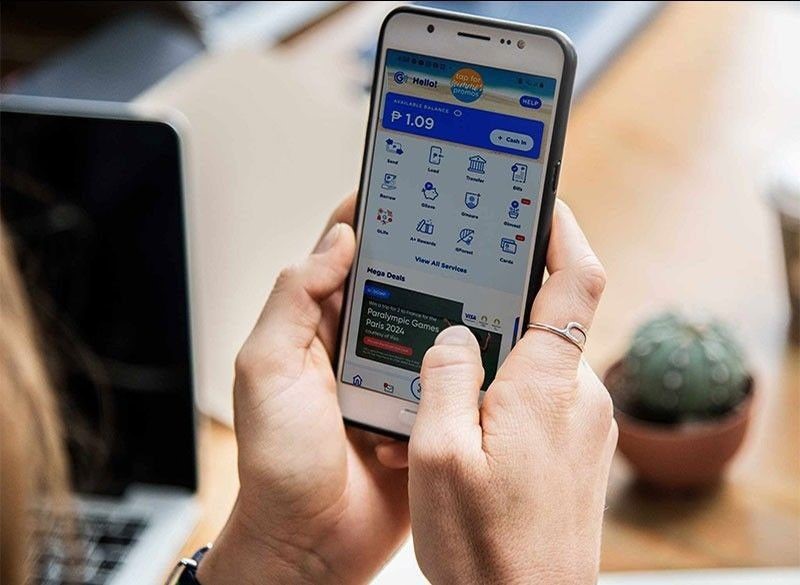

GCash, the country’s leading e-wallet, has launched GLoan Sakto, an innovative nanoloan product aimed at providing quick, small-scale loans to meet essential expenses.

This development comes as part of GCash’s ongoing efforts to enhance its lending portfolio, positioning itself as a key player in the financial inclusion space.

GLoan Sakto offers users the ability to borrow as little as P100 or P300 with interest-free repayment terms of 14 days. These microloans are designed for users who require immediate cash for urgent expenses such as food, transportation, or minor bills.

However, there is a minimal processing fee: P6.50 for a P100 loan and P19.50 for a P300 loan. Despite these charges, GLoan Sakto’s aim is not merely to address short-term financial gaps but to serve as a stepping stone for users to improve their credit standing and access more substantial financial products.

GCash’s GLoan Sakto: A step towards financial inclusion

The introduction of GLoan Sakto is aligned with GCash’s broader mission of promoting financial inclusion in the Philippines. Many Filipinos, particularly those in low-income brackets, remain underserved by traditional banks due to a lack of formal credit histories and access to financial services.

GCash hopes to bridge this gap by offering accessible financial tools that encourage responsible borrowing and repayment habits.

“Our goal is to not only meet the immediate needs of our users but to guide them toward building a positive credit history,” said Tony Isidro, president and CEO of Fuse Lending, the lending arm of GCash. “With GLoan Sakto, we are providing a viable alternative to informal lending sources, which can be costly and cumbersome for many Filipinos.”

Isidro’s comments highlight a key issue for low-income consumers: the reliance on informal lending systems, such as “5-6” loans, which often charge exorbitant interest rates and can trap borrowers in cycles of debt. GLoan Sakto offers a more structured and secure option, giving users an opportunity to meet their urgent needs without falling prey to predatory lending practices.

Building toward greater financial access

One of the most significant aspects of GLoan Sakto is its potential to help users transition into more formal financial systems. According to GCash, borrowers who successfully repay their nanoloans will be encouraged to explore other GCash lending products, such as GCredit, GGives, and the primary GLoan service, which offer higher loan amounts and longer repayment terms.

Earlier this year, GCash also unveiled several new products as part of its advocacy of ‘transforming FinTech for every Filipino.’ Revealed during this year’s GCash Futurecast held at Green Sun Hotel in Makati, these advancements promise to revolutionize the country’s fintech landscape, elevating consumer experiences and enhancing financial inclusivity.

By easing users into the world of credit with manageable loan amounts and clear repayment terms, GCash is creating a pathway for low-income Filipinos to build a credit profile. In turn, this could help more Filipinos access larger financial services, such as bank loans, in the future. The company’s long-term vision is to help integrate more of the population into the formal banking system, promoting financial stability and economic growth.

Meeting immediate needs and long-term goals

Fuse Lending views nanoloans as a tool that meets both immediate financial needs and long-term goals. With GLoan Sakto, GCash is addressing a gap in the market for small-scale, short-term loans that are quick and easy to access through their platform.

For many Filipinos, particularly those living paycheck to paycheck, P100 or P300 can make a significant difference in managing day-to-day expenses.

In addition to the practicality of the loans, the interest-free repayment terms offer borrowers some breathing room. Users can repay their loans within 14 days without the fear of accruing high interest, which is common in many informal lending situations. The minimal processing fee also ensures that the cost of borrowing remains low, making it an attractive option for users who need small amounts of money to tide them over until their next paycheck.

As GCash continues to innovate in the financial technology space, GLoan Sakto stands out as a key initiative aimed at uplifting low-income consumers. By offering accessible, small-scale loans with straightforward terms, GCash is not only meeting the immediate needs of its users but also fostering a culture of responsible borrowing that could benefit the broader economy in the long run.

Through nanoloans, GCash hopes to empower more Filipinos to take control of their financial futures. As users become familiar with GLoan Sakto and other GCash products, the e-wallet provider anticipates that more people will be drawn into the formal financial system. With greater access to credit and financial tools, low-income consumers may find themselves on a path toward improved financial health and security.

In this way, GCash’s GLoan Sakto serves not only as a quick financial fix but as a critical step in the journey toward greater financial inclusion in the Philippines.