Global remittances are a colossal lifeline for low and middle-income countries, valued at over US$900 billion in 2024 by the World Bank. For millions of families in the Philippines, India, Mexico, and China, these funds are the bedrock of stability, covering essential needs like food, healthcare, and education.

Yet, the current traditional banking systems governing this vital flow are notoriously slow, costly, and inefficient — a painful reality that directly cuts into the hard-earned money sent by migrant workers. This painful status quo is being aggressively dismantled by the rise of stablecoins, and Coins.ph, the Philippines’ largest and pioneering crypto exchange, is at the forefront of this revolution.

The stablecoin advantage: A market in hyper-growth

Stablecoins, digital currencies pegged to fiat assets like the U.S. dollar, have emerged as the preferred medium for injecting speed and cost-efficiency into global exchange.

- The combined market capitalization of the two largest stablecoins, USDC and USDT, has doubled since 2023, soaring to over US$260 billion in 2025.

- Analysts project the total stablecoin market cap could surge toward US$2 trillion by 2028, driven largely by payment use cases and robust institutional adoption following new regulatory clarity.

Coins.ph builds a global corridor for Filipino diasporas

Coins.ph has aggressively expanded its stablecoin infrastructure through strategic global partnerships with companies like BCRemit, Hashkey, Hi-Globe, and FinFan.

This network creates compliant, near-instant payment corridors between major sending markets—including Hong Kong, the UK, US, Canada, and the European Union — and the Philippines. This allows money senders to bypass costly, multi-layer bank intermediaries, ensuring more of their remittance reaches home quickly.

Wei Zhou, Chief Executive Officer of Coins.ph

“We are aggressively supporting stablecoin remittances because they solve the fundamental problems of cost and time that plague millions of migrant workers,” says Wei Zhou, Coins.ph Chief Executive Officer. “Stablecoins offer a pathway to near-instant, compliant transfers at a fraction of the current cost, ensuring more of that hard-earned funds reaches home. This isn’t just an improvement — it’s the potential for a massive, equitable shift that truly empowers the Filipino diaspora.”

Here are the 5 key ways stablecoin remittances, championed by Coins.ph, are fundamentally improving cross-border payments for emerging markets:

1. Drastic reduction in transaction costs

The most immediate benefit is the elimination of excessive fees. Traditional remittance costs still average 6.62% globally, more than twice the UN Sustainable Development Goal target of under 3% by 2030. These high fees disproportionately affect the poorest families.

By leveraging efficient blockchain networks, stablecoin remittances bypass the multiple intermediary banks and fees of the legacy system. In competitive corridors, transaction costs can often drop to under 1% of the transfer value.

This cost-saving is critical for the Philippines; by ensuring more of the US$38.34 billion sent by OFWs stays with their families, stablecoins directly fight poverty and inject greater liquidity into the local economy.

2. Near-instant settlement speed and 24/7 availability

Traditional payments can take 3 to 5 business days due to restricted operating hours and batch processing — a massive logistical hurdle for families dependent on timely support.

Stablecoins enable near-instant settlement, with transfers typically finalized within minutes, regardless of geography, time zone, or banking holidays. This 24/7/365 “always-on” capability is revolutionary, giving recipients reliable, fast access to funds for emergencies or daily needs.

Zhou asserts: “By adopting stablecoin rails for remittances, we are enabling near real-time, low-cost transfers that offer overseas Filipinos and their families greater value, transparency, and financial freedom.”

3. Increased financial inclusion for the unbanked

Stablecoin remittances fundamentally democratize access to global finance. In many emerging markets, a large portion of the population remains unbanked. Traditional services require formal bank accounts or physical branch locations, limiting access in rural or underserved regions.

Stablecoins require only a mobile device and a digital wallet to send and receive funds. This minimal requirement removes a major barrier to entry, allowing migrant workers to send money directly to family members who may not have access to a traditional bank account, providing them with a secure, USD-denominated digital store of value.

4. Mitigation of foreign exchange (FX) risk and opacity

The traditional system subjects users to hidden fees and unpredictable currency conversion losses as funds pass through multiple intermediaries.

Because the most popular stablecoins are pegged to strong fiat currencies (e.g., USD), they provide a stable, predictable unit of account throughout the transfer.

This transparency shields the value of the remittance from local currency volatility and opaque FX spreads — a key concern in emerging markets where local currencies can experience rapid devaluation.

5. Enabling new, programmable financial services

Beyond simple person-to-person transfers, stablecoins create a robust, programmable foundation for future financial innovation. The transactions are digital, transparent, and settled on an immutable ledger.

This inherent programmability allows for sophisticated services like automated micropayments, real-time payroll for remote workers, and conditional payments.

For companies in high-growth markets across Southeast Asia and Africa, stablecoin rails boost working capital efficiency and end-to-end transparency for vendor payouts.

A fundamental restructuring of global finance

The rise of stablecoin remittances is a fundamental restructuring of global finance.

With the unprecedented savings, speed, and access they offer, stablecoins dismantle the costly barriers built by decades of slow traditional systems, ensuring migrant workers and their families in emerging markets can finally retain more of their hard-earned money and receive it when they need it most.

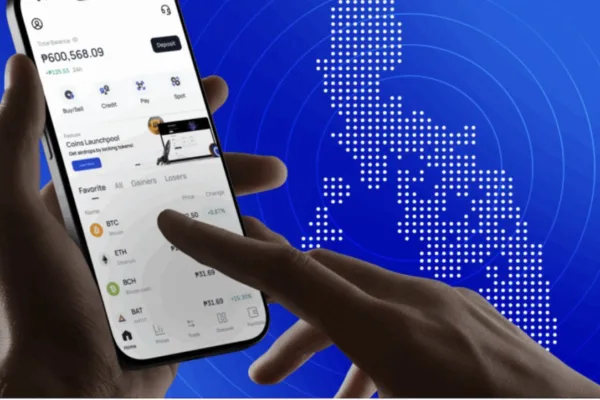

Coins.ph is an all-in-one financial app for millions, seamlessly fusing traditional finance with digital assets. Established in 2014, it stands as the Philippines’ premier cryptocurrency exchange.

Licensed by the Bangko Sentral ng Pilipinas (BSP) as both a virtual asset marketplace and a mobile wallet, the platform empowers users to trade, and execute payments all in one secure place.

To learn more about Coins.ph’s stablecoin partnerships, visit www.coins.ph or https://www.facebook.com/coinsph.