The Bangko Sentral ng Pilipinas (BSP) has removed the 10% non-resident ownership limit for Personal Equity and Retirement Account (PERA) Unit Investment Trust Funds (UITFs) that invest in BSP-issued securities — making it easier for overseas Filipino workers (OFWs) to grow their retirement savings through secure, local investment options.

Previously, PERA-UITFs could not invest in BSP securities if more than 10% of their investors were non-residents. This restriction limited OFWs’ access to BSP-backed instruments. With the new exemption, PERA-UITFs can now include these low-risk assets even if foreign-based investors hold more than 10% of the fund.

Wider access, stronger inclusion

The BSP said the move aims to broaden investment participation and strengthen the private retirement system by giving OFWs more flexibility in diversifying their portfolios.

“This amendment aligns with our goal of making PERA a truly inclusive retirement vehicle — not only for Filipinos in the country but also for those working overseas,” the central bank said in a statement.

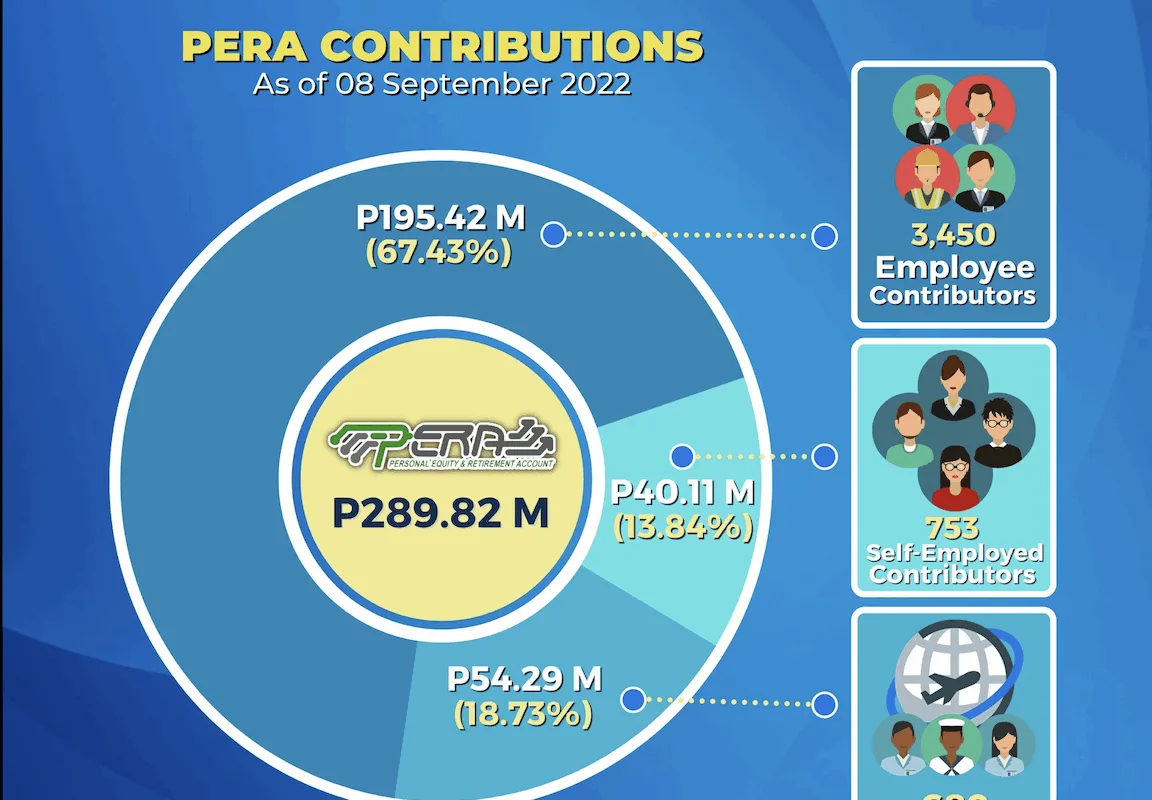

As of 2024, BSP data show total PERA contributions reached ₱491.39 million, up 24% year-on-year, from 5,912 contributors. OFWs accounted for ₱82.25 million from 789 contributors, showing growing participation in voluntary retirement investing.

Catalyst for fintech growth

The regulatory change is expected to benefit digital PERA platforms, robo-advisors, and fintech startups offering cross-border financial services. With more flexible investment rules, providers can develop OFW-focused retirement products that integrate digital remittances, mobile onboarding, and automated contributions.

Banks and fund managers can also design more balanced PERA-UITFs that blend BSP securities with other instruments, offering better diversification and risk management for conservative investors.

Bridging gaps in financial access

The BSP has been steadily modernizing the PERA ecosystem — from enabling digital onboarding to expanding investment channels via mobile apps. Lifting the non-resident cap builds on these efforts by making PERA more inclusive, portable, and accessible to Filipinos abroad.

Still, awareness and accessibility remain key challenges. Many OFWs are unfamiliar with PERA or face onboarding issues from overseas. Collaboration between fintech firms, remittance partners, and banks will be crucial in translating policy reforms into real financial inclusion.

The bigger picture

For the Philippines’ nearly 2 million OFWs, the change marks a step toward transforming remittances into long-term wealth. Instead of being limited to consumption or savings accounts, OFWs can now channel part of their earnings into structured retirement investments tied to the Philippine economy.

By easing ownership restrictions, the BSP has opened the door for more global Filipinos to secure their financial future — turning every remittance into a potential investment for retirement.