by Jan Michael Carpo, Reporter

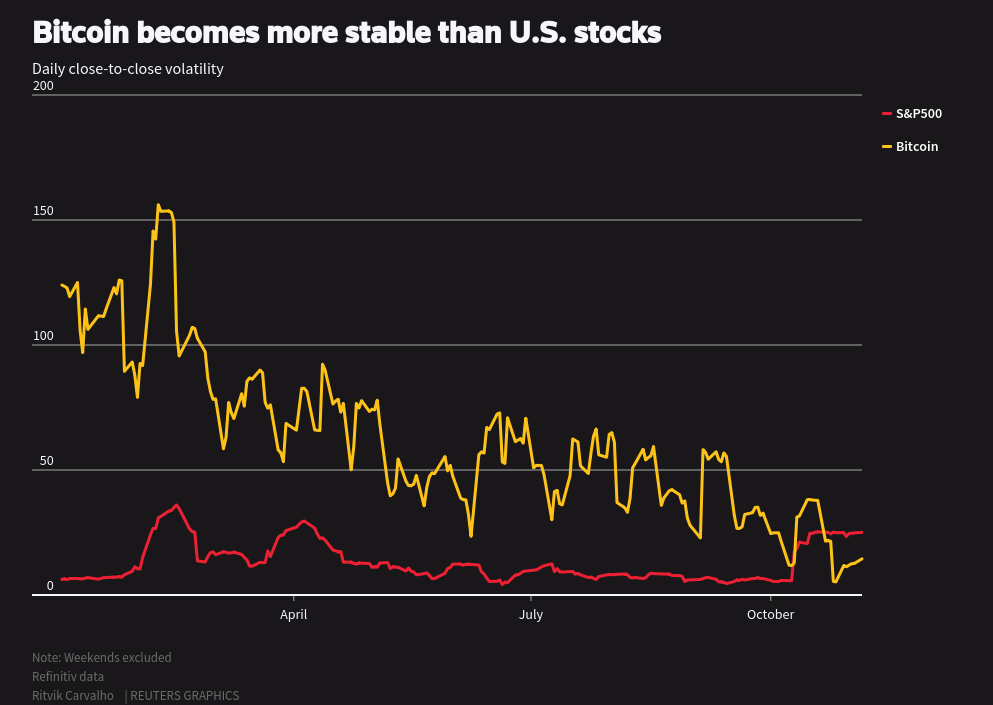

I’ve said it before, and I’ll say it again — only invest money you’re willing to lose in cryptocurrencies since they are a risky, speculative investment.

For the first time since June 22, Bitcoins fell below the $30,000 mark in July last year.

According to Coindesk’s Bitcoin price tracker, its all-time high — which was above $60,000 in April — was followed by a slump in late July as it fell below the US$30,000 range. From there, it declined steadily and remained close to $30,000 before increasing again to more than US$46,000 in August.

In spite of this trend, a number of finance experts say long-term cryptocurrency investors need not fear. They just need to be prepared and understand that volatility with cryptocurrency is part of the game.

What Investors Should Know About the Current Volatility

“Investors should anticipate this level of volatility with cryptocurrencies, which may be attributed to the industry’s youth,” says Ollie Leech, learn editor at Coindesk, a prominent source of cryptocurrency news.

It is this exact same reason why experts advise limiting your cryptocurrency investment to no more than 5% of your overall holdings.

According to Nate Nieri, a Certified Financial Planner (CFP) and founder of Modern Money Management, “Cryptocurrencies are a highly speculative asset that bears a tremendous risk with no income-producing properties.”

But this doesn’t mean that someone who wants to make it big and hit a home run cannot be fortunate.

“I don’t see anything wrong with putting a small amount toward it if a crypto investor wants to make a low-return, high-risk wager, and is okay with it burning away overnight,” adds Nieri.

However, one thing is certain: the conventional long-term financial advice to never invest anything that you wouldn’t be okay losing is still valid.

“Setting it and forgetting it is the best strategy for avoiding stress related to your assets,” says Humphrey Yang, the personal finance guru behind Humphrey Talks. “The best action you can take is to stop checking on it. You might sell at the wrong time or decide poorly if you let your emotions take over,” he explains.