The Bangko Sentral ng Pilipinas (BSP) has reported that the Philippines recorded a balance of payments (BOP) surplus of US$88 million in August this year, a significant turnaround from the US$57 million BOP deficit registered in the same period last year.

In a media advisory, the BSP stated that the BOP surplus, driven by inflows from the BSP’s investments abroad, marks a positive development for the country’s external position, reflecting an improved economic outlook and resilience in its international financial activities.

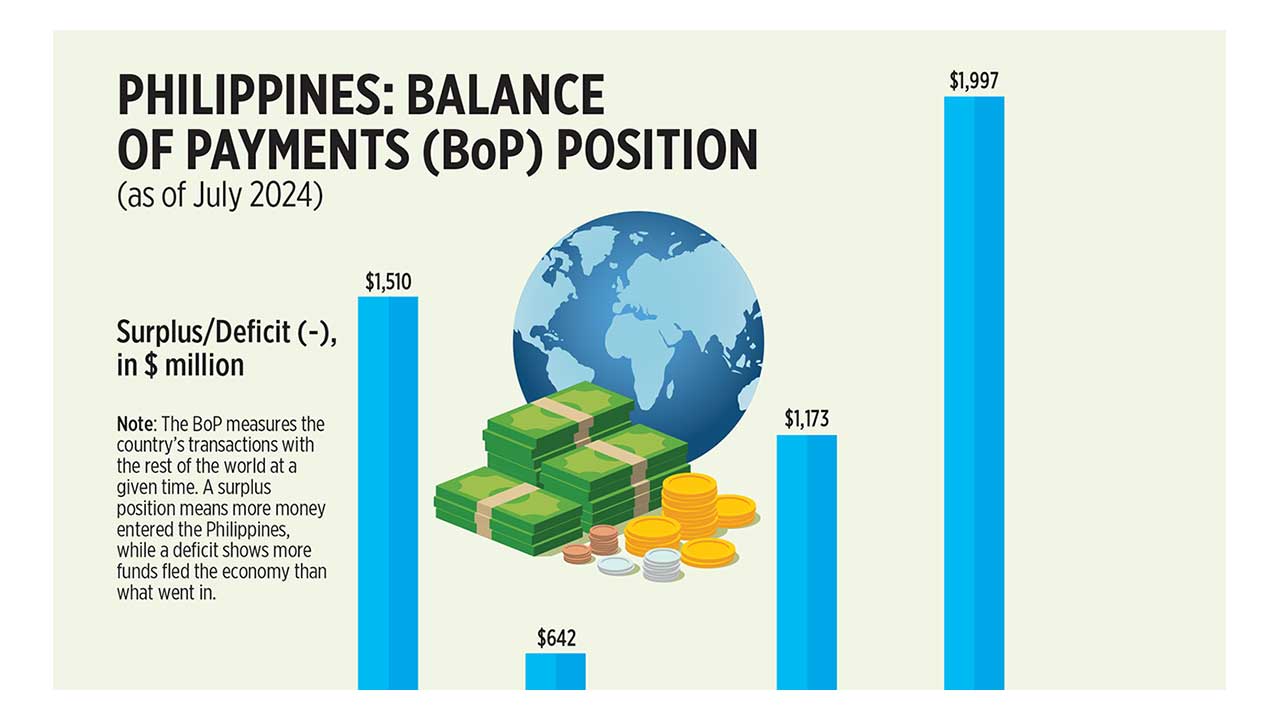

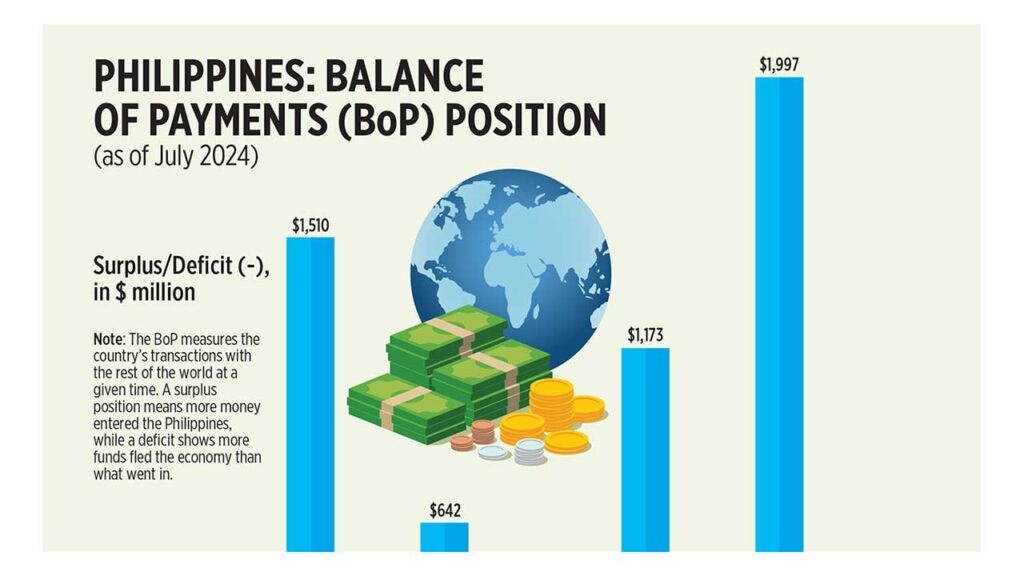

This recent BOP surplus brought the year-to-date BOP level to US$1.6 billion, a slight decrease compared to the US$2.1 billion surplus in January-August 2023.

Preliminary data reveals that this cumulative surplus primarily reflects a narrowing trade deficit in goods, alongside consistent net inflows from personal remittances, trade in services, foreign direct investments, foreign borrowings by the National Government (NG), and foreign portfolio investments.

In a recent virtual media briefing, BSP Department of Economic Research Director Sittie Hannisha Butocan announced an upward revision of the country’s balance of payments (BOP) forecast for 2024. Butocan revealed that the BOP position is now expected to reach a surplus of USD 700 million, a notable increase from the previous estimate of USD 400 million.

BSP Department of Economic Research Director Sittie Hannisha Butocan

“This improved outlook is primarily driven by the projected narrowing of the current account gap for the year, along with modest inflows from non-resident investments,” Butocan explained during the briefing. She highlighted that the current account deficit is now estimated to be USD6.1 billion, reflecting adjustments in the growth forecasts for both goods imports and exports. “The downward revision of these trade figures underscores a more cautious global economic environment, which has influenced our projections,” she added.

Despite these revisions, Butocan emphasized the continued resilience of the Philippine economy in managing external accounts, pointing out that the country remains well-positioned to sustain its BOP surplus amid global uncertainties.

BSP report identifies key drivers of BOP improvement

The shift from a deficit to a surplus highlights the country’s ability to manage its international transactions more effectively, as evidenced by improvements in several areas.

A key factor behind this surplus is the significant narrowing of the trade in goods deficit, which stood at US$29.9 billion for the first seven months of 2024, down from US$31.8 billion in the same period last year, based on data from the Philippine Statistics Authority (PSA).

The reduced trade deficit signals improved exports and a moderation in imports, reflecting better domestic production capacity and global demand for Philippine goods.

Furthermore, sustained remittance inflows from overseas Filipino workers continue to provide a steady stream of foreign currency, supporting the country’s BOP position. Remittances are a critical pillar of the Philippines’ external accounts, providing substantial liquidity to fund imports and repay foreign debt.

Additionally, the steady inflow of foreign direct investments (FDIs) demonstrates increased investor confidence in the country, bolstered by a stable macroeconomic environment.

Foreign borrowings by the NG and foreign portfolio investments further contributed to the positive BOP position. These inflows underscore the international community’s recognition of the Philippines as a viable investment destination.

Foreign reserves strengthen amid BOP surplus

The improvement in the BOP position has also resulted in a significant boost in the country’s gross international reserves (GIR), which rose to US$107.9 billion by the end of August 2024, up from US$106.7 billion at the end of July.

This level of reserves provides the Philippines with a more than adequate external liquidity buffer, equivalent to 7.8 months’ worth of goods imported and payments for services and primary income.

The GIR serves as a critical safeguard against external shocks, ensuring the country has sufficient foreign exchange to meet its balance of payments financing needs, such as payments for imports and debt servicing, even during extreme global financial conditions.

The reserves are also about 6.0 times the country’s short-term external debt based on original maturity and 3.8 times based on residual maturity, highlighting the country’s strong external liquidity position.

Implications for the Philippine economy

This is one of the predictions made by the Philippine Monetary Board after it approved the latest set of 2024 and 2025 Balance of Payments (BOP) projections in a meeting held late last week. The BOP surplus and higher GIR levels indicate that the Philippines is in a strong position to weather external risks, such as rising global interest rates, geopolitical tensions, or potential downturns in global trade.

In March this year, the Philippine Monetary Board also predicted that more funds could soon be entering the country this year but the same may probably not be maintained, leading to a possible deficit position in 2025.

The country’s ability to maintain a surplus, despite global economic challenges, speaks to the resilience of its economic fundamentals and the effectiveness of the BSP’s policies in managing foreign exchange operations and monetary policy.

Moving forward, the BSP is expected to continue closely monitoring the country’s external accounts, particularly the trade balance and foreign exchange inflows, to maintain financial stability.

Sustaining the surplus will be critical for ensuring that the Philippines remains attractive to investors while providing enough buffer to handle any potential economic shocks.

In conclusion, the Philippines’ August 2024 BOP surplus is a welcome development, reflecting improvements in the country’s international financial transactions and its growing reserves.

As global economic uncertainties persist, maintaining a positive BOP position will be key to ensuring the country’s continued economic stability and growth in the months ahead.