Cybersecurity risks are rising as Filipinos increasingly rely on e-wallets, digital banks, and real-time payment systems for daily transactions.

Phishing scams, account takeovers, and social engineering attacks have surged alongside the country’s shift to cashless payments, exposing weaknesses not only in technology but also in consumer behavior, institutional coordination, and regulatory response.

The Philippines is now one of Southeast Asia’s fastest-growing digital payments markets. Mobile wallets, QR-based transactions, and instant fund transfers have become routine for groceries, transport, bills, and even small neighborhood purchases.

But as more money moves digitally, cybercriminals are moving faster — adapting old fraud tactics to new platforms and exploiting the speed that makes cashless payments attractive in the first place.

The fraud surge behind the cashless boom

Digital payments thrive on convenience and volume. For scammers, those same traits create opportunity. Fraudsters no longer need to physically access victims or compromise bank branches. A single phishing message sent at scale can reach thousands of users within minutes, with even a small success rate yielding quick returns.

Account takeover incidents — where attackers gain access to e-wallet or digital bank accounts—are often the end result of these campaigns. Once credentials or one-time passwords are compromised, funds can be transferred almost instantly, frequently hopping across multiple platforms before victims realize what has happened.

The problem is compounded by the interoperability of payment systems. Real-time rails allow funds to move seamlessly between banks and e-wallets, but once money leaves the original platform, recovery becomes far more difficult.

Phishing and social engineering: old scams, new delivery

Most attacks targeting Filipino users are not technically sophisticated. Instead, they rely on social engineering — manipulating victims into giving away access themselves.

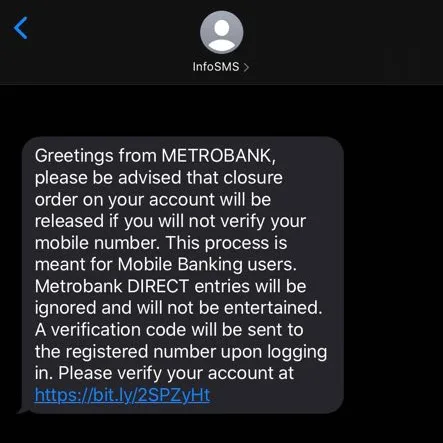

Common tactics include fake SMS alerts claiming a suspended account, fraudulent promos offering cashbacks, or messages posing as customer support requesting verification. Messaging apps and SMS remain the primary vectors, capitalizing on users’ trust in familiar brands and the urgency of financial notifications.

What makes these attacks effective is their timing and personalization. Messages often mimic actual alerts sent by banks or e-wallets, using similar language and formatting. In some cases, scammers time messages during paydays, sales, or major shopping events, when users are more likely to transact quickly and overlook warning signs.

Why Filipino users are particularly exposed

The Philippines’ mobile-first digital economy brings clear advantages, but it also creates unique risks.

Many users access financial apps on shared devices, rely heavily on SMS-based authentication, or reuse passwords across platforms. Cybersecurity awareness remains uneven, especially outside major urban centers, and financial literacy campaigns have struggled to keep pace with the speed of digital adoption.

Cultural factors also play a role. Filipinos tend to be responsive to authority cues and customer service messaging, which scammers exploit by posing as banks, telcos, or government agencies. The fear of account suspension or lost funds often pushes victims to act before verifying information.

Where security gaps emerge

While banks and e-wallets invest heavily in cybersecurity, gaps persist across the broader ecosystem.

Authentication remains a weak point, particularly where SMS-based one-time passwords are still used. SIM swap fraud, compromised devices, and malware can all undermine these safeguards. Meanwhile, delays in freezing accounts or flagging suspicious transfers can give fraudsters enough time to move funds beyond reach.

Cross-platform fraud adds another layer of complexity. Once money moves from an e-wallet to a bank — or vice versa — responsibility for investigation and recovery can become fragmented. Victims are often bounced between institutions, unsure which party is accountable.

How financial institutions are responding

Banks and e-wallet providers are rolling out stronger controls, including behavioral analytics, transaction limits, and AI-driven fraud detection. Some platforms now flag unusual activity in real time, require additional verification for high-risk transfers, or temporarily lock accounts when anomalies are detected.

However, technology alone has limits. Fraud detection systems can reduce losses, but they also risk false positives that inconvenience legitimate users. Striking the balance between security and usability remains a challenge, particularly in a market where speed and ease are key drivers of adoption.

Industry players increasingly acknowledge that user education must complement technical defenses. In-app warnings, scam advisories, and simplified reporting channels are becoming more common, but their effectiveness depends on sustained engagement rather than one-off campaigns.

The regulator’s coordination challenge

Oversight of digital payments and cybersecurity in the Philippines is shared across multiple agencies, including the Bangko Sentral ng Pilipinas, the National Privacy Commission, and the Department of Information and Communications Technology.

While frameworks and advisories are in place, enforcement becomes difficult once fraud crosses institutional boundaries. Real-time payments move faster than investigation processes, and coordination between financial institutions and telcos is not always seamless.

Regulators face a delicate task: strengthening consumer protection without slowing innovation in a sector seen as critical to financial inclusion. As digital finance deepens its reach, expectations for accountability and redress are also rising.

Trust as the real currency of cashless finance

The Philippines’ push toward a cashless economy has delivered clear gains in convenience and access. But cybersecurity risks now threaten to undermine user trust — the foundation on which digital finance depends.

If consumers believe that digital payments are unsafe or that recovery after fraud is unlikely, adoption could stall, particularly among first-time users and those in lower-income segments.

The long-term success of cashless initiatives will depend less on how fast transactions are processed and more on how well users are protected when things go wrong.

Cybersecurity, in this context, is no longer just a technical concern. It is a policy issue, a consumer trust issue, and a defining challenge for the next phase of the Philippines’ digital finance journey.