user accounts.

Following a comprehensive forensic investigation, the company confirmed there is no evidence of a data breach and assured its 94 million users that their funds and personal data remain secure.

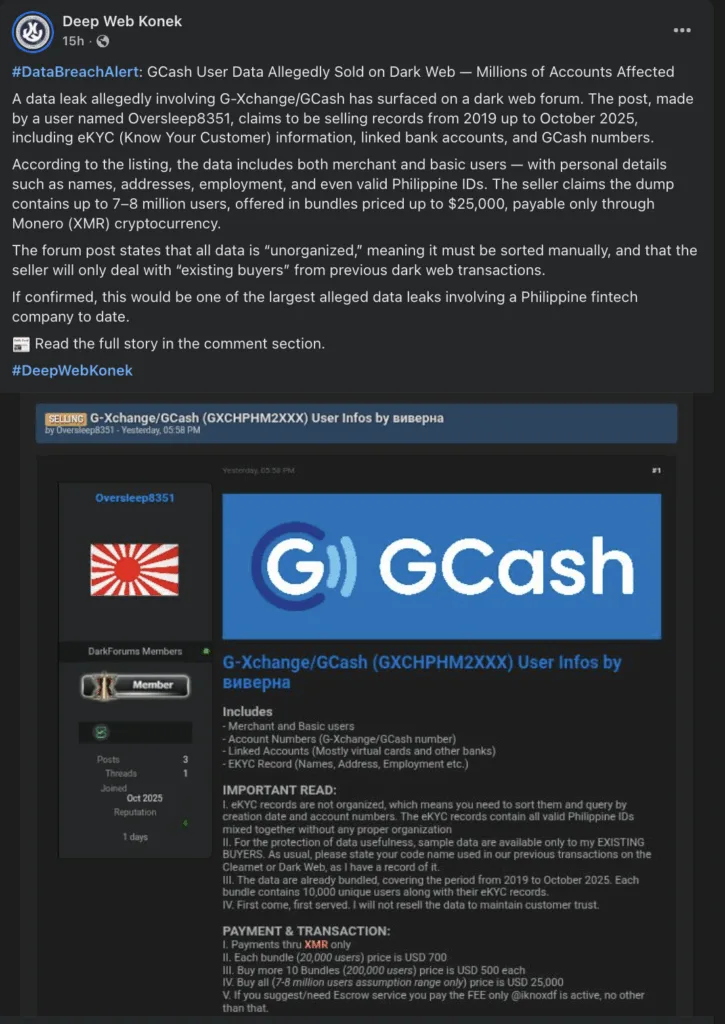

The clarification comes after reports surfaced that an alleged cache of user information was being sold on a dark web forum. In response, GCash moved swiftly to investigate, engaging regulators and cybersecurity experts to ensure full transparency and accountability.

Forensic probe finds no breach in GCash systems

GCash’s internal forensic analysis found no indication of unauthorized access or data exfiltration from its systems. The company said the dataset circulating online does not match GCash’s internal data structure, suggesting that the information likely originated elsewhere.

Initial findings also showed that the alleged dataset did not align with the data architecture used within GCash’s systems. Further analysis revealed that it included individuals who are not GCash users, and that many entries appeared incomplete, inconsistent, or invalid.

The company emphasized that all user accounts and funds remain secure, underscoring that its security infrastructure continues to operate effectively. GCash also noted that it upholds industry-standard security practices, including multi-layer encryption, regular penetration testing, and continuous monitoring to detect potential threats.

For a platform that processes billions of pesos in daily transactions, the assurance comes as a relief to consumers who rely on GCash not only for payments but also for savings, insurance, and investments.

Coordinated efforts with regulators and cyber Agencies

To ensure transparency, GCash confirmed that it is actively coordinating with government regulators and cybersecurity agencies, including the Bangko Sentral ng Pilipinas (BSP), the National Privacy Commission and the Cybercrime Investigation and Coordinating Center (CICC).

The company said it continues to work closely with these agencies to validate information from all possible sources and ensure that its systems remain protected.

Early this year, GCash has also partnered with the NPC to launch a data privacy campaign that’s aimed at educating millions of users and ensuring they are complying with the Data Privacy Act (DPA).

This collaboration underscores a growing trend in the Philippines’ fintech sector: proactive regulatory engagement. The BSP has long championed cybersecurity resilience as a core pillar of digital finance innovation, while the NPC continues to push for stronger compliance with data privacy laws. The CICC, meanwhile, plays a key role in tracing and verifying cyber-related claims circulating online.

By working in tandem with these institutions, GCash not only bolsters its credibility but also aligns itself with broader national efforts to strengthen public confidence in digital finance.

Industry observers note that such swift and open communication reflects the growing maturity of the country’s fintech ecosystem — where accountability and consumer protection are now non-negotiable standards.

Strengthening trust through vigilance and transparency

Even with no evidence of a breach, GCash has urged users to remain vigilant against phishing scams, fake websites, and social engineering tactics — all of which remain common threats in the digital finance landscape.

Users are encouraged to report any suspicious activity only through official GCash channels, such as the Help Center, the in-app chatbot “Gigi,” or the hotline at 2882.

The reminder is timely. Cybercriminals often exploit public concern during incidents like alleged data leaks to trick users into divulging sensitive information. GCash’s emphasis on user vigilance reinforces that cybersecurity is a shared responsibility — requiring both robust system safeguards and informed digital behavior.

Beyond incident response, GCash continues to invest heavily in its data protection frameworks, partnering with leading cybersecurity firms and adopting global best practices. The company also runs regular public education campaigns to promote safer digital habits, such as recognizing scam messages and securing mobile devices.

These steps, coupled with transparent communication, help strengthen user trust — a critical asset for a fintech leader preparing for an anticipated initial public offering in the coming year.

Safeguarding the future of digital finance

The latest incident underscores an important reality for the fintech industry: even without an actual breach, the perception of vulnerability can erode consumer confidence.

GCash’s swift and coordinated response demonstrates how transparency, technical rigor, and collaboration can effectively manage such challenges.

By confirming that its systems remain secure and that the alleged dataset did not originate from its servers, GCash not only protects its brand reputation but also sets a benchmark for how fintech players should address potential cybersecurity threats.

As digital finance becomes increasingly central to everyday life in the Philippines, maintaining public trust will remain the ultimate measure of success. GCash’s proactive stance in this episode reflects a broader commitment to safeguarding the digital ecosystem—ensuring that innovation and security go hand in hand.

For millions of Filipinos who rely on mobile wallets daily, that assurance makes all the difference.