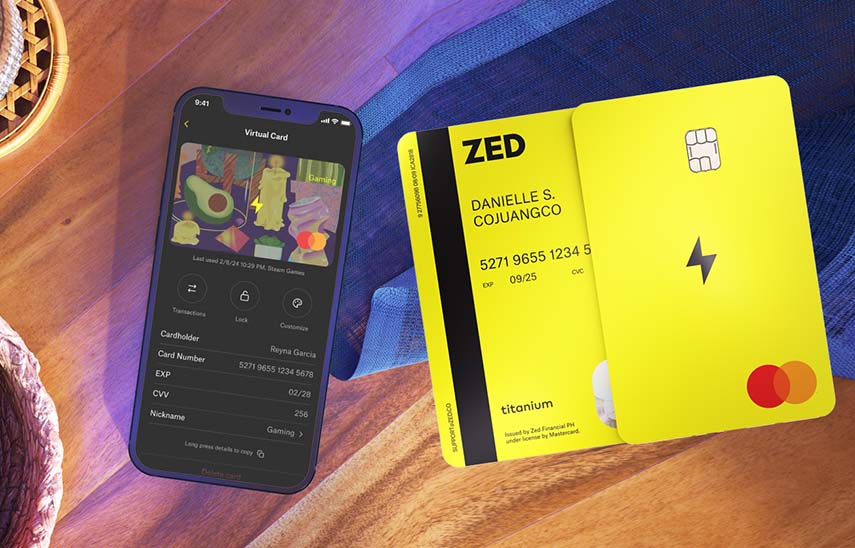

Zed, a burgeoning neobank focused on credit solutions and no-fee credit cards, has just made a groundbreaking announcement. Following a successful pilot program, the Zed Card is now rolling out in stages.

Those who signed up on the waitlist (now nearly 40,000 since March!) will receive invitations to apply in the coming months. “We’re amazed by the interest in Zed,” said Danielle Cojuangco Abraham, the co-founder of Zed. “Due to the high demand, it will take some time to get everyone on board. But invitations are already being sent, and we’re committed to onboarding new users while maintaining a top-notch experience for all Zed customers.”

In a separate press release, the bank also announced that it has already obtained a Certificate of Authority as a standalone credit card issuer from the Bangko Sentral ng Pilipinas (BSP). This milestone marks Zed’s transition from a promising startup to a key player in the financial sector, capable of issuing its own credit cards independently.

IMAGE CREDIT: https://www.zed.co

A no-interest, no-fee credit card

The journey to this achievement began with a BSP-sanctioned pilot program that spanned six months.

During this period, Zed rigorously tested its credit card offerings, fine-tuning features and ensuring compliance with regulatory standards.

The success of this pilot paved the way for the official launch of the Zed Card, which is now being rolled out to the public on an invite-only basis. This phased approach starts with individuals on Zed’s waitlist, a strategic move to manage demand for the no-fee credit card and ensure a seamless user experience.

The anticipation for the Zed Card has been immense. Since opening the waitlist in March, Zed has garnered nearly 40,000 sign-ups. This enthusiastic response can be attributed to the card’s unique value proposition: a no-interest, no-fee Mastercard Titanium Credit Card.

In an era where hidden fees and high interest rates are commonplace, Zed’s offer of a truly fee-free credit experience has struck a chord with consumers.

For those on the waitlist for this no-interest, no-fee credit card, the next few months will be exciting.

Invitations to apply for the Zed Card will be sent out progressively, allowing Zed to scale its operations while maintaining high service standards. This gradual rollout is designed to ensure that each new customer receives the support they need, reinforcing Zed’s commitment to customer satisfaction.

Revolutionizing the credit card industry

The Zed Card is set to revolutionize the credit card market in the Philippines. It offers a range of features designed to provide maximum benefit to users without the typical financial drawbacks. There are no annual fees, foreign transaction fees, or other hidden charges.

Additionally, cardholders can enjoy up to 31 interest-free days on purchases, effectively eliminating the burden of revolving balances and interest charges. This approach not only makes the Zed Card financially attractive but also encourages responsible spending and financial planning.

The launch of the Zed Card is backed by significant financial support. Zed has secured US$6 million in seed funding from Valar Ventures, an investment firm led by PayPal founder Peter Thiel.

This funding round also saw participation from influential backers associated with major fintech companies such as Nubank, Mercury, Cred, and Square. This impressive roster of investors underscores the confidence in Zed’s business model and growth potential.

Zed’s success with the no-fee credit card is not just about innovative financial products; it’s also about fostering a sense of community. By joining the Asian Banking and Finance community, Zed is positioning itself at the heart of the region’s financial ecosystem.

This engagement will allow Zed to stay abreast of industry trends, regulatory changes, and emerging technologies, ensuring that it remains at the cutting edge of financial innovation.

Scaling the rollout, expanding product offerings

Looking ahead, Zed has ambitious plans.

The initial focus is on scaling the rollout of the Zed Card and ensuring a flawless user experience. However, the vision extends beyond this. Aside from the no-fee credit card, Zed also aims to further expand its product offerings by leveraging its technological infrastructure to introduce new financial solutions tailored to the needs of its customers.

By doing so, Zed hopes to build a comprehensive financial ecosystem that empowers individuals and businesses alike. The announcement of Zed’s certification as a standalone credit card issuer is a significant milestone that heralds the arrival of a new era in Philippine banking.

With its no-interest, Mastercard Titanium no-fee credit card, Zed is set to disrupt the market and redefine consumer expectations. Supported by strong financial backing and a commitment to innovation, Zed is poised to become a major force in the neobanking sector, offering a glimpse into the future of finance.