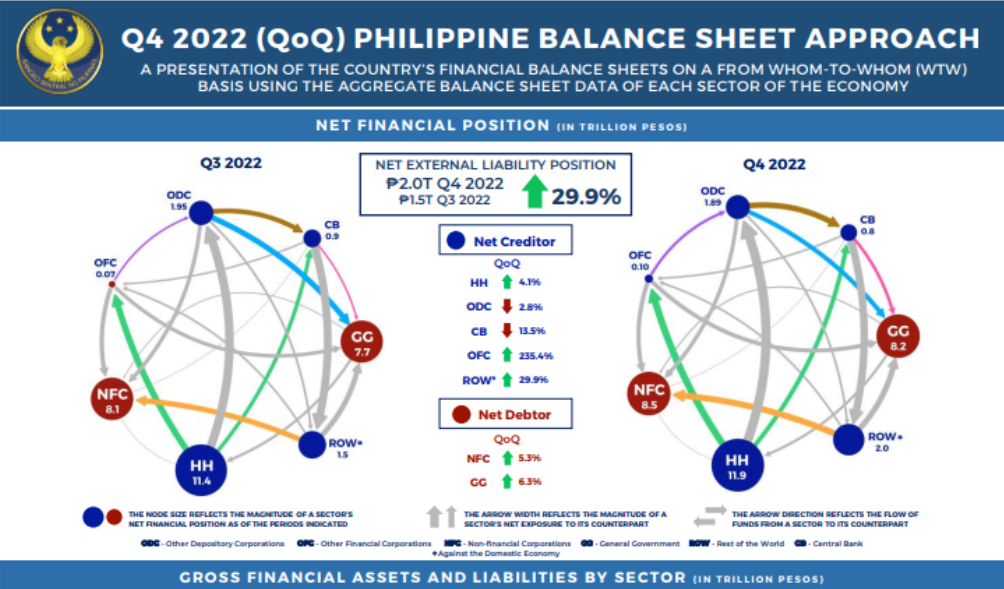

Earlier this month, the Bangko Sentral ng Pilipinas (BSP) shared that the country’s net external liability position has widened by 29.9 percent quarter-on-quarter (QoQ).

IMAGE CREDIT: BSA_4qtr2022.pdf (bsp.gov.ph)

Based on a preliminary Q4 2022 Philippine Balance Sheet Approach (BSA), it was reported that the net amount has grown from P1.5 trillion in Q3 2022 to P2 trillion in Q4 2022 due to the following factors:

- Higher net external liability positions of the Non-Financial Corporations (NFCs) and the General Government (GG)

- Lower net external asset position of the Central Bank (CB)

According to the report, NFCs remained to be the largest net debtor in the domestic economy, from P8.1 trillion in Q3 2022 to P8.5 trillion in Q4 2022, due to the sector’s higher net indebtedness against the rest of the world (ROW).

This arose from the expansion in the NFCs’ gross external liabilities and its lower external assets. The sector’s external assets and liabilities were mostly comprised of loans and equity securities.

In Q4 2022, the NFCs’ liabilities-to-GDP ratio decreased slightly to 91.1 percent as the economy’s growth in nominal terms exceeded the increase in the sector’s gross financial liabilities.

On a year-on-year (YoY) basis, the NFCs’ net debtor position widened due to its higher net indebtedness to other direct costs (ODCs).

This resulted mainly from the rise in bank loans availed to sustain operations amid heightened consumer demand brought about by the improved economic outlook.

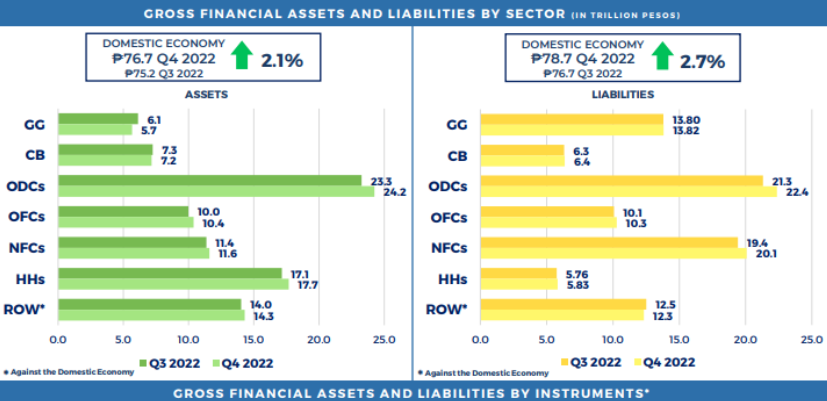

IMAGE CREDIT: BSA_4qtr2022.pdf (bsp.gov.ph)

The general government’s (GG’s) net debtor position also widened from P7.7 trillion in Q3 2022 to P8.2 trillion in Q4 2022 due to the sector’s deposit withdrawals from the Central Bank, which it used to meet the higher operating expenditures accrued during the last quarter of the year.

Likewise, the general government remained partly insulated from the exchange rate fluctuations as the majority of its liabilities were funded by domestic sectors. Notwithstanding the record-high debt levels, the growth in the GDP outpaced the increase in the GG’s level of borrowings in Q4 2022.

As a result, the sector’s liabilities-to-GDP ratio for the quarter decreased to 62.7 percent. YoY, the GG’s net debtor position rose primarily due to the increase in loans from the ROW and higher GS issuances.

The households (HHs) continued to be the top creditor of the economy at P11.9 trillion in Q4 2022 from P11.4 trillion in Q3 2022.

The HHs’ net claims on the CB, which were composed mainly of the sector’s currency holdings, increased. Amid the steady increase in the HHs’ assets, the sector’s gross financial liabilities registered double-digit YoY growth rates for the last two quarters of 2022 – the fastest recorded since Q1 2020.

This coincided with the steeper increase in prices as headline inflation accelerated to 7.9 percent in Q4 2022.

The ODCs’ net creditor position eased to P1.89 trillion in Q4 2022 from P1.95 trillion in Q3 2022. In Q4 2022, the sector’s net claims on the GG declined due to the increase in the GG’s deposits in banks.

Meanwhile, the ODCs’ net debtor position to the OFCs widened on the back of the OFCs’ higher deposit placements with the ODCs. Similarly, on a YoY basis, the sector’s net creditor position contracted brought about by the annual increase in deposits from the HHs and OFCs.

The CB’s net creditor position contracted to P811.4 billion in Q4 2022 from P937.9 billion in Q3 2022 as its net financial liability positions to the ODCs and the HHs increased.

The CB’s higher financial liabilities to these counterparty sectors were due mainly to the expansion in the deposits of the ODCs and currency holdings of the HHs. These developments were mitigated by the increase in the CB’s net financial asset position with the GG which resulted from the substantial decline in deposits from the NG.

However, on a year-on-year basis, the CB’s net creditor position increased mainly due to the NG’s deposit withdrawals.