The global landscape is constantly evolving when it comes to consumer behavior and expectations. Nowadays, digital access to products and services is no longer simply a matter of convenience — it has already become a standard requirement for discerning consumers!

In response to customers clamoring for user-first digital financial services, fintech firms like Plentina, a Filipino-led startup that offers a robo-advisor platform catering to Filipinos’ wealth management needs, are now rising to the challenge.

Alongside the readiness of millennials to embrace digital finance is also the need for guidance on how to invest their hard-earned money and build their wealth while managing their risk.

A guided wealth management strategy is needed in order to help achieve major financial goals, such as saving for your children’s schooling, retirement, a downpayment for your first home, or even taking a trip to the Bahamas that you’ve always dreamt about!

IMAGE CREDIT: https://www.plentinafinancial.com

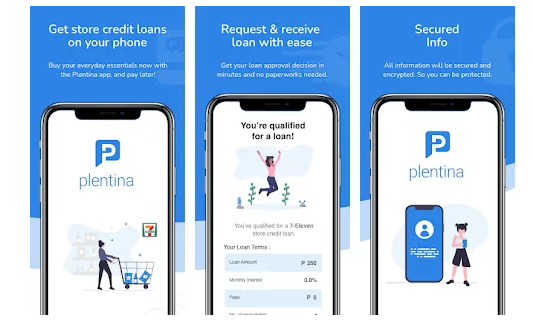

To address this need, Plentina Financial Inc. is proud to introduce to the Philippine market “Plentina Wealth,” a robo-advisor investment platform where users are sure to get a fully digital experience.

On the web-based platform, the Silicon Valley-based Filipino-led fintech company says users will be able to set up their global brokerage account and get a personalized investment portfolio that is aligned with their financial goals and risk tolerance.

While the service will initially be available only in the U.S., Plentina has already submitted a Letter of Intent to the Securities and Exchange Commission (SEC) in June to register a similar investment advisory service, which the fintech company aims to launch in the Philippines once approved.

Members of the Plentina Wealth team together with the event speakers

Last August 9, Plentina showcased to the media the concept for the Philippine robo-advisory platform at the QBO Innovation Hub in Makati.

Aptly titled “Tech Meets Wealth: The Future of Financial Freedom,” the event provided an opportunity for the attendees not only to get the latest exciting developments from the Plentina Wealth team but also to gain insights about the far-reaching implications of technology and artificial intelligence (AI) on our future from industry experts and leaders that were invited to the launch.

The program was opened by Kevin Gabayan, Plentina’s Co-founder and Chief Executive Officer, who shared the company’s mission of unlocking better opportunities for Filipinos, his own personal investment journey, and the crucial role of technology in sustainable and successful wealth creation.

On the other hand, the event’s featured guest speaker, Dominic Ligot, Founder, CEO and CTO of CirroLytix Research Services, a social impact artificial intelligence company, shared expert insights on the latest applications of artificial intelligence and generative AI across industries and the role that technology will play in creating a better future for the Philippines.

Mr. Ligot’s talk was followed by a panel discussion on the ripple effects of artificial intelligence and the responsibility of various stakeholders. The panel speakers were Michelle Alarcon, President of Analytics Association of the Philippines, and Rolly Miniano, a solutions architect from Amazon Web Services. The panel was moderated by Rose Concepcion, Plentina’s Director for Operations.

Following the panel, Earl Valencia, Co-founder and Chief Business Officer of Plentina, shared more about the vision of Plentina to be at the forefront of disruption and innovation in wealth management, and in highlighting the demand for a wealth management service that is digital and accessible to more people outside the markets served by traditional wealth management firms.

The highlight of the program was the product demonstration of the Plentina Wealth platform and algorithm, showcasing how the robo-advisor seamlessly generates the optimal diversified portfolio for a user based on their risk tolerance and goals, removing the friction and guesswork that comes with stock investing, and making it possible for users with limited investment experience to begin building their wealth instantly. The demonstration was led by Gabby Guiao, Plentina’s Product Manager, and Kenley Tan, Plentina’s Director for Data Science.

Following the product demonstration, Kat Valencia, Plentina’s Customer Retention Head, shared the team’s plans to launch financial education content and other campaigns alongside their robo-advisory platform to ensure that Filipinos are well guided on their investment journeys.

The program ended with a founder’s sharing session that enabled the audience to learn more about the Plentina Wealth platform as well as the Plentina team’s plans to empower their customers so they could better harness technology to build their wealth and achieve financial freedom.