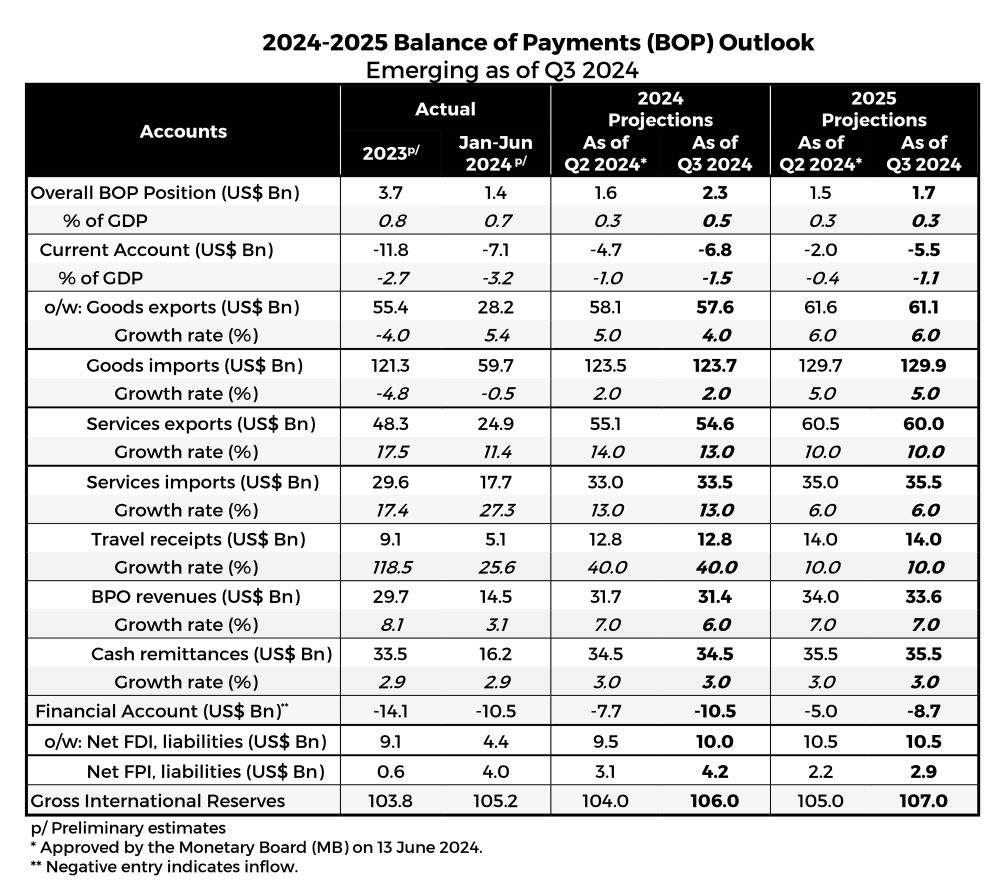

The Bangko Sentral ng Pilipinas (BSP) has announced recently that the Philippine economy is poised for a more favorable balance of payments (BOP) position in 2024 and 2025, marking an improvement from projections made in June 2024.

In a media advisory, the BSP said that based on the latest forecasts, this positive outlook is largely driven by sustained global and domestic economic growth, decelerating inflation, and a revival in world trade activity.

Globally, the economy is expected to grow steadily in 2024, with a slight uptick in 2025. Key emerging markets, especially China, are projected to experience higher growth in 2024 compared to previous forecasts.

This boost in China’s economy is expected to counterbalance the slowdown in the United States. A surge in global trade is also anticipated, with increasing demand for products tied to the energy transition and advancements in artificial intelligence.

Items like electric vehicles, solar panels, batteries, and high-end semiconductors are expected to drive this demand, indirectly benefiting Philippine exports.

On the domestic front, the Philippines is forecasted to maintain its economic momentum, fueled by strong domestic demand, a continued decline in inflation, and the timely implementation of the national budget.

Infrastructure development remains a priority for the government, supported by investment-related reforms, which are expected to enhance the overall business environment. These factors collectively contribute to an improved BOP outlook.

BSP sees risks and opportunities for PH BOP

Although there are emerging risks to the BOP, the outlook remains generally balanced. On the downside, the country could face challenges from commodity price volatility due to geopolitical tensions, extreme weather events, and the potential resurgence of infectious diseases such as monkeypox. Additionally, trade tensions between major global players and mobility risks could further complicate the external sector.

However, on the positive side, easing monetary policies by key trading partners, coupled with stronger economic growth, provide a more optimistic outlook.

Decelerating inflation globally and domestically, along with government-backed initiatives for trade and investment, are also encouraging signs.

Reforms in the corporate tax regime are expected to boost foreign investment, which will help stabilize the country’s external accounts.

Last March, the central bank announced that more funds could soon be entering the country this year but the same would probably not be maintained, leading to a possible deficit position in 2025.

Financial and trade contributions to the BOP

The improved BOP outlook for 2024 and 2025 is anchored in the significant rise in non-resident inflows observed in the first half of 2024, which has helped mitigate the effects of a wider current account deficit.

A notable increase in portfolio investments, driven by stronger global and domestic growth prospects, is expected to benefit from an anticipated easing of U.S. monetary policy.

These factors are likely to continue attracting higher levels of both foreign direct investments (FDIs) and foreign portfolio investments (FPIs) throughout the year.

However, the wider current account deficit in 2024 is due to a reduction in the growth forecast for goods and services exports. The local semiconductor industry, which relies heavily on legacy products and downstream assembly, is not expected to fully benefit from the AI-driven surge in global electronics demand.

On the other hand, exports of other electronic products, such as electronic data processing and automotive electronics, may experience growth due to the tech replacement cycle and recovering global demand. Additionally, services exports are projected to see only modest growth as the business process outsourcing (BPO) sector, particularly contact centers, underperforms.

Despite these challenges, the current account will continue to receive support from strong travel receipts and steady remittance flows from overseas Filipinos, ensuring that the BOP position remains relatively stable.

Outlook for 2025

Looking ahead to 2025, the overall BOP position is expected to register a higher surplus compared to previous forecasts, driven by continued net inflows from the financial account and a narrowing current account gap.

Global demand and trade activity are likely to rise, leading to increased exports of Philippine goods, especially in mineral and agro-based products, as well as a recovery in services exports. The IT-BPM sector, particularly the healthcare segment, is also expected to see growth, contributing to a stronger services export sector.

With a resilient domestic economy, a more favorable inflation environment, and government efforts to attract foreign investment, the Philippines is well-positioned to maintain positive direct and portfolio investment flows into 2025. However, downside risks remain, including potential market instability from geopolitical conflicts and trade tensions, which could impact the overall BOP outlook.

In the end, as the Philippine economy navigates the complexities of global economic shifts, the improved BOP projections for 2024 and 2025 signal a more stable financial outlook.

Continued foreign exchange inflows and the potential buildup of gross international reserves (GIR) provide a buffer against external challenges. Nevertheless, the Bangko Sentral ng Pilipinas (BSP) remains cautious, highlighting the limitations of these forecasts given the unpredictable nature of global economic risks.

For its part, the BSP will continue to closely monitor external sector developments to ensure the fulfilment of its financial stability objectives.