Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. announced recently that the Philippines can now look forward to a strong and inclusive economy with a supportive and liquid banking sector, lower inflation, and digitalization accelerating financial inclusion.

In a speech delivered at the central bank’s Manila office to celebrate the BSP’s 30th anniversary, the BSP chief also thanked the banking community for being a strong source of support for the country’s growing economy. He encouraged the banks to continue working with the BSP and its programs that are aimed at building a future-ready Philippines that is digital, sustainable, and inclusive.

Photo shows BSP Governor Eli M. Remolona, Jr. (third, from left) together with Monetary Board Member (MBM) Anita Linda R. Aquino, Finance Secretary Benjamin E. Diokno, and MBM V. Bruce J. Tolentino.

The BSP chief also underscored the importance of sustained policy improvement for the banking sector and its gains, especially at the height of the global health crisis, noting how the Philippine economy was able to register a strong rebound during the pandemic partly because of the strong banking system.

“Unlike in previous crises, our banks formed part of the solution rather than part of the problem. This is, in part, due to our work in ensuring financial stability,” he said.

According to the BSP, among the improvements that helped strengthen the domestic banking system is the increase in the bank’s capitalization as well as the changes in the capital ratios.

To boost economic activities and buoy domestic growth during the pandemic, the Philippine central bank also allowed financial institutions’ borrowings to micro, small, and medium-scale enterprises (MSMEs) as alternative compliance to reserve requirement (RR).

BSP’s inflation-targeting framework to boost efficiency

While various measures were being implemented to help lift the economy after a slump, inflation — both here and overseas — has hampered the moves that would have allowed for faster economic recovery.

“Fortunately, the BSP’s inflation-targeting framework has served us well in the face of unusual supply shocks. We continue to focus on our mandate of price stability and have dedicated our resources and attention in pursuit of this goal,” Remolona explained.

He reiterated monetary authorities’ forecast that the rate of price increases will continue to decelerate and return to within the government’s 2 to 4 percent target band starting in the last quarter of this year.

“This is the range that we think is ideal for an economy like the Philippines when it is growing at full capacity,” he added.

So far this year, the inflation rate peaked last January when it accelerated to 8.7 percent, the highest in 14 years. It has decelerated since then with the June 2023 level at 5.4 percent.

To date, the average inflation stands at 7.2 percent.

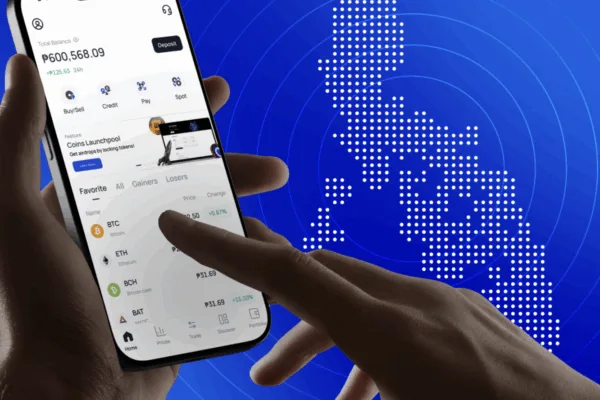

Meanwhile, Remolona said increased digitalization both in the banking and payments system can further boost efficiency, competitiveness, and inclusion in the country.

He said authorities “are mindful and we will manage the attendant risks to ensure continued trust and confidence in this increasingly digital economy.” “We want to bring more Filipinos into this financial fold, so that as many of us as possible can share in the fruits of economic progress,” he added.