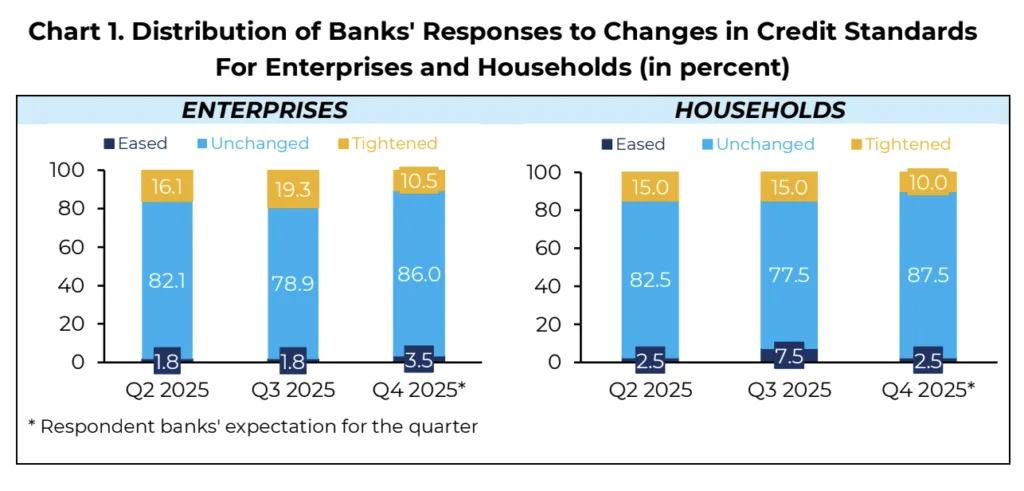

A growing number of banks expect to keep lending standards steady for both businesses and households in the last quarter of 2025, according to the latest “Bank Lending Survey” of the Bangko Sentral ng Pilipinas (BSP)

Citing responses from 58 respondents, the BSP said 86 percent of those surveyed plan to maintain their credit standards for business loans, up from 78.9 percent in the third quarter. Only 10.5 percent of respondents expect to tighten lending standards, while 3.5 percent anticipate easing them. [1],[2]

For household loans, 87.5 percent of those surveyed also see no changes in lending standards, compared with 77.5 percent in the previous quarter. Around 10 percent expect tighter conditions, while 2.5 percent may ease requirements.

Lending standards refer to the criteria banks apply in evaluating loan applications — such as interest rates, collateral requirements, loan size, loan conditions, and repayment terms.

Bank’s credit stability and fintech’s opportunity

Analysts said the steady outlook suggests banks remain cautious amid global economic uncertainty but are not expecting major disruptions in credit conditions.

However, the relatively stable lending environment could open space for fintech lenders and digital banks to compete more aggressively, particularly in market segments underserved by traditional institutions.

“While banks are holding steady, fintech players have more room to experiment with data-driven credit scoring and alternative lending models,” said one industry observer. “This could help small businesses and consumers who might otherwise face unchanged — or even stricter — standards from banks.”

For business loans, 86.0 percent of surveyed banks expect that they will likely maintain their lending standards, up from 78.9 percent in Q3. The rest of the respondents are split between easing (3.5 percent) and tightening (10.5 percent).[3]

The BSP has been supporting the digitalization of the financial system through initiatives such as the Open Finance Framework and the Digital Payments Transformation Roadmap, which aim to expand credit access through technology-driven solutions.

As traditional banks keep lending terms unchanged, market watchers expect fintech platforms to leverage real-time data and AI-driven risk models to offer much faster, more flexible credit options that can potentially reshape the country’s lending landscape in 2026. [4,5]

The current lending landscape, marked by stability rather than expansion, may encourage fintech firms to accelerate partnerships with banks and other financial institutions.

By integrating alternative data and digital identity systems, these companies can help lenders reach borrowers traditionally excluded from formal credit channels — such as freelancers, microentrepreneurs, and individuals without traditional credit histories.

Industry analysts note that this convergence between fintech innovation and banking conservatism could redefine credit delivery in the Philippines.

As banks uphold prudent standards, fintech players’ agility in risk assessment and digital onboarding may drive broader financial inclusion, setting the stage for a more dynamic and data-driven lending ecosystem in the years ahead.

—

1 Q3 2025 Senior Bank Loan Officers’ Survey (SLOS).

2 The SLOS consists of questions on loan officers’ perceptions relating to the overall credit standards of their respective banks, as well as to factors affecting the supply of and demand for loans to both enterprises and households. The analysis of the results of the SLOS focuses on the quarter-on-quarter changes in the perception of respondent banks. The responses for the Q3 2025 SLOS were gathered from 11 September 2025 to 21 October 2025 with a total of 58 respondent banks out of 60 surveyed banks or a 96.7 percent response rate.

3 Based on the Modal approach: categorical response such as “tighten,” “loosen,” and “unchanged.”

4 Based on the diffusion index (DI) method: a positive DI for credit standards indicates that the proportion of respondent banks that have tightened their credit standards exceeds those that eased (“net tightening”), whereas a negative DI for credit standards indicates that more respondent banks have eased their credit standards compared to those that tightened (“net easing”).

5 In terms of loan demand, the three choices for modal approach are either: 1) increasing, 2) decreasing, or 3) unchanged demand for credit from businesses and from consumers. In the DI method, a positive DI for loan demand shows that the percentage of respondent banks that reported increasing demand for loans exceeds those that indicated decreasing credit demand (“net increasing”), whereas a negative DI for loan demand indicates that more respondent banks have noted a decline in credit demand compared to those that observed increasing demand for credit (“net decreasing”). Meanwhile, an unchanged loan demand in the DI approach notes that the proportion of the respondent banks that have reported an increase in loan demand is equal to those that indicated a decrease in demand for loans.