Cryptocurrency communities in the Philippines are speaking out against a recent appeal by Infrawatch PH, a public policy think tank, urging the Securities and Exchange Commission (SEC) to ban the unregistered cryptocurrency exchanges OKX and Bitget from operating in the Philippines.

The think tank’s request has stirred controversy, drawing criticism from local crypto enthusiasts who view it as an overreach that could stifle financial growth and innovation in the country.

Infrawatch PH’s appeal to the SEC stems from concerns about the legal status of these platforms.

Cryptocurrency users being put at risk: Infrawatch

According to Infrawatch convenor Terry Ridon, both OKX and Bitget have been engaging in aggressive marketing campaigns, including events and giveaways targeting Filipino university students, without the proper licenses to operate as virtual asset service providers (VASPs).

Ridon also highlighted that these platforms allow users to purchase cryptocurrency using local payment systems such as GCash, PayMaya, and UnionBank, even though they are not licensed by the Bangko Sentral ng Pilipinas (BSP).

“Similar to Binance, Filipino users of Bitget and OKX are exposed to several financial risks every day and are left without recourse,” Ridon was quoted to have said. “We are thus calling on the SEC to implement the same resolve to Bitget and OKX as it did with Binance, as these exchanges pose a threat to the security of Filipino investors’ funds.”

Infrawatch’s request also touched on the issue of peer-to-peer (P2P) transactions, which Ridon claims facilitate illegal activities and violate financial regulations.

The policy group called on the SEC to issue cease-and-desist orders, impose penalties, and investigate the operations of these platforms, saying that their unregulated status poses a significant risk for the Filipino crypto market.

Backlash from the cryptocurrency community

Despite Infrawatch’s concerns, the Filipino crypto community has largely reacted negatively to the call for a ban on OKX and Bitget.

In response to an announcement made on Facebook by a well-known content website that promotes the sustained, positive growth of the Philippine fintech industry, especially cryptocurrency and blockchain, many commenters expressed frustration with the country’s regulatory approach to cryptocurrency.

A recurring sentiment is that Infrawatch’s actions seem to favor local exchanges at the expense of global platforms, which many Filipinos prefer due to their ease of use, lower fees, and a broader range of offerings.

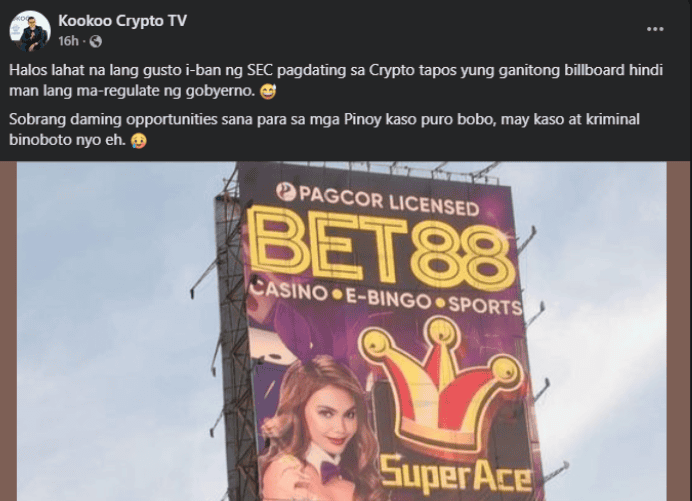

One common complaint is the perceived double standard in the country’s regulatory landscape. Commenters pointed out that while cryptocurrency platforms are being targeted for enforcement, gambling sites — many of which operate with little oversight — are allowed to advertise freely on billboards across the country.

“It seems like the government is more lenient towards gambling, which destroys lives, yet they’re cracking down on crypto, which can help Filipinos grow financially,” one user remarked.

Several members of the community also expressed dissatisfaction with local crypto exchanges, citing high transaction fees and inadequate services as reasons for preferring international platforms like OKX and Bitget. Others also questioned the effectiveness of the SEC in protecting investors, pointing to unresolved issues with other registered platforms, such as the investment platforms SeedIn and Blend, where some users claim they have not yet received refunds.

A call for regulation, not bans

The Filipino crypto community has largely called for a more balanced approach to regulation, advocating for the licensing of foreign exchanges rather than outright bans.

This sentiment aligns with a recent House Resolution filed by Albay Representative Joey Salceda, who proposed that instead of banning these platforms, the government should study the possibility of taxing foreign exchanges under an expanded value-added tax (VAT) law on digital services.

“The government should look at how to regulate these platforms instead of banning them,” one commenter suggested. “Banning only pushes people to look for less secure and more underground methods of accessing crypto, which puts them at greater risk.”

The push to ban Bitget and OKX has also led to a wider discussion about the role of cryptocurrency in the Philippines.

Many in the community feel that crypto presents significant opportunities for financial growth, particularly for Filipinos who are underserved by traditional financial institutions.

As more regions and companies explore digital currencies, initiatives like the PHPC’s integration with Solana and PayPal’s crypto expansion point to the growing importance of blockchain in transforming global financial landscapes. And with Hong Kong advancing its own digital currency pilot, the future of finance is increasingly digital, decentralized, and accessible.

A framework that protects consumers without stifling innovation

As more Filipinos look to digital assets for investment and remittance purposes, they argue that the government should focus on creating a robust regulatory framework that protects consumers without stifling innovation.

Notably, prominent web3 content creator Kookoo Crypto TV weighed in on the controversy, criticizing the SEC for its strict stance on cryptocurrency while allowing gambling platforms to operate with little interference. This criticism has been echoed by many in the community, who feel that the regulatory environment is becoming increasingly hostile to crypto at a time when global interest in digital assets continues to rise.

The frustrations have also spilt over into other platforms, with crypto enthusiasts leaving one-star reviews for Infrawatch on Google Maps, a trend that began when the group first pushed for the banning of Binance in the Philippines last year. Many reviews expressed concern that Infrawatch’s actions are hindering ordinary Filipinos from accessing global financial opportunities.

As the debate over crypto regulation in the Philippines rages on, the call to ban OKX and Bitget highlights the tension between regulatory bodies and the crypto community.

While Infrawatch argues that unregulated platforms pose a significant risk to Filipino investors, many in the community believe that bans are not the answer. Instead, they are calling for a regulatory framework that balances protection with financial growth, ensuring that Filipinos can safely participate in the global crypto market.