Special Report by Edielyn Mangol

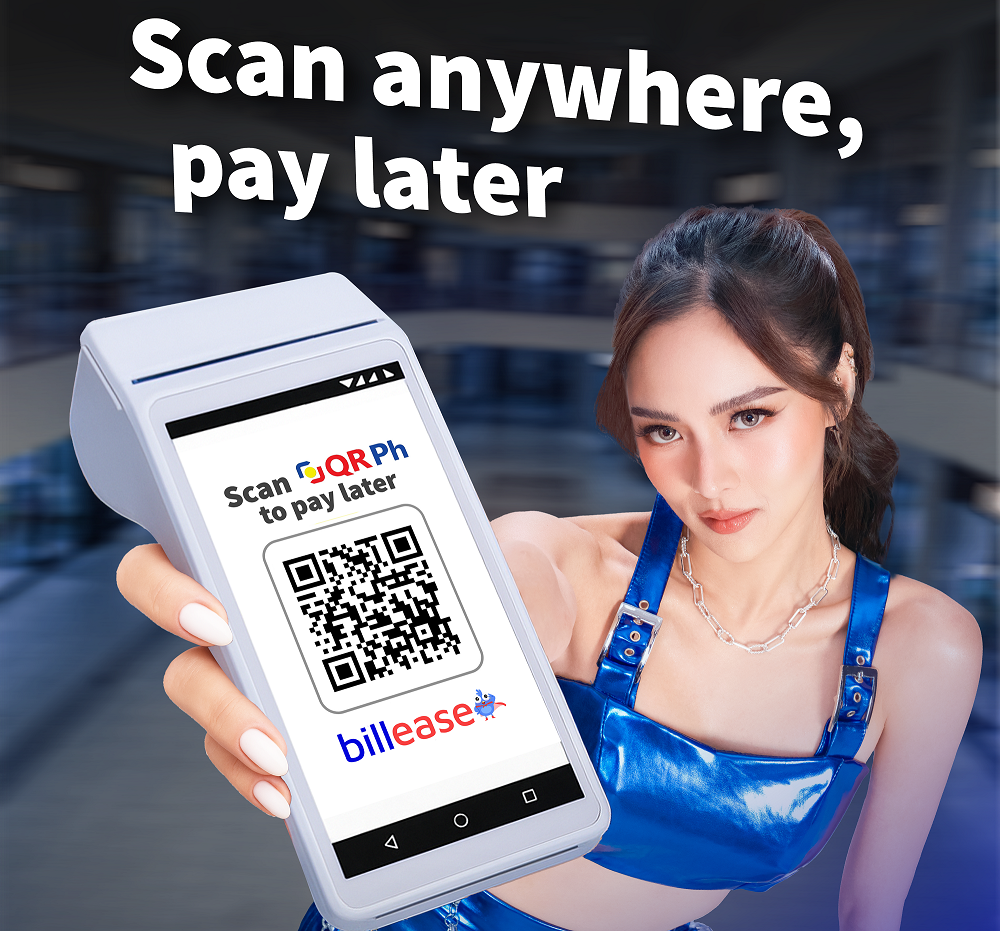

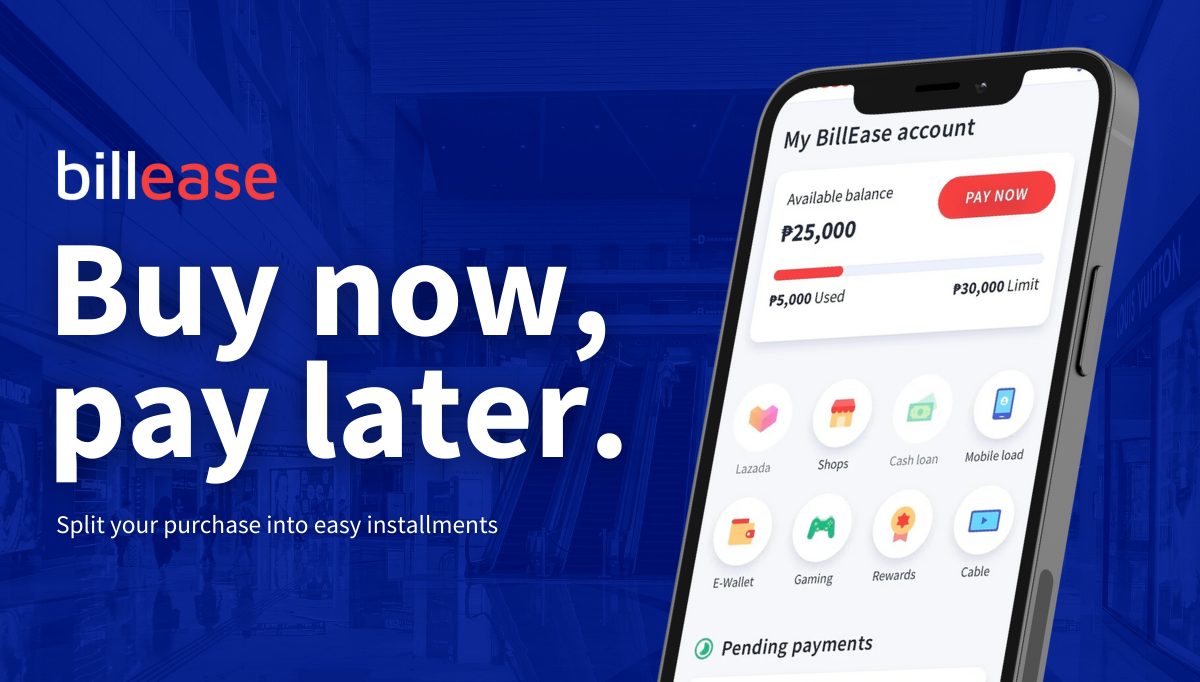

The buy-now-pay-later (BNPL) market in the Philippines continues to expand, reshaping how consumers handle day-to-day expenses. Billease, one of the country’s fastest-growing digital credit platforms, has introduced Everyday Spend Credit, allowing users to pay later for small purchases via QRPh and NFC tap-to-pay.

This innovation positions Billease at the heart of the growing digital payments adoption in the Philippines, bridging the gap between online and offline spending. It also reflects the broader fintech trend where credit options are no longer limited to e-commerce but extend to daily financial routines.

As Filipinos become more comfortable with QR-based and contactless transactions, this launch could redefine how they manage financial flexibility while balancing convenience and responsibility.

How Billease’s everyday spend credit works

1) Instant payment via QRPh or Tap — Through the new feature, Billease users can pay for groceries, transport, dining, or other essentials directly via QRPh scan-to-pay or tap-to-pay transactions. The system eliminates the need for topping up wallets, as purchases are automatically charged to the Billease credit line. This development underscores the increasing relevance of QRPh in the Philippines, which aims to unify QR-based payments nationwide. By riding on this infrastructure, Billease ensures its services are widely accessible, convenient, and integrated into existing merchant payment systems.

2) Flexible repayment or installment conversion — The repayment model is designed to give users control. Customers can:

Pay next payday – Settle balances on the next salary day with no added interest.

Convert to installments – Break down purchases into manageable repayments through Billease’s EasyPace plan, which uses a declining balance interest structure.

This dual approach highlights how BNPL products are evolving from short-term credit options into tools that support both cash flow management and long-term financial planning.

Strategic implications for the Philippine fintech market

Driving BNPL adoption offline

The Philippine BNPL market has been primarily centered around online platforms. Billease’s move to integrate offline payments shifts this dynamic, making BNPL a mainstream consumer habit.

With this, BNPL is no longer limited to big-ticket purchases — it now fits into the everyday digital economy.

For fintech competitors, this raises the bar. The blending of BNPL with offline contactless payments suggests that the future of consumer finance will be omnichannel, where digital credit options seamlessly cross between online stores and brick-and-mortar merchants.

Boosting merchant acceptance and reach

Merchants stand to benefit from increased sales and higher customer spending power. By tapping into QRPh and NFC-enabled payments, even small businesses can now indirectly offer BNPL without the need for specialized integrations.

This aligns with the broader government and industry push to digitize Philippine SMEs and bring them into the digital payments ecosystem. For Billease, the strategy is clear: increase the number of acceptance points, boost transaction volume, and build loyalty within its growing customer base.

Risks and regulatory considerations

With more consumers using credit for everyday purchases, regulatory oversight of fintech in the Philippines becomes critical. Transparent disclosure of fees, clear repayment terms, and responsible lending practices are key factors that regulators will look at.

There is also the risk of consumer over-indebtedness, a challenge seen in other BNPL markets globally. To sustain trust, Billease must prioritize credit risk management while supporting financial literacy programs that encourage responsible credit use.

What this means for consumers

More freedom in daily purchases

Everyday Spend Credit provides Filipinos with greater financial flexibility, particularly during tight budget cycles. Instead of delaying essential purchases, they can use credit lines for necessities and settle later. This is especially useful for households managing cash flow between paydays.

Encouraging responsible credit use

The design of repayment options promotes responsible borrowing habits. Paying next payday interest-free reduces reliance on long-term debt, while installment conversion provides a safety net for larger or unexpected expenses. This balance ensures that BNPL can be both accessible and sustainable.

Potential for overuse

The ease of use, however, comes with risks. Treating credit lines as extra disposable income could lead to overspending.

Billease can mitigate this by integrating spending trackers, reminders, and usage alerts — features that align with the growing demand for personal finance management tools in fintech apps.

Everyday credit as the future of BNPL

Billease’s Everyday Spend Credit reflects a global trend: BNPL is moving beyond online checkouts to become a daily payment solution. This convergence of BNPL, digital wallets in the Philippines, and QR-based payments is reshaping the way consumers interact with money.

For Billease, success hinges on balancing innovation with consumer protection. If the platform manages to maintain transparency, affordability, and accessibility, it could solidify its place in the Philippine digital finance ecosystem.

Rethinking everyday finance

The launch of Everyday Spend Credit demonstrates that the future of BNPL lies in everyday usability. By empowering Filipinos with flexible payment choices through QRPh and tap-to-pay, Billease is making credit access practical and relevant.

As the Philippine fintech industry matures, the ability of players like Billease to combine innovation with responsible lending will define their long-term success. For now, one thing is clear — BNPL is no longer just a convenient option for e-commerce but a powerful tool shaping how Filipinos approach financial freedom in their daily lives.