The Monetary Board of the Bangko Sentral ng Pilipinas (BSP) has introduced updated guidelines for the “Settlement of Electronic Payments under the National Retail Payment System (NRPS) Framework,” aiming to bolster the integrity and efficiency of the country’s payment system.

Issued under Circular No. 1196 on June 27, 2024, these amendments provide increased operational flexibility to Automated Clearing Houses (ACHs) within the NRPS Framework.

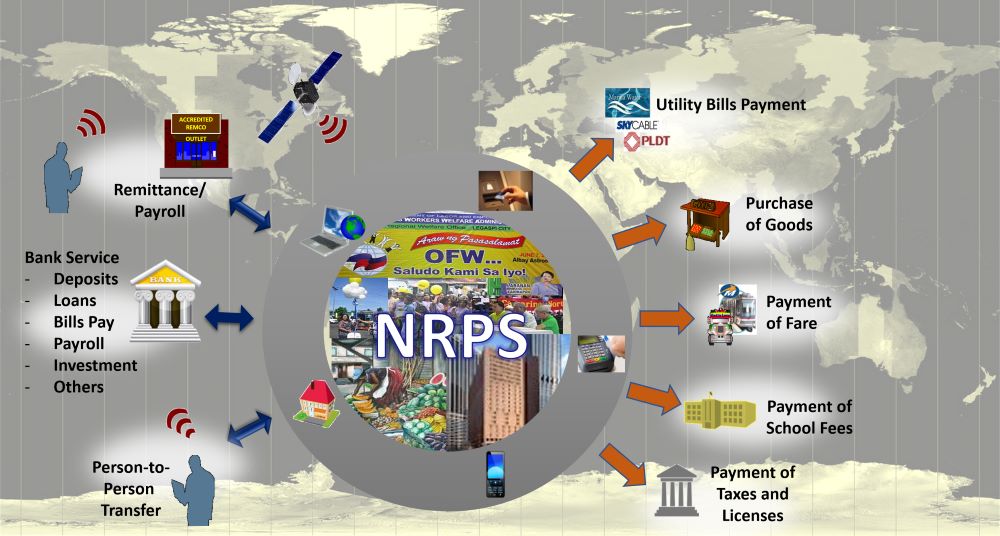

The NRPS Framework encompasses key ACHs such as InstaPay and PESONet. InstaPay offers a real-time, low-value digital payment service, serving as an alternative to cash transactions.

On the other hand, PESONet facilitates batch electronic funds transfers, providing a viable option for checks and recurring payments. These ACHs play a critical role in the Philippines’ digital financial landscape, enabling seamless electronic transactions across the nation.

The revised guidelines mandate prior BSP approval for any new rules or enhancements related to the settlement of e-payments, as outlined in the Manual of Regulations for Payment Systems (MORPS). This requirement ensures that all proposed modifications undergo thorough scrutiny and approval by the BSP before they are implemented.

The new guidelines grant ACHs the ability to request adjustments to enable more frequent settlement cycles, accelerate the settlement process, and enhance the overall efficiency of e-payments.

One significant provision in the updated guidelines is the allowance for ACHs to propose the use of a specific demand deposit account (DDA) maintained with the BSP for settling e-payments, rather than using separate DDAs.

This flexibility can be requested based on evolving circumstances or the emergence of new use cases. By centralizing the settlement process through a single DDA, ACHs can streamline operations and reduce the complexity associated with maintaining multiple accounts.

BSP’s commitment to continuously improving the NRPS Framework

In a significant development under these new guidelines, the BSP, in collaboration with the Philippine Payments Management Inc. (PPMI) and the PESONet Steering Committee, activated a third settlement cycle for PESONet transactions on July 8, 2024.

This initiative, known as the PESONet Multiple Batch Settlement (MBS) facility, introduced a midday settlement cycle, expanding the number of daily settlements to three per banking day.

The introduction of the “PESONet 3MBS” system marks a significant improvement in the country’s payment infrastructure. Previously, PESONet transactions were settled twice daily—once in the morning and again at the end of the banking day.

Adding a third settlement cycle in the midday now shortens the clearing intervals, allowing for faster crediting of funds to recipients’ accounts. This enhancement significantly improves the user experience by enabling quicker access to transferred funds and facilitates more efficient cash flow management for businesses.

Moreover, the new settlement cycle helps PESONet participating banks and electronic money issuers manage settlement risks more effectively. By dividing the transactions into three batches throughout the day, the risk associated with large volume settlements at a single time is mitigated. This staggered approach ensures that the payment system remains robust and resilient, even during peak transaction periods.

The BSP’s commitment to continuously improving the NRPS Framework is evident in these latest measures. By providing ACHs with greater flexibility and introducing additional settlement cycles, the BSP is not only enhancing the efficiency of the payment system but also promoting financial inclusion and supporting the digitalization of the Philippine economy.

These initiatives are expected to further increase public trust in electronic payment systems, encouraging wider adoption and contributing to the overall goal of a more inclusive and efficient financial ecosystem in the Philippines. As the BSP continues to refine and strengthen the regulatory framework, stakeholders and consumers alike can look forward to more innovative and secure digital payment solutions in the future.

In 2023, the BSP announced that it would continue to work with banks on measures to lower or waive transaction fees for small e-payments to make financial digitalization more inclusive.