The Philippines is starting 2026 on firmer macroeconomic footing, buoyed by a strong external buffer (reserves), subdued inflation, and continued liquidity support from the Bangko Sentral ng Pilipinas (BSP).

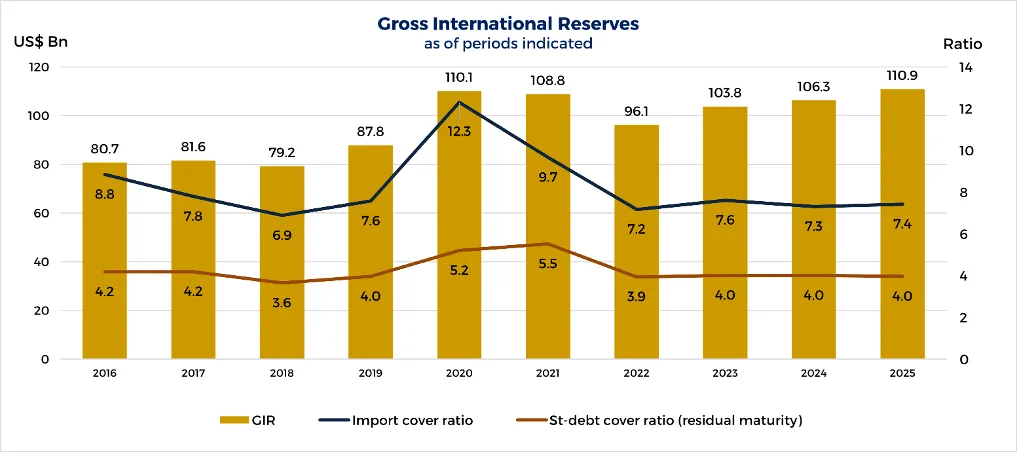

Data released by the central bank showed that the country’s Gross International Reserves (GIR) [1] stood at US$110.9 billion as of end-December 2025, providing a robust shield against external shocks.

The reserve level is equivalent to 7.4 months’ worth of imports of goods and payments of services and primary income, well above the international adequacy benchmark of three months.

The latest GIR also covers around four times [2],[3] the country’s short-term external debt based on residual maturity, underscoring the Philippines’ capacity to meet near-term foreign obligations of both the public and private sectors.

The reserves are composed of foreign-denominated securities, foreign exchange holdings, and other assets, including gold, and serve as a key line of defense for currency stability and balance-of-payments needs.

At the same time, inflation remained manageable, reinforcing expectations that monetary conditions could remain supportive. Headline inflation rose slightly to 1.8 percent in December from 1.5 percent in November, still within the BSP’s forecast range of 1.2 to 2.0 percent for the month.

For the full year 2025, average inflation settled at 1.7 percent, below the government’s target of 3.0 percent ± 1.0 percentage point.

Low inflation sustained by easing prices, demand

Inflation pressures were even more muted for lower-income households, with inflation for the bottom 30 percent income group at 1.1 percent in December and averaging just 0.3 percent for the year.

The generally low inflation environment reflected declining prices of key commodities such as rice and petroleum, as well as easing demand-side pressures, with core inflation holding steady at 2.4 percent in December.

The uptick in headline inflation during the month was largely driven by higher food prices, particularly vegetables, corn, and fish and other seafood.

These increases were attributed to weather-related disruptions, lower import arrivals, the closed fishing season, and stronger seasonal demand during the holidays.

Rice prices, however, continued to decline, albeit at a slower pace.

BSP recalibrates discount window rates for banks

Against this backdrop, the BSP moved to recalibrate its liquidity facilities in line with prevailing monetary conditions.

Effective 08 January 2026, the central bank adjusted interest rates under its Discount Window Facility (DWF), which provides short-term liquidity to banks.

For peso-denominated loans, rates were set at 5.6177 percent for maturities of 1–90 days and 5.7354 percent for 91–180 days, based on the BSP Overnight Lending Rate.

US dollar loans under the DWF carry a uniform rate of 6.1517 percent for maturities of up to 360 days, while Japanese yen loans range from 2.83375 percent to 3.00625 percent, depending on tenor.

The BSP said applicable spreads may be adjusted periodically to reflect market movements and support its monetary policy objectives.

BSP sees benign inflation, strong reserves and stable macro outlook

Looking ahead, the central bank said the inflation outlook remains benign, with price pressures expected to return toward the target range in 2026 and 2027.

The BSP has since reiterated its commitment to a data-dependent approach, closely monitoring domestic and external developments that could influence inflation and economic growth.

Taken together, strong reserve buffers, contained inflation, and calibrated liquidity support signal a relatively stable macro-financial environment as the Philippines navigates global uncertainties in the year ahead.

[1] By convention, GIR is viewed to be adequate if it can finance at least three-months’ worth of the country’s imports of goods and payments of services and primary income. The latest GIR level ensures availability of foreign exchange to meet balance of payments financing needs, such as for payment of imports and debt service, in extreme conditions when there are no export earnings or foreign loans.

[2] Short-term debt based on residual maturity refers to outstanding external debt with original maturity of one year or less, plus principal payments on medium- and long-term loans of the public and private sectors falling due within the next 12 months.

[3] The level of GIR as of a particular period is considered adequate, if it provides at least 100 percent cover for the payment of the country’s foreign liabilities, public and private, falling due within the immediate 12-month period.